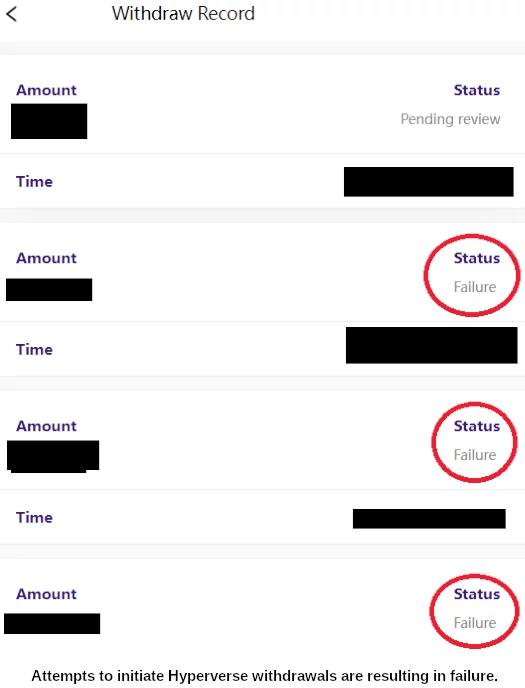

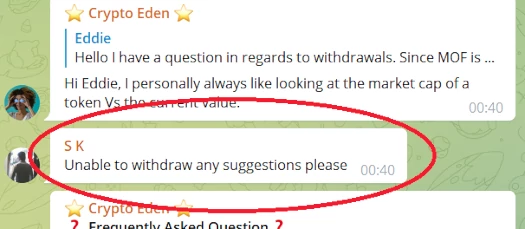

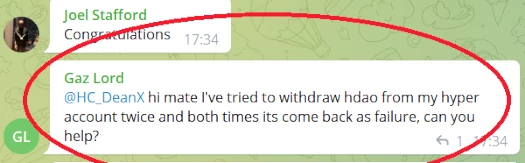

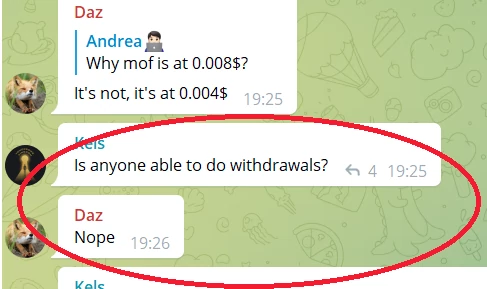

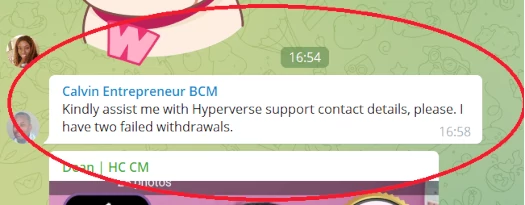

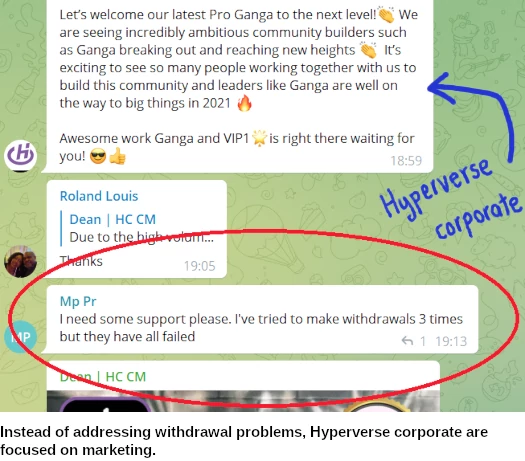

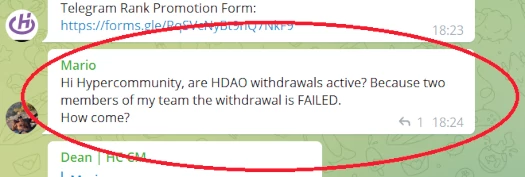

Hyperverse affiliate traders are flooding official help channels with stories of withdrawal failures.

Different associates are claiming HDAO is working for them.

The examples of reported withdrawal failures have been sourced from certainly one of Hyperverse’s official Telegram channels, all throughout the final 24 hours.

Previous to the Hyperverse catastrophe reboot, HyperFund associates invested precise cryptocurrency into HU Ponzi factors.

HyperFund’s 300% returns have been calculated in HU factors, which aren’t publicly tradeable. When affiliate traders needed to withdraw, they’d achieve this in MOF, a shitcoin created by HyperTech house owners Ryan Xu and Sam Lee.

HyperFund associates would then promote MOF to appreciate a return on their funding.

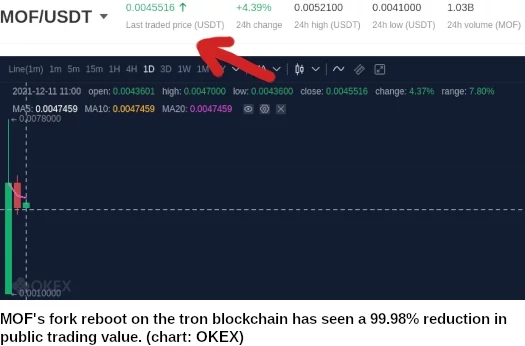

The Hyperverse reboot noticed Xu and Lee additionally switch MOF from the ethereum blockchain to that of tron.

This noticed MOF’s complete coin supple develop from 100 million to 100 billion.

Consequently MOF’s public buying and selling worth plummeted 98.98% from ~$2 to round $0.004, lower than half a cent.

CoinMarketCap is recording ~$15,000 unverified buying and selling quantity on Bittrex, which has artificially inflated MOF’s chart worth to simply over a cent.

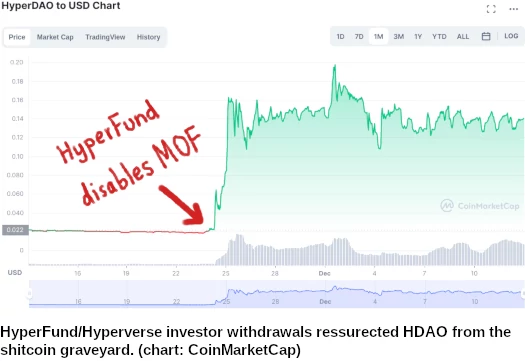

To facilitate the blockchain transition, MOF was faraway from the Hyperverse backoffice as a withdrawal possibility.

BehindMLM understands that as at time of publication, MOF withdrawals stay disabled.

In MOF’s place is HyperDAO or HDAO, one other shitcoin Xu and Lee launched in early 2020.

Hyperverse disabling MOF withdrawals noticed the comparatively lifeless HDAO spike in worth on November twenty fifth.

For the previous three weeks, HyperFund/Hyperverse associates have been withdrawing via HDAO.

That stopped working someday within the final 24-48 hours.

For the reason that prerecorded Hyperverse launch video went stay final weekend, there have been no Hyperverse company bulletins addressing ongoing withdrawal points.

Hyperverse’s web site stays principally in the identical unfinished state it’s been because it surfaced a number of weeks in the past.

There have been no additional updates on the deliberate Hyperverse NFT Ponzi “sport”. I’ve seen stories these plans have been since been deserted however haven’t been capable of confirm.

HyperTech and Hyperverse house owners Ryan Xu and Sam Lee fled to Dubai earlier this 12 months. They’re on the run from Blockchain World traders in Australia, who’re looking for to get better $48.9 million in losses.

Blockchain World was the precursor to HyperTech, via which Xu and Lee went on to launch the HyperCapital, HyperFund and now Hyperverse Ponzi schemes.

Hyperverse’s “company presenters” have introduced a webinar someday at the moment. Whether or not they deal with Hyperverse’s catastrophe launch and withdrawal issues is unclear.

Primarily based on Alexa web site visitors estimates, nearly all of Hyperverse traders are believed to be within the US.

US authorities have but to announce regulatory motion towards HyperTech, Hyperverse, its executives and/or promoters.