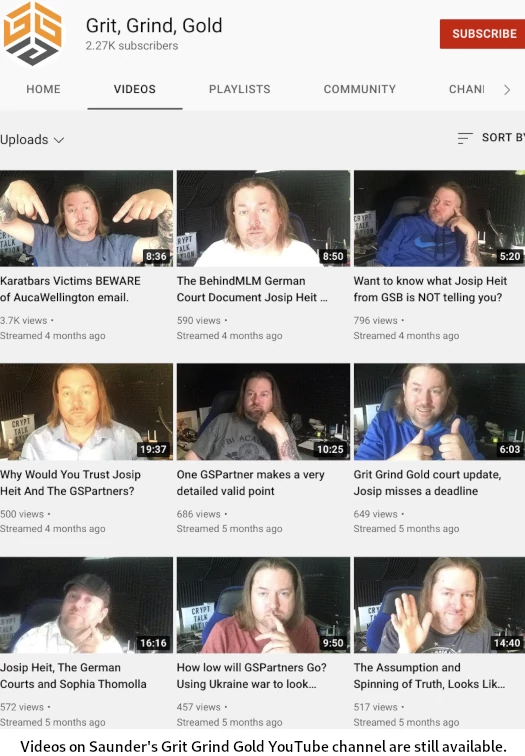

Saunders personal and operates the YouTube channel Grit Grind Gold, which he used to report on and criticize the GSPartners Ponzi scheme.

This attracted the eye of proprietor Josip Heit and promoters Michael Dalcoe and Antonio (Tony) Euclides Menesis De Gouveia, who filed a harassment lawsuit in opposition to Saunders earlier this this 12 months.

Heit and the GSPartners Plaintiffs claimed Sunders making movies on the Ponzi scheme constituted defamation.

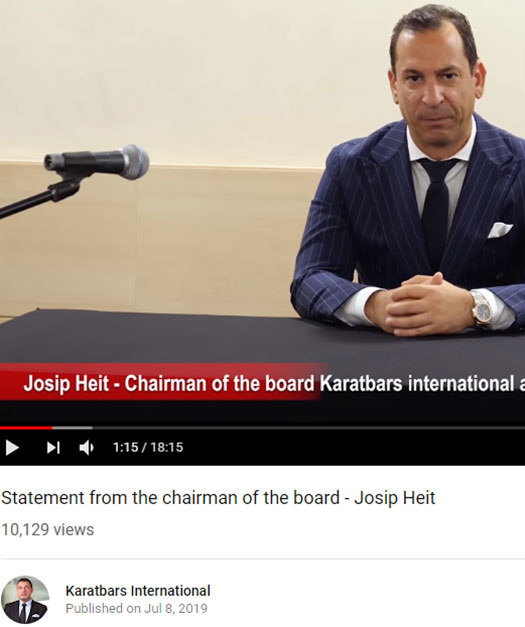

Heit additionally took offense to Saunders mentioning his position in Karatbars Worldwide’s failed precursor crypto Ponzi.

On July twenty ninth GSB Gold Normal Company AG, Josip Heit, Michael Dalcoe and Tony De Gouveia filed a stipulation of dismissal.

On July 29, 2022, Defendant Christopher Saunders executed a declaration in reference to the above-captioned matter (the “Saunders’ Declaration”).

Pursuant to the Saunders’ Declaration (submitted as Exhibit A hereto), Plaintiffs GSB Gold Normal Company AG, Josip Heit, Antonio Euclides Menesis De Gouveia, and Michael Dalcoe, by counsel and with the signature and settlement of counsel for Defendant Christopher

Saunders, hereby stipulate to the dismissal with out prejudice of all claims on this matter.

The referred to stipulation from Saunders reveals he acquired

5 1000’s {dollars} in bitcoin from Mr. Ovidu Toma in reference to making the Statements and Allegations in opposition to Plaintiffs.

Since January 2020, Mr. Ovidu Toma has been offering me with paperwork and supplies (that) corroborate Mr. Harald Seiz’s position in Karatbars’ purported wrongdoing.

“Ovidu Toma” refers to Ovidiu Toma, Karatbars Worldwide’s former Chief Know-how Officer.

At present Toma heads up Crypto Knowledge as CEO. Crypto Knowledge sells crypto bro merchandise out of Romania.

Getting again to Saunder’s declaration;

I used to be conscious, by way of first-hand information, of details and paperwork that any purported wrongdoing carried out by Karatbars in reference to its Miami crypto financial institution and the issuance of KBC/KBC tokens was perpetrated by Karatbars’ CEO, Mr. Harald Seiz, and that mentioned wrongdoing was perpetrated earlier than any affiliation between Karatbars and GSB/Mr. Heit.

This can be a unusual concession to make. Heit was very a lot the face of Karatbars first foray in to crypto securities fraud.

In an interview dated April 2019, Seiz is launched as a “large investor and Board Member” of Karatbars Worldwide.

On the time Karatbars was shilling a “blockchain cellphone” in Dubai.

When requested about his statements on the occasion, and I quote;

You talked in regards to the KBC uh coin. You mentioned it’s potential that it is going to be 1 kilogram of gold. Is that this actually potential?

Heit responded;

Sure, in fact it’s potential. No one assume and many individuals acknowledge in uh, proper time and there with us they usually can be part of us.

We’ve got final week, or earlier than two weeks, we’ve got simply market capitalization of about 300 million greenback. And now we’ve got nearly one billion.

And nonetheless is it not realized mainnet. And when the mainnet will probably be realized, and this will probably be very quickly, in a few of months, I inform you; we may have market capitalization greater than 200 billion.

After months of Heit and Seiz pumping up Karatbars’ KBC, the KBC Ponzi coin dumped 62% following July 4th 2019 hype occasion.

It was Josip Heit, not Harald Seiz, who was despatched out to handle offended traders and clarify the collapse.

KBC continued to dump over the next months and was finally deserted. By the tip of 2019 Heit had cashed out, left Karatbars and gone on to launch his personal Ponzi spinoff, GSPartners.

GSPartners’ Ponzi cash haven’t fared any higher than KBC. G999 is being propped up with wash buying and selling, which I consider is slowly draining GSPartners’ different Ponzi coin LYS.

G999 is being wash traded at round $0.002413. LYS continues to empty at $66.78.

The continued failure of G999 and LYS to take off prompted the launch of GEUR earlier this month.

GSPartners and Heit characterize GEUR is pegged to the euro. GEUR was created as a result of GSPartners traders had been cautious of withdrawing in G999 and LYS.

At time of publication GEUR doesn’t exist exterior of GSPartners. GSPartners is utilizing GEUR to prop up its newest 300% ROI Ponzi reboot, metaverse certificates.

Such to the extent a settlement was reached between GSPartners and Saunders, it has not been made public.

Apart from incorrectly asserting Heit wasn’t concerned in Karatbars KBC rip-off, Saunders has not retracted any of his different GSPartners associated claims.

The GSPartners Plaintiff’s Stipulation of Dismissal was accepted by the court docket on August 2nd. This brings GSPartner’s harassment swimsuit in opposition to Saunders to an finish.