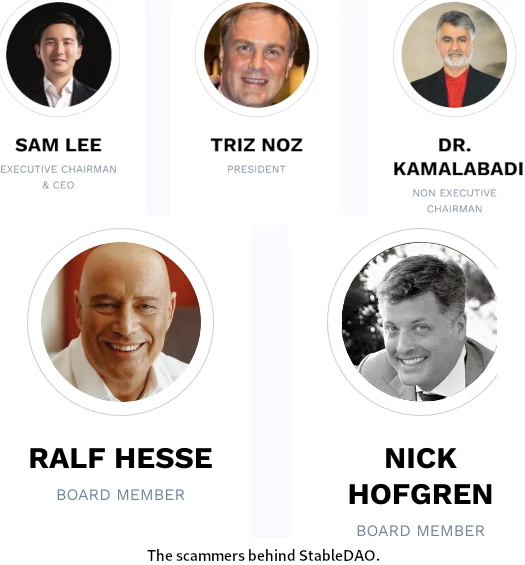

As Sam Lee gears as much as defraud customers together with his new StableDAO Ponzi, proceedings in Australia are offering perception into his earliest crypto scams.

I need to preface that Blockchain World was a cloud mining platform. Its enterprise mannequin is thus in fact totally different to StableDAO and Lee’s numerous Hyper* Ponzi schemes.

What’s related with Blockchain World is what was occurring behind the scenes.

Blockchain World was a cryptocurrency trade and mining agency, beginning out as Bitcoin Group.

In 2016 Bitcoin Group rebranded as Blockchain World. In 2017 Blockchain World spun off ACX, a cryptocurrency trade.

Blockchain World and ACX collapsed in 2020. Later that very same 12 months Xu and Lee fled to Dubai.

Claims obtained by liquidators would peg Blockchain World and ACX losses at $48.9 million.

As liquidators and presumably additionally regulation enforcement hunted them down, Xu and Lee turning up in Dubai is not any coincidence. The crime-riddled emirate is infamous for sheltering scammers from authorities.

The liquidation of Blockchain World and ACX hit the Victorian Supreme Court docket earlier this week. And with that we’ve gained further info into how Lee runs his scams.

Poor report retaining, comingling of invested funds, misappropriating investor funds for private profit and, finally, playing away invested funds.

Sarah Danckert from the Sydney Morning Herald has been protecting proceedings;

The court docket heard on Wednesday that Blockchain World’s ACX trade took the money invested by its buyer to commerce cryptocurrency and mingled the funds into one pooled fund – a observe that’s in breach of consumer cash reporting guidelines for licensed stockbrokers and buying and selling teams however not for the largely unregulated cryptocurrency market.

Below examination by counsel for the liquidators Andrew Silver on Wednesday, Blockchain World’s chief know-how officer, Jin Chen, stated the corporate stored restricted information of every buyer’s trades and their holdings.

Invested funds had been commingled with Blockchain World’s founder’s private funds, a mortgage taken out towards ACX’s consumer balances (unknown to purchasers) and purported buying and selling income.

Chen additionally instructed the court docket that he was instructed by Blockchain’s co-founder Allan Guo, who held the roles of chief working officer and chief funding officer on the group at numerous instances, to switch bitcoin from the pool of buyer funds to different components of the enterprise.

Different makes use of of consumer funds included:

- investing right into a hashish themed shitcoin;

- investing in shares of a Canadian firm;

- topping up Blockchain World’s founder’s and workers’s financial institution accounts; and

- paying off Blockchain World’s founder’s and workers’s mortgages

Once more, none of this was disclosed to Blockchain World and ACX purchasers.

Blockchain World had instructed its clients their cash could be held in belief whereas they traded on Blockchain’s well-liked ACX trade.

To keep away from regulatory detection, Lee and Xu arrange financial institution accounts in workers member of the family’s names – none of whom had something to do with the enterprise.

The court docket heard that Blockchain World, regardless of being a profitable trade with hundreds of shoppers, stored being “debanked” by numerous banks, a course of the place a financial institution stops coping with a buyer as a result of it was working within the cryptocurrency trade.

Blockchain World used corporations arrange within the names of Guo’s mom after which mother-in-law to arrange financial institution accounts from the group to make its banking course of simpler.

Guo additionally instructed the court docket Blockchain World established one other subsidiary within the title of Guo’s then spouse to acquire an Austrac registration.

Allan Guo, aka Liang Guo, was Blockchain World’s COO and CIO. He and CTO Jin Chen have been left holding the bag in Australia.

The investigation into Blockchain World is ongoing, nonetheless Supreme Court docket proceedings strongly suggests $48.9 million in losses is extraordinarily conservative.

Below examination by counsel for liquidators Andrew Silver, former firm chief funding officer Allan Guo confirmed the transfers out of the corporate of buyer funds was important.

Probing Guo, Silver requested: “If I instructed you lots of of hundreds of thousands of {dollars} had been withdrawn on this method from gateway accounts after which invested into different exchanges, what would you say to that? Would it not have been lots of of hundreds of thousands of {dollars}?”

Guo responded: “Whole, sure.”

You’d be naive to suppose this isn’t precisely how Xu’s and Lee’s HyperCash, HyperCapital, HyperFund and Hyperverse Ponzi schemes had been run.

And, extra to the purpose given current developments, how Lee will run StableDAO.

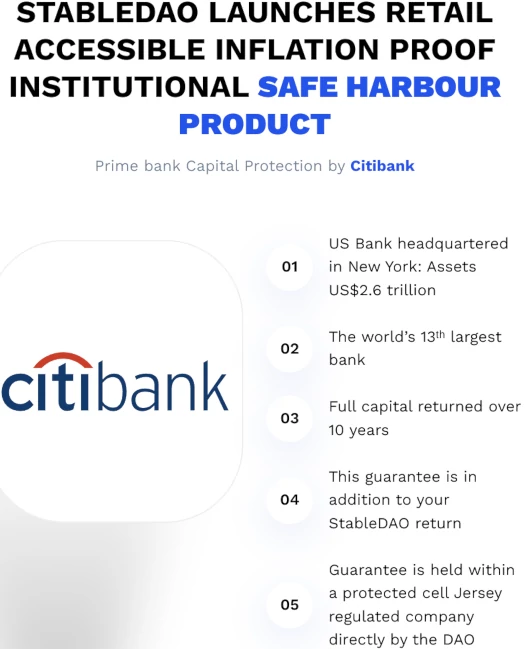

One in all StableDAO’s main advertising factors is “prime financial institution capital safety by Citibank”.

Such to the extent StableDAO has any interplay with CitiBank, if any, I can assure you “StableDAO” or Sam Lee aren’t disclosed.

Given Lee and Xu haven’t been arrested but (Xu hasn’t been seen in public since late 2021), pegging down complete sufferer losses since HyperCash is inconceivable.

I could make an informed guess primarily based on how huge HyperFund received although, that shopper losses in all probability sit properly over a billion. And most of that’s believed to be from US resident buyers.

And now Lee is seeking to do it once more with StableDAO.

You spend money on STBL tokens, Lee and his co-conspirators, early buyers and high recruiters steal your cash.

Given Australian authorities haven’t any extra sway with Dubai’s corrupt officers than US authorities, I’m undecided what is going to come of the Blockchain World proceedings.

We’ll hold you posted on any important updates.