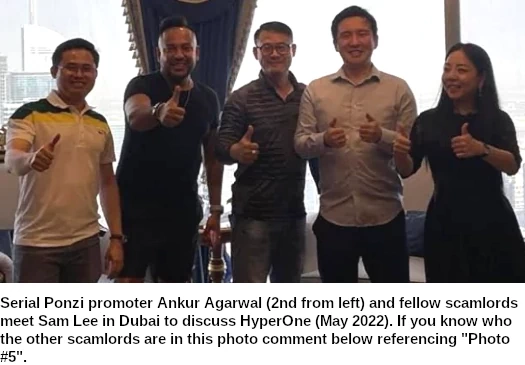

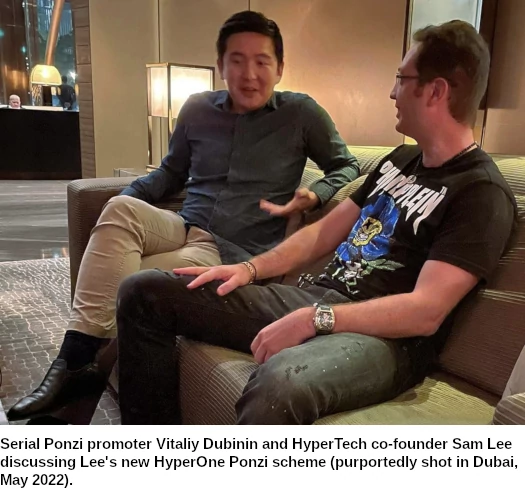

Lee and various scamlords are plotting the launch of HyperOne. They’re aiming to get smaller scammers and victims under them on board.

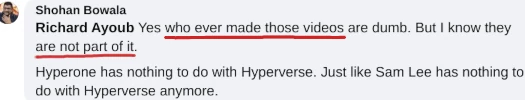

HyperOne’s bungled launch saw official marketing videos represent Kalpesh Patel, Keith Williams and other “crypto leaders” were part of the Ponzi scheme.

Patel publicly denied involvement, prompting HyperOne to delete the videos from their official YouTube channel.

HyperOne promoters have since claimed the videos were uploaded by a third-party, which is untrue.

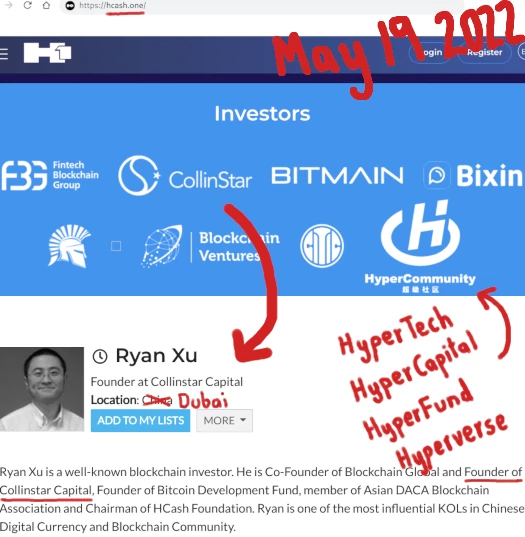

HyperOne is essentially a spinoff of the collapsed Hyperverse Ponzi scheme. Ryan Xu hasn’t been seen or heard in public since late 2021.

The reason for the “Sam Lee has gone off on his own” narrative is so HyperFund/Hyperverse Ponzi losses can be blamed on a boogeyman.

As co-founders of HyperTech, Xu and Lee (aka Xue Lee), profited handsomely from the firm’s first three Ponzi schemes.

HyperOne is a spinoff reboot of the collapsed Hyperverse Ponzi scheme. Which in turn was a reboot of the collapsed HyperFund Ponzi scheme, itself a reboot of the collapsed HyperCapital Ponzi scheme, which was launched to resurrect Xu and Lee’s collapsed HCASH Ponzi token.

All of this took place under Xu and Lee’s umbrella HyperTech parent company.

Personally, my money is on Xu and Lee still working together.

This is all smoke and mirror to reboot yet another iteration of the same Ponzi scheme – but without letting investors carry over existing losses via recycled tokens.

As outlined in BehindMLM’s original HyperOne article, not much has changed between Hyperverse and HyperOne.

They’ve got a new shitcoin and marketing pitch. Some nonsense about NFT mining. This is probably the NFT nonsense Xu and Lee failed to launch under Hyperverse.

Pending regulatory action, which is a question mark seeing as Hyper* scammers, Xu and Lee are mostly hiding in Dubai, exact HyperCapital, HyperFund and Hyperverse investor losses are unknown.

Given there’s been three Ponzi schemes and how big HyperFund got though, I’d peg total losses well into the hundreds of millions. HyperTech’s Ponzi empire might have even cracked a billion or two.

One last thing, Shohan Bowala wanted credit for these photos…

…so I guess we’ll oblige.

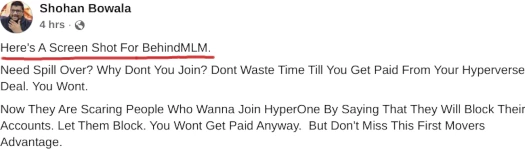

Bowala, a resident of Melbourne, Australia, has been scamming people through MLM Ponzi schemes since at least Cloud Token (~2019).

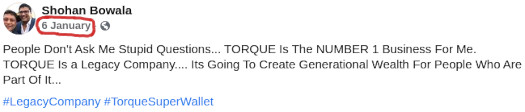

Another of Bowala’s greatest hits was Torque Trading:

Torque Trading, which Bowala claimed was a “legacy company” that was “going to create generational wealth”, collapsed in early 2021.

More recently, Bowala claimed to have earned “millions” in EmpiresX (late 2021):

EmpiresX was co-founded by Emerson Pires. The SEC filed suit against Pires for securities fraud earlier this month.

The regulator claims Pires’ earlier launch, Mining Capital Coin, was a Ponzi scheme.

Pires’ Mining Capital Coin partner, Luiz Carlos Capuci, has been indicted. The DOJ pegs Mining Capital Coin losses at $62 million.

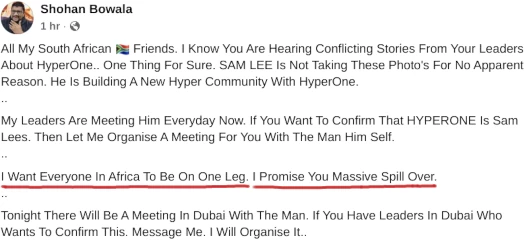

Now Bowala is busy recruiting HyperOne investors, targeting low-hanging fruit in Africa:

By the time an MLM Ponzi scheme reached Africa, it is generally on its last legs.

Regulation of MLM fraud in Africa is unfortunately hopeless. This leaves African Ponzi victims, fleeced by scammers like Bowala living in western countries, with no recourse.

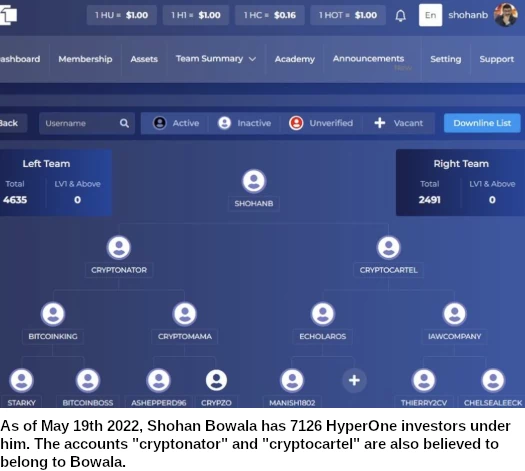

As of May 19th, Bowala claims to have over seven thousand HyperOne investors under him:

HyperOne’s use of cryptocurrency is likely working in its favor. Several MLM crypto Ponzi schemes collapsed over the past week, leaving victims looking to make up losses.

Unfortunately, unless you’re having meetings in Dubai with Sam Lee, investing in HyperOne will just lead to more losses.