Hyperverse is little greater than a damaged web site. Associates are nonetheless logging into the HyperFund backoffice.

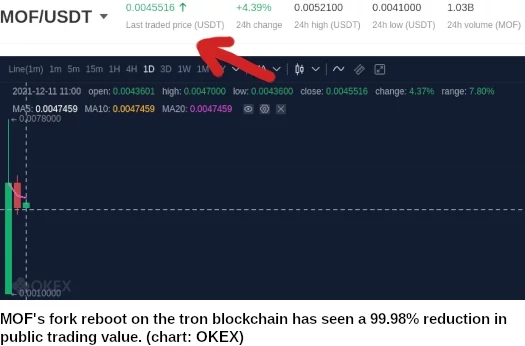

MOF has transitioned over to the tron blockchain, permitting Ryan Xu and Sam Lee to develop 100 million MOF tokens to 100 billion.

This has seen MOF’s public buying and selling worth plummet from ~$2 to lower than half a cent.

Hyperverse associates are panicking. As an alternative of explaining what went unsuitable, Hyperverse has trotted out serial Ponzi promoter James Lockett to lie about securities fraud and compliance.

Lockett’s look in a post-launch official compliance video suggests Ronae Jull may need been shelved.

The primary thirty minutes of Lockett’s Hyperverse presentation is advertising and compliance fluff BehindMLM has already debunked.

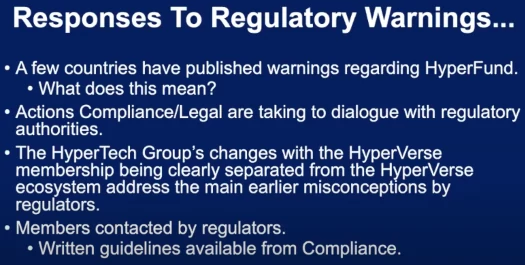

At [29:50] the next slide pops up:

[29:52] Now we did need to replace you on the HyperGroup response to regulatory [sic].

There are just a few nations which have printed warning relating to the HyperFund. None to this point concerning the Hyperverse.

BehindMLM has documented HyperFund securities fraud warnings and investigations from the UK, India, New Zealand, Guernsey, Germany and Bermuda.

Replace eleventh December 2021 – The UK added Hyperverse to their HyperFund securities fraud discover on December tenth. /finish replace

[30:08] That implies that they’ve questions. Normally these warnings or investigations have been began due to member’s publishing or saying the unsuitable factor in an incorrect means, or in a non-compliant means or each.

And so warnings have come up. Individuals have misunderstood issues.

Whereas regulatory investigations may be triggered through promotion, the warnings and investigations pertain to HyperFund and now Hyperverse’s fraudulent enterprise mannequin.

To be clear: Not one of the regulatory securities fraud notices or investigations cited above pertain to promotion of HyperFund. They’re all directed at HyperFund and its executives – as a direct results of the corporate’s enterprise mannequin.

Claiming monetary regulators have “misunderstood” securities fraud is Ponzi pseudo-compliance at its best.

[30:30] So compliance and authorized have been reaching out to those regulatory companies. There’s only a handful of them, so it’s not an enormous pattern like some folks within the press would love you to imagine.

Diminishing securities fraud can be pseudo-compliance. Securities regulation doesn’t differ a lot between nation to nation.

Any nation with a monetary regulator regulates securities. And that requires registration with monetary regulators and filed audited studies.

The rationale for that is to determine verifiable exterior income technology, to show that newly invested funds aren’t getting used to pay returns.

Any MLM firm that doesn’t register with monetary regulators, and as a substitute opts to commit securities fraud and function illegally, does so as a result of it’s a Ponzi scheme.

HyperFund and now Hyperverse is one such firm.

[30:46] We’re in dialogue with each regulatory authority that has raised a query.

In truth we have been in contact with one regulator the day after (Hyperverse’s) launch.

So on Monday morning, the sixth of December, we have been in contact with one regulator, who was completely delighted with the brand new modifications.

New modifications you say? Go onnnnnnn…

[31:08] So the modifications made by HyperTech Group with the Hyperverse membership clearly being separated from the Hyperverse ecosystem; that addresses a whole lot of the sooner misconceptions that regulators have.

Sorry, what?

Regulators have an issue with HyperFund and Hyperverse as a result of its a Ponzi scheme providing 300% returns.

From a regulatory standpoint regulation begins with figuring out an funding contract and, as soon as recognized, establishing whether or not an organization providing securities is appropriately registered and submitting audited monetary studies.

If not, that firm is committing securities fraud and working illegally.

The US makes use of the Howey Take a look at to determine an funding contract.

An funding contract exists if there may be an “funding of cash in a standard enterprise with an affordable expectation of income to be derived from the efforts of others.”

In HyperFund and Hyperverse, associates spend money on a standard enterprise (HyperFund and Hyperverse), with a “cheap expectation of income (an marketed 300% ROI), to be derived from the efforts of others (HyperFund and Hyperverse manages the ROI payout).

It doesn’t matter what foolish names you provide you with to masks an funding contract (“memberships”, “each day rewards” and many others.), if it matches the Howey Take a look at then it’s an funding contract as per US securities regulation.

Materially, there isn’t any distinction to the definition of an funding contact exterior of the US.

Each monetary regulator has an analogous variation of the Howey Take a look at. The one distinction within the US is it was made a public written definition on account of a Supreme Courtroom case.

This is the reason, when an MLM Ponzi scheme will get large enough to draw regulatory consideration, you’ll see equally worded securities fraud warnings issued throughout a number of jurisdictions.

That’s all that actually must be stated in relation to Hyperverse compliance.

However as a result of James Lockett goes onto blatantly lie about securities regulation, we’ll proceed to report Lockett’s lies.

[31:23] The (Hyperverse) membership is an unregulated membership.

And the ecosystem is a mixture of unregulated and several types of regulated companies.

And so long as we hold them separate, the membership can fly around the globe with out regulation, and be authorized and correct in all these nations.

I’ve already addressed this “renaming” pseudo-compliance above. What I’ll do right here is problem anybody in Hyperverse to show the place within the Howey Take a look at or Securities and Change Act, it states

- securities fraud is authorized for those who name it a membership; and

- Ponzi schemes are authorized for those who separate them from membership.

That problem is prolonged to Hyperverse traders exterior of the US. By all means present proof of related securities laws in any nation that legalizes securities fraud when performed via a “separate membership”.

Clearly, for causes we’ll get into later, James Lockett is aware of he’s mendacity via his tooth.

It’s no secret that a big proportion of HyperFund/Hyperverse affiliate traders are holding updated with developments on BehindMLM.

As a result of BehindMLM is without doubt one of the largest MLM assets, that extends past HyperFund/Hyperverse’s associates.

And so Lockett’s subsequent process is, somewhat then addressing the truth of securities fraud that destroys Hyperverse’s pseudo-compliance above (as a result of he can’t with out giving the sport away), to “assault the messenger” so to talk.

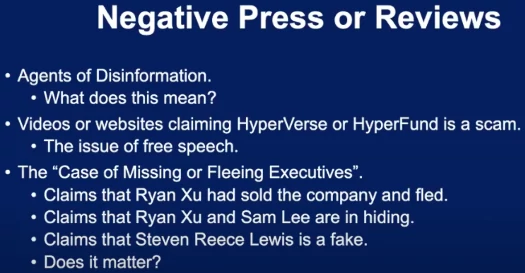

[33:03] So we’ve brokers of disinformation. There are two or three main blogs which can be simply assault animals and so they deliberately unfold misinformation to attract visitors to their website.

And for them every little thing is a rip-off. And it’s not simply Hyperverse or HyperFund, just about every little thing besides what they’re doing is supposedly a rip-off.

For reference, within the twelve years I’ve been operating BehindMLM I’ve by no means promoted something on it.

As to “every little thing is a rip-off”, I’m going into each evaluation with a impartial mindset. Analysis into an organization creates the construction, course and tone of every evaluation, accurately.

[34:02] So for those who take note of all this rubbish, and that’s what these items is, you then’re giving it extra credit score then it’s due.

And the issue is, if many people, y’know once we see a weblog article that… let’s undergo these examples.

We just lately had claims that Ryan Xu or Sam Lee had bought the corporate and fled, or they’re in hiding, or the corporate is shut down and now it’s relaunching, or they ran out of cash and now they’re a Ponzi scheme – all that is faux. And everyone knows it.

We additionally had new claims that Steven Reece Lewis, our new CEO, we’ve seen a number of movies from him, that he’s a faux individual.

Does it matter?

Properly it’s the sticks and stones thought. Nevertheless it doesn’t actually matter what they are saying. We all know what the reality is.

Once more, anybody who’s been following BehindMLM’s protection, particularly the Blockchain World fallout of late, can attest that solely the information have been reported as they’ve been made public.

Ryan Xu and Sam Lee have fled to Dubai. Ryan Xu and Sam Lee are in hiding from Blockchain World liquidators after the corporate collapsed, producing $48.9 million AUD in losses.

Steven Reece Lewis has no verifiable digital footprint. He is a Boris CEO actor plucked from obscurity.

And Hyperverse is a reboot of HyperFund. Similar Ponzi scheme, new coat of paint.

Pretending there’s some different reality to those precise occasions enjoying out sees Lockett gaslighting Hyperverse traders.

That is much less conduct present in a respectable enterprise, and extra in step with what you’d see in a cult.

What makes James Lockett’s denial of information and gaslighting all of the extra egregious, is that is removed from his first Ponzi rodeo.

And the playbook is precisely the identical.

Lockett cemented his scamming legacy with USI-Tech. USI-Tech launched in 2016 as a foreign currency trading Ponzi scheme.

That collapsed a yr later, prompting USI-Tech to relaunch as a 150% ROI MLM crypto Ponzi scheme.

Lockett was a distinguished promoter of USI-Tech via his YouTube channel “World Turbo Crew”.

Following a collection of regulatory securities fraud warnings (I don’t assume I have to level out the apparent sample right here), USI-Tech collapsed in early 2018.

Like Hyperverse, USI-Tech’s executives fled to Dubai.

Up till USI-Tech’s collapse, Lockett sputtered the identical pseudo-compliance and “don’t take heed to the information” denials he’s now regurgitating for Hyperverse.

BehindMLM documented USI-Tech, as we’re doing with HyperFund and Hyperverse, from launch to break down throughout fifty-one articles.

After USI-Tech Lockett deleted all his denial and promotional movies from World Turbo Crew.

He continued to make use of World Turbo Crew to advertise numerous smaller MLM Ponzi schemes.

Because the collapses started to mount, so did the backlash from Lockett’s victims. This ultimately result in Lockett spitting the dummy and deleting his YouTube channel.

Lockett resorted to selling scams via Telegram, the place he felt he may preserve a a lot tighter grip on his victims.

BehindMLM documented Lockett’s “eat shit” second, noting he formally deserted USI-Tech in April 2018.

Thankfully, Lockett’s USI-Tech scamming was immortalized in movies hosted on “The Ponzi Present” YouTube channel.

In early 2020 Lockett had a crack at My Day by day Alternative. Evidently that didn’t work out and so he returned to MLM crypto Ponzi scamming.

Now he’s weaseled his means into HyperFund compliance and right here we’re. The identical bullshit, three and a half years later.

When he’s not selling Ponzi schemes and mendacity about securities fraud, Lockett doubles as an “worldwide lawyer and supervisor” via Lockett Worldwide.

Lockett is predicated out of the US. Neither he, HyperTech, HyperFund, Hyperverse or any of its executives are registered with the SEC.

At time of publication Alexa estimates the US is the most important supply of visitors to Hyperverse’s web site (29%).

Replace sixteenth July 2022 – This text initially included a hyperlink to James Lockett’s Hyperverse presentation.

As on the time of this replace, YouTube advises “the YouTube account related to this video has been terminated.” As such I’ve disabled the beforehand accessible hyperlink.