HyperFund is the latest launch by Ryan Xu’s company HyperTech.

HyperTech represents it operates from Hong Kong. Whether Xu is based in Hong Kong or elsewhere is unclear.

BehindMLM first became aware of Xu and HyperTech through our Jan 2020 HyperCapital review.

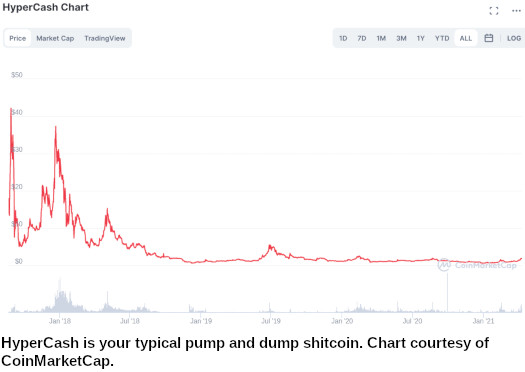

HyperCapital was a Ponzi scheme launched to resurrect HyperCash (formerly HCash), a failed shitcoin Xu launched a few years earlier.

HyperCapital failed to have any impact on HyperCash’s public trading value:

HyperCapital was eventually abandoned and today its website is defunct.

HyperFund was announced in mid 2020. It is essentially Xu and HyperTech’s migration to DeFi.

Which is to say we can likely expect more the same crypto investment related fraud.

Read on for a full review of HyperFund’s MLM opportunity.

HyperFund’s Products

HyperFund has no retailable products or services, with affiliates only able to market HyperFund affiliate membership itself.

HyperFund’s Compensation Plan

HyperFund refer to their MLM opportunity and compensation pan as “HyperCommunity”.

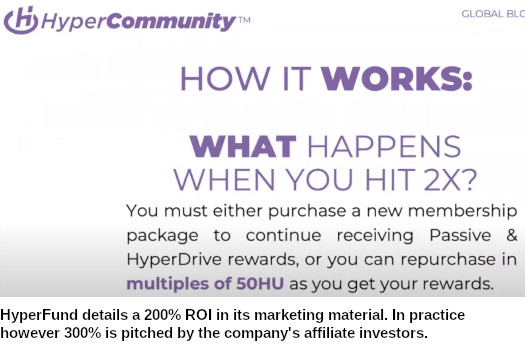

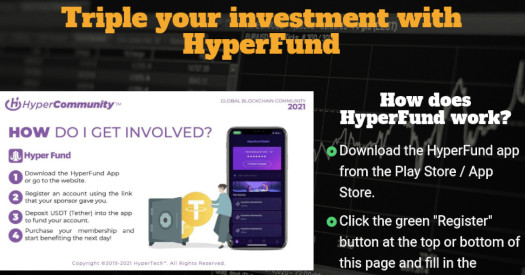

HyperFund affiliates invest tether (USDT) into HU, an internal token, on the promise of a 300% ROI.

HU investment tiers are 300, 500 and 1000.

Apparently the regular return is 200% but there seems to be a perpetual 300% limited time offer.

The 300% cap is calculated based off a daily return plus earned commissions (detailed below).

HyperFund pays returns daily in HU. Withdrawals to actual money are made through an internal exchange (HyperPay).

Note that once 300% has been realized, reinvestment is required to continue earning. HyperFund reinvestment is made in 50 HU increments.

Also note that 20% of commissions paid out (excludes daily returns), must be reinvested into various tokens HyperFund is promoting).

Residual Commissions

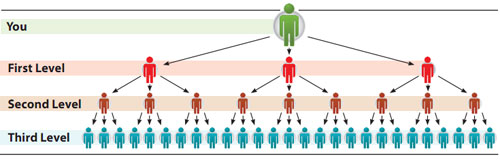

HyperFund pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

HyperFund caps payable unilevel team levels at twenty.

Referral commissions are paid as a percentage of daily HU earnings paid across these twenty levels as follows:

- level 1 (personally recruited affiliates) – 20%

- level 2 – 15%

- level 3 – 10%

- levels 4 to 6 – 5%

- levels 7 to 15 – 2%

- levels 16 to 20 – 1%

Note that each unilevel team level requires a recruited affiliate with an active investment to qualify.

E.g. you need to recruit and maintain one affiliate investor to earn commissions on level 1.

You need to recruit and maintain four affiliate investors to earn commissions on levels 1 to 4 etc.

VIP Reward

The VIP Reward allows HyperFund affiliates earn on HU earned by unilevel team affiliates outside of their strongest leg.

The strongest leg is calculated and based on daily HU generated across all unilevel team legs.

There are seven ranks within the VIP Reward:

- Expert – build a downline receiving 50,000 HU a day outside of your strongest unilevel team leg

- Pro – build a downline receiving 100,000 HU a day outside of your strongest unilevel team leg

- 1 Star – build a downline receiving 250,000 HU a day outside of your strongest unilevel team leg

- 2 Star – build a downline receiving 500,000 HU a day outside of your strongest unilevel team leg

- 3 Star – build a downline receiving 1,000,000 HU a day outside of your strongest unilevel team leg

- 4 Star – build a downline receiving 3,000,000 HU a day outside of your strongest unilevel team leg

- 5 Star – build a downline receiving 5,000,000 HU a day outside of your strongest unilevel team leg

Corresponding VIP Rewards paid out based on the above rank qualifications are as follows:

- Experts receive a 0.5% VIP Reward rate

- Pros receive 1% VIP Reward rate

- 1 Stars receive a 3% VIP Reward rate

- 2 Stars receive a 6% VIP Reward rate

- 3 Stars receive a 9% VIP Reward rate

- 4 Stars receive a 12% VIP Reward rate

- 5 Stars receive a 15% VIP Reward rate

Again these percentages are paid on all unilevel team legs (full depth), excluding the strongest leg.

There is also a coded component to the VIP Reward. This means that 15% is paid on all HU generated across each affiliate’s unilevel team.

In the event an HyperFund affiliate isn’t 5 Star ranked and receiving the full 15% paid out, the difference between their VIP Reward rate and 15% is paid to their upline (the affiliate who recruited them).

E.g. a 2 Star receives a 6% VIP Reward rate, leaving up to 9% left to be paid out to their upline.

How much is paid out depends on the upline affiliate’s rank.

If the personally recruited affiliate is at the same rank as the upline, the upline receives a 1% VIP Reward rate.

If the personally recruited affiliate isn’t VIP Reward qualified, the upline receives the full 15% volume on that affiliate’s unilevel team HU volume.

Global Reward

HyperFund puts the HU equivalent of 4% of company-wide investment into the Global Reward pool.

The Global Reward pool is split into four smaller pools.

Along with their qualification criteria, they are as follows:

- 2% Global Reward pool – generate 2 million in HU investment outside of your strongest unilevel team leg

- 1% Global Reward pool – generate 4 million in HU investment outside of your strongest unilevel team leg

- 0.5% Global Reward pool – generate 6 million in HU investment outside of your strongest unilevel team leg

- 0.5% Global Reward pool – generate 10 million in HU investment outside of your strongest unilevel team leg

Qualification appears to be accumulative. The Global Reward pool is paid out monthly.

Joining HyperFund

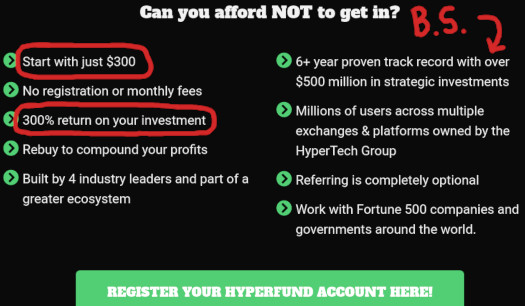

HyperFund affiliate membership is tied to an initial 300, 500 or 1000 HU investment package.

HyperFund solicits investment in USDT, meaning the above amounts are roughly equivalent to $300, $500 and $1000.

Conclusion

Having failed to resuscitate HyperCash, Ryan Xu has turned HyperTech into a full-blown Ponzi shitcoin factory.

This is being done behind the ruse of DeFi, because that’s the current trendy model for MLM crypto shitfuckery.

HyperFund is a 300% ROI Ponzi scheme combined with pyramid recruitment.

Affiliates sign up and invest USDT. They then receive a return and commissions in HU points, capped at 300%.

HyperFund’s commissions are tied to affiliate investor recruitment, slapping pyramid fraud on top of Ponzi investment fraud.

Notably, HyperFund’s compensation plan is a 1:1 clone of HyperCapital’s. The only difference is instead of paying HyperCash, HU Ponzi points have been created.

HU points are worthless outside of HyperFund. They cost the company nothing to generate, meaning commissions and returns can be “paid out” regardless of whether actual money can be withdrawn.

The other difference between HyperCapital and HyperFund is the shitcoin factory element.

HyperFund withholds 20% of paid commissions for mandatory shitcoin investment.

These shitcoins are created by HyperFund anytime they feel like pushing a new scam.

The first HyperFund shitcoin launch is HyperDAO (HDAO).

HyperDAO aims to establish a complete DeFi (Decentralised Finance) ecosystem, providing clients with a decentralised financial infrastructure.

Under the ruse of DeFi, HDAO is just an excuse to stop affiliates withdrawing 20% of earned commissions.

Attached to HyperFund are a bunch of HyperX branded smoke and mirrors companies:

- HyperPay

- HyperFin

- HyperBC

- HPX

- HyperMining

- HyperTalk

- HyperNews

- HyperMall

- HyperShow

Similar bullshit will presumably be set up for HDAO and any other yet-to-be released shitcoins.

This is typical of HyperTech, with the company’s marketing tying at least 150 shell companies to Ryan Xu.

If you’re wondering why I haven’t gone into any of the above HyperX branded companies, it’s because they have nothing to do with HyperFund’s MLM opportunity.

The HyperX companies are smoke and mirrors to put on HyperFund marketing slides.

Outside of HyperPay, HyperTech’s internal exchange, the HyperX companies either don’t exist or aren’t being used by anyone.

Finally there’s also the issue of HyperFund being engaged in securities fraud.

HyperTech acknowledge they are offering an passive investment opportunity through HyperFund. This constitutes a securities offering.

At the time of publication Alexa ranks the US as the top source of traffic to HyperFund’s website (52%).

Neither HyperTech, HyperFund, Ryan Xu or any of the plethora of associated shell companies are registered with the SEC.

This means that Xu and his Hyper companies are committing securities fraud in the US. Promotion of unregistered securities by US residents is also illegal.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve HyperFund of ROI revenue, eventually leaving them unable to pay HyperPay withdrawal requests.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

In the case of HyperFund, this will manifest itself by way of HyperFund affiliates being left holding worthless HU points.

To see this in action one need look no further than HyperTech’s HyperCash bagholders.