There is of course no reference to iGenius’ passive returns trading bot. In fact iGenius flat out lies about the offering altogether.

The following is taken from iGenius’ new compliance documentation verbatim.

In case the offending compliance text disappears from iGenius’ website, here’s a screenshot of how it originally appeared.

Automated Trade Technology

The Company does not offer automated trade technology. In the past, we offered automated trading as a convenience for FOREX users.

The Commodities and Futures Trade Commission reviewed our automated technology and determined that it required a Commodity Trading Advisor.

Since we are committed to providing education and not advice, we entered a settlement on the finding from the CFTC and discontinued the use of automated trade services.

We know automated tools are still available in the marketplace as described below, but we ALSO know promotion or use of this automation requires registration and licensing.

We do not provide these services and we caution our customers about these types of automated tools.

Example of Automated Trading: A company or an individual trader issues a trade signal.

A person pays the company/trader for their signals. The individual then attaches their MT4 enabled forex account to the provider of the trade signal.

Even though the customer attaches their account themselves, and the provider of the signal does not review, monitor or manage the client account, the signal itself is deemed as advice.

Therefore, if the signal is deemed investment advice, then the tool requires a Registered Investment or Commodity Trading Advisory.

The Company does not provide automated trading or tools.

Wow. Just, wow. So uh, a few things.

The CFTC enforcement action pertains to Wealth Generators and happened in 2018.

The CFTC found Wealth Generators was illegally offering access to an automated ROI trading bot. Wealth Generators settled the CFTC’s fraud charges for $150,000.

Shortly after Investview rebranded as Kuvera Global. Kuvera Global was rebranded to iGenius in early 2021.

For the sake of simplicity we’ll ignore the securities fraud that took place under Kuvera Global.

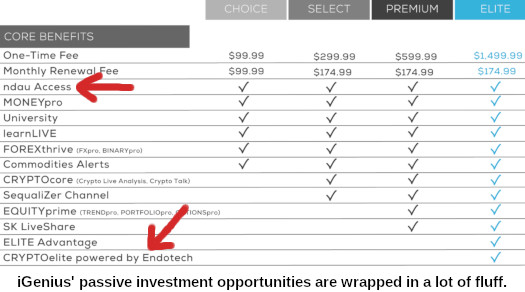

Today if we visit iGenius’ website, we see Crypto Elite bundled with the most expensive $1499 and then $174.99 a month “Elite” membership.

So what is CryptoElite?

In iGenius’ own words, it’s “AI crypto trading software”.

Seriously, that’s the pitch. CryptoElite is an automated trading bot, the exact thing iGenius claims it doesn’t provide.

Since we are committed to providing education and not advice, we entered a settlement on the finding from the CFTC and discontinued the use of automated trade services.

The Company does not provide automated trading or tools.

WHAT? (click to enlarge below)

For reference, EndoTech represents it’s an Israeli firm.

The month prior to iGenius launching a trading bot opp, BehindMLM documented EndoTech’s own Daisy AI securities fraud.

In November 2021 Investview revealed it had received an SEC subpoena requesting information on iGenius.

In the raw Zoom footage that was cut from iGenius’ official compliance video that went up yesterday, President Chad Garner additionally revealed;

[24:57] Ah there was a, y’know the subpoena was from the SEC. So there’s a whole line of questioning.

Based on the line of questioning, it seems like there is some interest from them on understanding the Apex model.

This footage is provided courtesy of Savannah Marie, as featured in her January 22nd video, “I snuck into the iGenius compliance call“.

BehindMLM covered Investview’s fraudulent Apex investment scheme in 2019.

I can’t confirm but imagine what Investview sent back to the SEC in response to the November 2021 subpoena, was similar to the baloney denials in iGenius’ compliance documentation (updated for Jan 2022).

Whether Investview and iGenius gaslighting the SEC and consumers works out remains to be seen.