A UK financial institution has frozen a Hyperverse promoter’s account on suspicion of fraud.

Emma Smedley is a UK-based promoter of the Hyperverse Ponzi scheme.

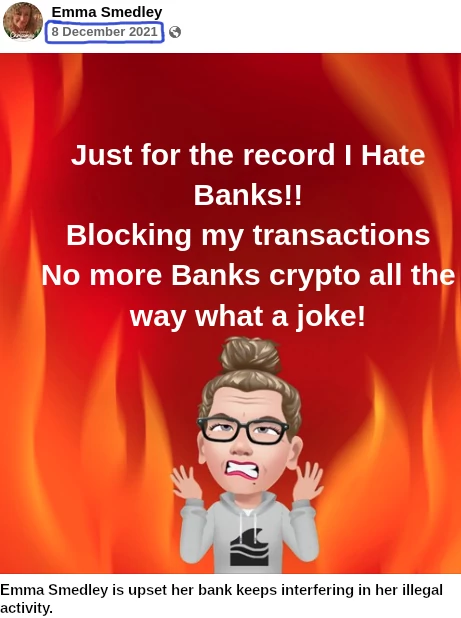

Smedley took to FaceBook on January sixth to “have a bitch” about her financial institution.

[1:34] I attempted to pay for my Calendly app final night time … and my card wouldn’t undergo.

“Your card’s not acknowledged”. I used to be like, “acknowledged? It’s a nationwide card.” What a load of shit.

So anyway, this morning I rung ’em up. I’d been on the telephone an hour … I obtained by to customer support, who simply takes my particulars after which says, “Oh yeah I have to move you thru to a different division”.

[2:19] So ultimately I obtained by to a second individual, who then proceeds to inform me, “Oh no no, I can’t take care of this. I’m going to must put you thru to the fraud division”.

I used to be like, “proper”. So I get on there and I’m interviewed like a prison.

“The place’s this cash come from?”

So I’m like, “What? Why do it’s good to know the place my cash’s come from?”

“As a result of that’s what we do, we examine fraud.”

“Proper nicely I can let you know that I needed that transaction to undergo.”

And he stated, “Effectively um..”

“Oh and look, I don’t assume it’s a couple of Calendly transaction that you simply’re nervous about. It’s in all probability the truth that I’ve transferred cash into my financial institution from Coinbase. And that’s what you’re excited by.

You’re not within the Calendly app. You need to know what I’m doing.”

So I stated, “I’ll let you know what I’m doing, I’m buying and selling. And that’s the place my cash comes from.”

The lengthy and the in need of it’s, I can’t now get any cash out of my account in any respect that’s left in there.

They’ve fully shut down my checking account. They’ve restricted my on-line banking. In concept they’ve left me, if you would like, with no cash within the regular world.

[3:59] Doesn’t that simply bloody nicely let you know why you don’t need to be round banks.

They’re not doing that for safety, they’re doing that as a result of they need to know the place the cash’s coming from, to allow them to go to the supply.

Smedley’s ignorance of finance legislation is commendable.

Hyperverse is a reboot of the collapsed HyperFund Ponzi scheme.

Each HyperFund and Hyperverse have been singled out by the FCA for securities fraud.

No matter who you financial institution with, should you’re suspected of participating in fraudulent exercise, equivalent to involvement in one of many largest MLM Ponzi schemes presently working, they’re going to flag your account and examine.

For those who can’t show to your financial institution the cash you’re depositing into that account hasn’t come from a official supply (securities fraud isn’t a official supply), they’re going to close you down.

When fraud departments come knocking, “We promote memberships” doesn’t reduce it. Nor does hiding involvement in Ponzi schemes behind “buying and selling”.

When you’ve been flagged for potential fraud, on the financial institution’s backend a Suspicious Exercise Report is generated.

This SAR report is then forwarded to regulators and/or related authorities for additional investigation.

Evidently this isn’t Smedley’s first run in along with her financial institution’s fraud division:

Smedley has been in Hyperverse for a while, relationship again to past the latest HyperFund collapse.

Smedley is believed to be in Sharon James’ Hyperverse downline, who’s in flip in Kalpesh Patel’s downline.

Kalpesh Patel is believed to be one in every of Hyperverse’s high net-winners. Initially from the UK, Patel has been hiding out in Dubai for a while.

In mid-December, a couple of weeks after HyperFund collapsed, Patel organized a hype occasion in Dubai for his high earners.

Emma Smedley was in attendance:

As for the corporate Smedley retains; Sharon James has been selling Ponzi schemes for years.

Stone made a reputation for herself as one of many high earners within the collapsed Visitors Monsoon Ponzi scheme.

In 2019 a court-appointed Receiver sued James for $249,758.

James did not defend the swimsuit, leading to a $303,691 default judgment recorded in opposition to her in June 2021.

Kalpesh Patel has been scamming individuals relationship again to the infamous Zeek Rewards Ponzi scheme.

Replace eleventh January 2022 – Following publication of this text Smedley pulled her video. No clarification for the deletion was offered.

There was a hyperlink to the video however in gentle of Smedley deleting it I’ve eliminated it.