Hyperverse is now promising traders 400% ROI. That is up from the 300% supplied via HyperFund.

With withdrawals disabled all through most of 2022, Hypervere’s 400% return comes off as a determined money seize.

Hyperverse is billing its new funding plans as “Hyperverse 2.0”.

Hyperverse itself solely launched a couple of months in the past, following HyperFund’s collapse.

Underneath Hypverse’s new 400% ROI plans, traders purchase in at as much as $3600. That is finished on the promise of an eventual $14,400 ROI, calculated at 0.3% a day and paid in HU.

Observe that is down from 0.5% beforehand supplied below Hypverse’s 300% ROI plans.

HyperUnit is an inside factors system used inside Hyperverse. Associates must convert it to one thing else to withdraw.

That brings us to Hyperverse’s rolling withdrawal issues.

Since HyperFund collapsed, Hyperverse has juggled withdrawals via MOF and HVT. These have since been disabled.

GNX was launched as a solution to punish Hyperverse associates who didn’t recruit. GNX withdrawals have been imagined to be enabled in mid February however stay disabled.

Because it stands the one solution to withdraw something from Hyperverse is to take part of their “subscription swimming pools”.

Hypervere’s subscription swimming pools see associates convert HU to HVT internally, after which dump HVT into the swimming pools.

As soon as the timer runs down, a subscription pool splits up a set quantity of cryptocurrency between associates. Associates obtain pro-rata shares of the cryptocurrency quantity, based mostly on how a lot HVT they dumped into the pool.

Hyperverse makes use of the swimming pools to slash its ROI withdrawal liabilities. Traders flock to the swimming pools, determined to withdraw no matter they will.

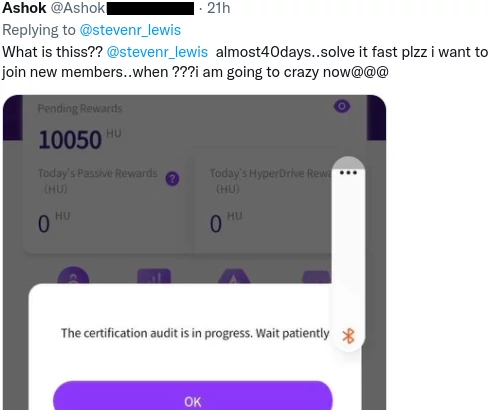

Worse off associates are caught ready for KYC verification.

HyperFund launched KYC as a selective solution to limit withdrawals round October 2021. Associates focused for withdrawal restriction report KYC verification has blown out to over 40 days.

These which were verified declare it took upwards of 90 days:

One other technique Hyperverse has give you to dissuade withdrawals is APY swimming pools:

Associates make investments HVT as a substitute of cashing out, on the promise of a further annual 15% ROI. Throughout that point that’s much less HVT Hyperverse has to fret about paying out on.

Hyperverse house owners Ryan Xu and Sam Lee haven’t been seen for months.

Xu and Lee disappeared following reviews they’re needed by Australian liquidators over tens of hundreds of thousands in losses.

Different Hyperverse executives are MIA too. Hyperverse Compliance Officer Ronae Jull (aka Hope Hill), has been largely absent since HyperFund’s collapse.

Stephen Lewis, an actor introduced on to moonlight as Hyperverse’s CEO whereas Xu disappears, has additionally not been seen for some time.

Lewis remains to be energetic on social media, nevertheless his account is believed to be run by a Hyperverse account supervisor in Dubai.

Rodney Burton, considered one of Hyperverse’s most seen prime earners, has reverted to the “a number of streams of earnings” pitch:

Burton, a US resident who fled to Dubai after getting in early with HyperFund, is recruiting victims for “new earnings producing alternatives”.

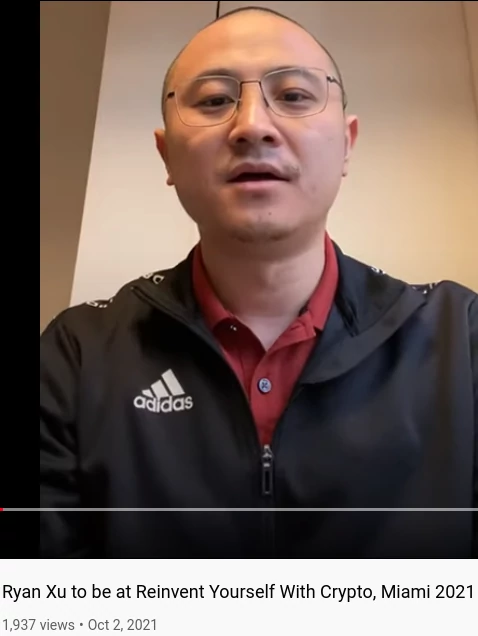

Hyperverse’s different outstanding prime earner, Kalpesh Patel, a UK citizen additionally hiding out in Dubai, remains to be stringing victims together with occasions.

Primarily based on constant Alexa visitors estimates courting again to HyperFund’s launch, the overwhelming majority of Hyperverse victims are believed to be US residents.

Thus far US authorities haven’t taken any motion in opposition to Hyperverse, its executives or promoters.