A UK bank has frozen a Hyperverse promoter’s account on suspicion of fraud.

Emma Smedley is a UK-based promoter of the Hyperverse Ponzi scheme.

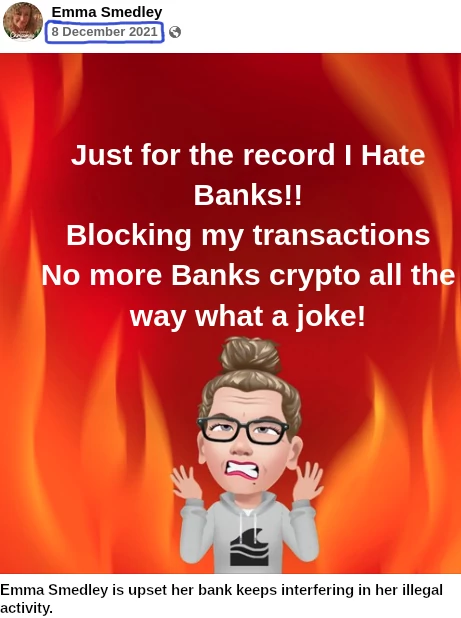

Smedley took to FaceBook on January 6th to “have a whinge” about her bank.

[1:34] I tried to pay for my Calendly app last night … and my card wouldn’t go through.

“Your card’s not recognized”. I was like, “recognized? It’s a nationwide card.” What a load of shit.

So anyway, this morning I rung ’em up. I’d been on the phone an hour … I got through to customer service, who just takes my details and then says, “Oh yeah I need to pass you through to another department”.

[2:19] So eventually I got through to a second person, who then proceeds to tell me, “Oh no no, I can’t deal with this. I’m going to have to put you through to the fraud department”.

I was like, “right”. So I get on there and I am interviewed like a criminal.

“Where’s this money come from?”

So I’m like, “What? Why do you need to know where my money’s come from?”

“Because that’s what we do, we investigate fraud.”

“Right well I can tell you that I wanted that transaction to go through.”

And he said, “Well um..”

“Oh and look, I don’t think it’s about a Calendly transaction that you’re worried about. It’s probably the fact that I’ve transferred money into my bank from Coinbase. And that’s what you’re interested in.

You’re not interested in the Calendly app. You want to know what I’m doing.”

So I said, “I’ll tell you what I’m doing, I’m trading. And that’s where my money comes from.”

The long and the short of it is, I can’t now get any money out of my account whatsoever that’s left in there.

They’ve completely shut down my bank account. They have restricted my online banking. In theory they’ve left me, if you want, with no money in the normal world.

[3:59] Doesn’t that just bloody well tell you why you don’t want to be around banks.

They’re not doing that for security, they’re doing that because they want to know where the money’s coming from, so they can go to the source.

Smedley’s ignorance of finance law is commendable.

Hyperverse is a reboot of the collapsed HyperFund Ponzi scheme.

Both HyperFund and Hyperverse have been singled out by the FCA for securities fraud.

Regardless of who you bank with, if you’re suspected of engaging in fraudulent activity, such as involvement in one of the largest MLM Ponzi schemes currently operating, they’re going to flag your account and investigate.

If you can’t prove to your bank the money you’re depositing into that account hasn’t come from a legitimate source (securities fraud isn’t a legitimate source), they’re going to shut you down.

When fraud departments come knocking, “We sell memberships” doesn’t cut it. Nor does hiding involvement in Ponzi schemes behind “trading”.

Once you’ve been flagged for potential fraud, on the bank’s backend a Suspicious Activity Report is generated.

This SAR report is then forwarded to regulators and/or relevant authorities for further investigation.

Evidently this isn’t Smedley’s first run in with her bank’s fraud department:

Smedley has been in Hyperverse for some time, dating back to beyond the recent HyperFund collapse.

Smedley is believed to be in Sharon James’ Hyperverse downline, who is in turn in Kalpesh Patel’s downline.

Kalpesh Patel is believed to be one of Hyperverse’s top net-winners. Originally from the UK, Patel has been hiding out in Dubai for some time.

In mid-December, a few weeks after HyperFund collapsed, Patel organized a hype event in Dubai for his top earners.

Emma Smedley was in attendance:

As for the company Smedley keeps; Sharon James has been promoting Ponzi schemes for years.

Stone made a name for herself as one of the top earners in the collapsed Traffic Monsoon Ponzi scheme.

In 2019 a court-appointed Receiver sued James for $249,758.

James failed to defend the suit, resulting in a $303,691 default judgment recorded against her in June 2021.

Kalpesh Patel has been scamming people dating back to the notorious Zeek Rewards Ponzi scheme.

Update 11th January 2022 – Following publication of this article Smedley pulled her video. No explanation for the deletion was provided.

There was a link to the video but in light of Smedley deleting it I’ve removed it.