There’s after all no reference to iGenius’ passive returns buying and selling bot. In reality iGenius flat out lies concerning the providing altogether.

The next is taken from iGenius’ new compliance documentation verbatim.

In case the offending compliance textual content disappears from iGenius’ web site, right here’s a screenshot of the way it initially appeared.

Automated Commerce Know-how

The Firm doesn’t supply automated commerce expertise. Up to now, we provided automated buying and selling as a comfort for FOREX customers.

The Commodities and Futures Commerce Fee reviewed our automated expertise and decided that it required a Commodity Buying and selling Advisor.

Since we’re dedicated to offering schooling and never recommendation, we entered a settlement on the discovering from the CFTC and discontinued using automated commerce companies.

We all know automated instruments are nonetheless obtainable within the market as described beneath, however we ALSO know promotion or use of this automation requires registration and licensing.

We don’t present these companies and we warning our clients about most of these automated instruments.

Instance of Automated Buying and selling: An organization or a person dealer points a commerce sign.

An individual pays the corporate/dealer for his or her indicators. The person then attaches their MT4 enabled foreign exchange account to the supplier of the commerce sign.

Although the client attaches their account themselves, and the supplier of the sign doesn’t evaluate, monitor or handle the shopper account, the sign itself is deemed as recommendation.

Subsequently, if the sign is deemed funding recommendation, then the instrument requires a Registered Funding or Commodity Buying and selling Advisory.

The Firm doesn’t present automated buying and selling or instruments.

Wow. Simply, wow. So uh, a couple of issues.

The CFTC enforcement motion pertains to Wealth Mills and occurred in 2018.

The CFTC discovered Wealth Mills was illegally providing entry to an automatic ROI buying and selling bot. Wealth Mills settled the CFTC’s fraud expenses for $150,000.

Shortly after Investview rebranded as Kuvera World. Kuvera World was rebranded to iGenius in early 2021.

For the sake of simplicity we’ll ignore the securities fraud that occurred underneath Kuvera World.

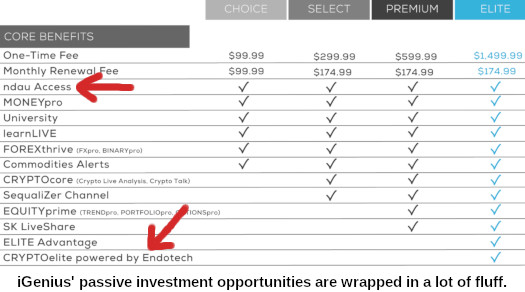

At the moment if we go to iGenius’ web site, we see Crypto Elite bundled with the costliest $1499 after which $174.99 a month “Elite” membership.

So what’s CryptoElite?

In iGenius’ personal phrases, it’s “AI crypto buying and selling software program”.

Severely, that’s the pitch. CryptoElite is an automatic buying and selling bot, the precise factor iGenius claims it doesn’t present.

Since we’re dedicated to offering schooling and never recommendation, we entered a settlement on the discovering from the CFTC and discontinued using automated commerce companies.

The Firm doesn’t present automated buying and selling or instruments.

WHAT? (click on to enlarge beneath)

For reference, EndoTech represents it’s an Israeli agency.

The month previous to iGenius launching a buying and selling bot opp, BehindMLM documented EndoTech’s personal Daisy AI securities fraud.

In November 2021 Investview revealed it had obtained an SEC subpoena requesting data on iGenius.

Within the uncooked Zoom footage that was minimize from iGenius’ official compliance video that went up yesterday, President Chad Garner moreover revealed;

[24:57] Ah there was a, y’know the subpoena was from the SEC. So there’s a complete line of questioning.

Based mostly on the road of questioning, it looks as if there’s some curiosity from them on understanding the Apex mannequin.

This footage is offered courtesy of Savannah Marie, as featured in her January twenty second video, “I snuck into the iGenius compliance name“.

BehindMLM lined Investview’s fraudulent Apex funding scheme in 2019.

I can’t verify however think about what Investview despatched again to the SEC in response to the November 2021 subpoena, was just like the baloney denials in iGenius’ compliance documentation (up to date for Jan 2022).

Whether or not Investview and iGenius gaslighting the SEC and customers works out stays to be seen.