On December 16th, GSPartners filed a harassment lawsuit against Grit Grind Gold and owner Chris Saunders.

Saunders is the sole named defendant in GSPartners’ Virginia suit.

Saunders owns and operates a YouTube Channel named “Grit, Grind, Gold,” an Instagram account named “Grit, Grind, Gold,” a Facebook page named “Grit, Grind, Gold,” and a Twitter Handle named “@24KaratChris”.

Through his various Grit Grind Gold accounts, Saunders has been publishing content critical of GSPartners throughout most of 2021.

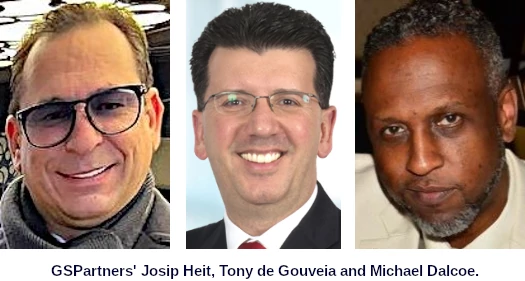

Named Plaintiffs in GSPartners suit are

- Gold Standard Bank, incorporated in Germany;

- GSB and GSPartners owner Josip Heit, a Croatian national with ties to Germany and Dubai;

- Antonio Euclides Meneses de Gouveia, a South African GSPartners promoter and top earner; and

- Michael Dalcoe, a US-based GSPartners promoter and top earner.

GSPartners alleges Saunders

began broadcasting videos on the GGG YouTube Channel that included a series of false and defamatory statements about GSB, its principals, and agents.

As of the filing of this action, Saunders has since published at least ninety-nine (99) videos on the GGG YouTube Channel.

Hilariously, GSPartners’ lawsuit objects to Saunders highlighting the ties between it and Harald Seiz’s Karatbars International Ponzi.

On information and belief, Karatbars was created in 2011 by Harald Seiz, Karatbars’ founder and Chief Executive Officer.

From 2011 through to 2020, Karatbars employed thousands of sales agents who earned sizeable commissions selling various gold products to customers across the world.

From 2018 through 2020, Karatbars also sold a cryptocurrency called V999, which Karatbars claimed was the only cryptocurrency backed by gold (the “V999 Token”).

On information and belief, Karatbars’ business activities came under criminal and regulatory investigation in several jurisdictions:

In May 2019, authorities in Namibia declared Karatbars a pyramid scheme.

In October 2019, the Florida Office of Financial Regulation refuted claims that Karatbars was operating under a banking license in Florida.

In November 2019, South Africa’s Financial Sector Conduct Authority (FSCA) issued a warning for the public not to deal with Karatbars.

In November 2019, Germany’s banking watchdog, BaFin, issued a cease and desist order to Karatbit Foundation and ordered the company to settle outstanding claims.

In May 2021, the Financial Markets Authority of New Zealand issued an advisory warning against Karatbars.

On further information and belief, Karatbars has gained a reputation as being a fraudulent, pyramid scheme that has harmed investors as determined by these various criminal and regulatory investigations.

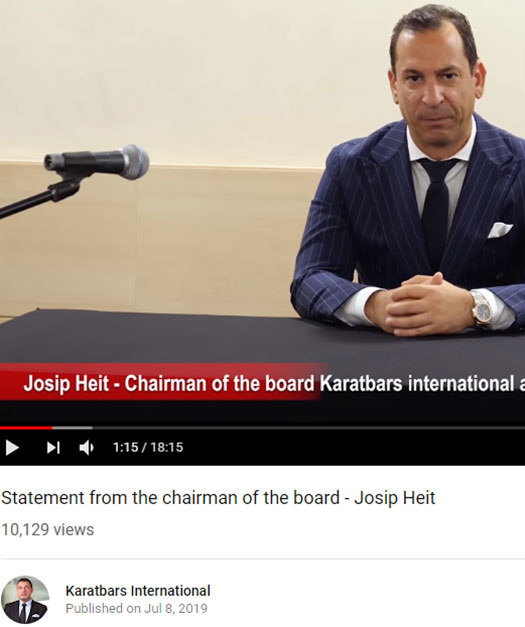

The reason this outrage is hilarious is because Josip Heit is Karatbars’ former Chairman of the Board.

Harald Seiz brought on Heit to orchestrate Karatbars’ failed cryptocurrency Ponzi scheme.

After it flopped in 2019, Heit, as Karatbars’ Chairman of the Board, fronted angry investors.

Heit split from Seiz in late 2019. GSPartners launched in early 2020 as a Karatbars spinoff.

Rather than address any of that though, GSPartners instead seeks to create confusion around the two companies.

In both legal and practical terms, Karatbars and GSB are not the same entity.

First, Karatbars and GSB are two separate legal entities.

Karatbars is a corporate entity that was registered under the laws of Germany in 2011 as Karatbars International GmbH, whereas GSB was registered in 2020 as GSB Gold Standard Corporation AG.

Second, Karatbars and GSB do not enjoy a parent, subsidiary, sister, related, or affiliated company relationship of any kind whatsoever.

Third, Karatbars and GSB do not share the same owners. On information and belief, Karatbars is wholly owned by its founder, Mr. Harald Seiz, while GSB is wholly owned by Josip

Heit.Fourth, Karatbars and GSB do not have any j Dint venture, partnership, or similar business relationship. In sum, Karatbars and GSB are not the same entity.

While all of that is true, it doesn’t change Heit’s time at Karatbars, or the fact that GSPartners is a spinoff.

Notwithstanding, Saunders has repeatedly made false and defamatory statements alleging that Karatbars and GSB are the same entity.

Practically speaking GSPartners’ launch was a clone of Karatbars at the time. This isn’t surprising, seeing as Heit was behind Karatbars’ failed transition to crypto fraud.

Heit and GSB used a free script to create Karatbars’ various shitcoins. They did the same for GSPartners and G999.

Prior to Heit’s and GSB’s involvement, Karatbars operated as a gold-based pyramid scheme.

The two named GSPartners promoter plaintiffs, Tony de Gouveia…

…and Michael Dalcoe?

They’re both former Karatbars top earners.

De Gouveia and Dalcoe jumped ship with Heit. As did a number of then Karatbars top earners and their downlines.

GSPartners gave Karatbars scammers an opportunity to promote the same fraudulent business model under a new name.

V999 is to Karatbars what G999 is to GSPartners.

Collectively, Saunders’ statements falsely conflating Karatbars with GSB have been viewed at least 205,283 times as of the filing of this Complaint.

At all times, Saunders has made each of these statements conflating GSB with an organization internationally known for fraud and deceit with the knowledge that his statements were false and that GSB and Karatbars are separate entities.

Well geez, anyone would think GSPartners wasn’t a clone Ponzi scheme. Go figure.

In summary, while GSPartners have surpassed Karatbars’ securities fraud by launching multiple shitcoins and an NFT scheme, it remains a spinoff of Karatbars.

That’s GSPartners’ origin story. It is what it is.

Rather than address GSPartners committing securities fraud and running a Ponzi scheme, the cliche “iF wE wErE iLlEgAl We’D hAvE bEeN sHuT dOwN!” defense is raised.

GSB, its principals, and agents are not engaged in a Ponzi scheme.

Neither GSB nor its principals or agents have been charged must less convicted of participating in a Ponzi scheme, nor has there been any criminal or regulatory investigations into GSB in connection

with allegations that it may be running a Ponzi scheme.GSB, its principals, and agents, including, more specifically, Plaintiffs, have not and are not engaged in criminal acts or acts of moral turpitude.

Neither GSB nor its principals or agents have been charged must less convicted of any crimes or acts of moral turpitude, nor has there been any criminal or regulatory investigations into GSB, its principals, or agents in connection with possible crimes or acts of moral turpitude.

By this flawed logic Bernie Madoff’s Ponzi scheme wasn’t a Ponzi scheme, until the SEC filed suit in December 2008.

Investigation into Madoff’s Ponzi scheme dates fraud back as early as 1964. But uh yeah, the Ponzi scheme didn’t exist until 2008.

“But we haven’t been shut down” is a common bad faith argument raised by scammers. It ignores that regulation is reactionary, and that illegal conduct is illegal irrespective of whether authorities do or don’t step in.

Here GSPartners and Heit present the lack of regulatory action against themselves as proof of legitimacy.

Let’s say the SEC and/or DOJ took action against GSPartners and Heit next week. What would that action be based on?

It’d be based on GSPartners’ and Heit’s conduct, namely running a Ponzi scheme through G999 and other shitcoins.

Whether the SEC and/or DOJ take action, that conduct remains the same. It is illegal as per US securities law (offering/selling unregistered securities) and the US Code (wire fraud and money laundering) – irrespective of whether GSPartners and Heit are ever charged.

The lack of regulatory action, civil or criminal, is not proof of legitimacy.

Collectively, Saunders’ statements falsely alleging that GSB, its principals, and agents are engaged in a Ponzi scheme have been viewed at least 205,283 times as of the date of filing of this Complaint.

Saunders has made each of these statements, while knowing that such statements are false and that GSB, its principals, and agents are not engaged in a Ponzi scheme and with the malicious intent that his statements would harm the business and reputation of GSB, its principals, and agents.

Tellingly, GSPartners provides no evidence Saunders knew or knows GSPartners is not a Ponzi scheme.

Next up we have GSPartners and Heit upset over comparisons to the OneCoin Ponzi scheme.

What made OneCoin a Ponzi scheme is investors invested in onecoin, received more onecoin and cashed out subsequently invested funds.

This is precisely what happens in GSPartners. And indeed every MLM crypto Ponzi.

Rather than address that though, GSPartners incorrectly attributes OneCoin’s fraud solely to the mining lie;

OneCoin was alleged to have been mined using mining services maintained and operated by OneCoin but its price was in fact determined internally rather than being based upon market supply and demand.

That was certainly part of OneCoin’s fraud but it’s not explicitly why OneCoin was a Ponzi scheme. It’s also not why GSPartners and OneCoin are similar with respect to both being shitcoin Ponzi schemes.

Again, rather than address that though, GSPartners waffles on about the two companies being legally separate entities;

In both legal and practical terms, GSB and OneCoin are not the same entity.

First, GSB are two separate legal entities. OneCoin was a corporate entity that was registered under the laws of Bulgaria in 2014 by Konstantin Ignatov and Ruja Ignatova, whereas GSB was

registered in 2020 as GSB Gold Standard Corporation AG.Second, OneCoin and GSB do not enjoy a parent, subsidiary, sister, related, or affiliated company relationship of any kind

whatsoever.Third, OneCoin and GSB do not share the same owners. On information and belief, OneCoin was wholly owned by its founders, Konstantin Ignatov and Ruja Ignatova, while GSB is wholly owned by Josip Heit.

Fourth, OneCoin and GSB do not have any joint venture, partnership, or similar business relationship.

In sum, OneCoin and GSB are not the same entity.

None of that changes both OneCoin and GSPartners operating similar Ponzi schemes via their respective tokens.

In July 2021 BehindMLM learned of a kangaroo court ruling, purportedly handed down ex-parte in the Ukraine.

Turns out this failed strategy to censor criticism of GSPartners wasn’t only directed at BehindMLM.

On June 18, 2021, a Ukrainian District Court issued an order in connection with a complaint brought by GSB against Saunders and his GGG YouTube Channel and GGG Instagram Account (the “Ukraine Complaint”).

The Ukraine Complaint alleged that Saunders falsified pictures, as well as published factually untrue statements about GSB, its agents, and its principals.

After a detailed examination of Saunders’ statements, as well as evidence presented by GSB pertaining to the substance of statements and representations made by Saunders on his GGG YouTube Channel, the Ukrainian District Court ruled in favor of GSB and issued an injunction demanding Saunders remove the “deliberate defamations” he published on his GGG YouTube Channel and GGG Instagram Account.

As with the BehindMLM ruling, Saunders wasn’t aware of the Ukraine proceedings and there was no due process.

Tellingly, GSPartners and Heit have no ties to the Ukraine.

Both BehindMLM and Saunders ignoring kangaroo court ex-parte proceedings in the Ukraine has evidently infuriated Heit.

Notwithstanding the Ukrainian Take-Down Notice, Saunders refused to remove the “deliberate defamations,” and has since published fifty (50) videos on his GGG YouTube Channel making similarly defamatory statements, with the full knowledge that these statements were false and defamatory, and in direct contempt of the Ukrainian Take-Down Notice.

GSPartners again provides no evidence Saunders knew any of the alleged statements made in the fifty videos were “false and defamatory”.

Saunders mocking GSPartners’ November cease and desist has also infuriated Heit.

Saunders is currently using the Cease and Desist Letter not as a guide to help him identify which false and defamatory statements to retract but to actively promote these false and defamatory statements to his viewers by posting a copy of the Cease and Desist letter on his GGG Facebook Channel and making videos about it on his GGG YouTube Channel.

And these tactics are working the video Saunders posted on his GGG YouTube Channel on November 18, 2021 where he mocked the Cease and Desist Letter, is now one of Saunders’ top videos of all time.

As a result of Saunders calling out Heit’s GSPartners Ponzi scheme, the company complains Saunders’ content

show up on Google, YouTube, and other search engines when GSB’s prospective customers are searching online for information about GSB.

As a result … GSB, its principals, and agents have lost, and continue to lose, thousands of dollars in monthly revenues from customers, lost business relationships, and lost prospective business opportunities, including substantially more than $75,000 in lost income.

How much GSPartners affiliates have lost investing in G999 since 2020 is unknown.

Across two causes of action, GSPartners allege Saunders calling out the G999 Ponzi scheme constitutes

- defamation per se; and

- tortious interference with business expectancy.

Looking at the case docket, Saunders was served on December 29th.

Saunders has been given till February 11th to respond to the lawsuit.

Stay tuned as we continue to track the case.

Update 12th February 2022 – Chris Saunders has filed a motion to dismiss on February 11th.

A hearing on the motion has been scheduled for March 11th. I’ve marked my next case docket check for March 12th.

Update 12th March 2022 – The GSPartners filed for an extension to respond to Saunders’ motion to dismiss on February 15th.

The court gave the GSPartners defendants an extension till March 4th.

As a result, the motion to dismiss hearing has been pushed back to March 16th. I’ve marked my next case docket check for March 17th.

Update 29th August 2022 – GSPartners has abandoned its lawsuit against Chris Saunders.