In an attempt to create the illusion that affiliates haven’t mostly lost their money, GSPartners has come up with GEUR.

G999 is GSPartners’ original Ponzi coin. Gullible investors were lead to believe if they bought G999 investment packages through GSPartners, they’d be bajillionaires because reasons.

Here’s how that’s going:

As it became evident G999 was a Ponzi shitcoin that wasn’t going anywhere, GSPartners sought to launch more shitcoins. After some turbulence with foiled Dubai property scams, GSPartners settled on an NFT grift they called Lydian World.

Lydian World is attached to LYS and XLT tokens, although these days nobody talks about the latter.

Anyway, here’s how Lydian World is going:

Once it became clear nobody was interested in a Ponzi cash grab NFT “game”, GSPartners launched a “metaverse certificates” scheme.

Not surprisingly, GSPartners’ metaverse certificates scheme has nothing to do with the metaverse.

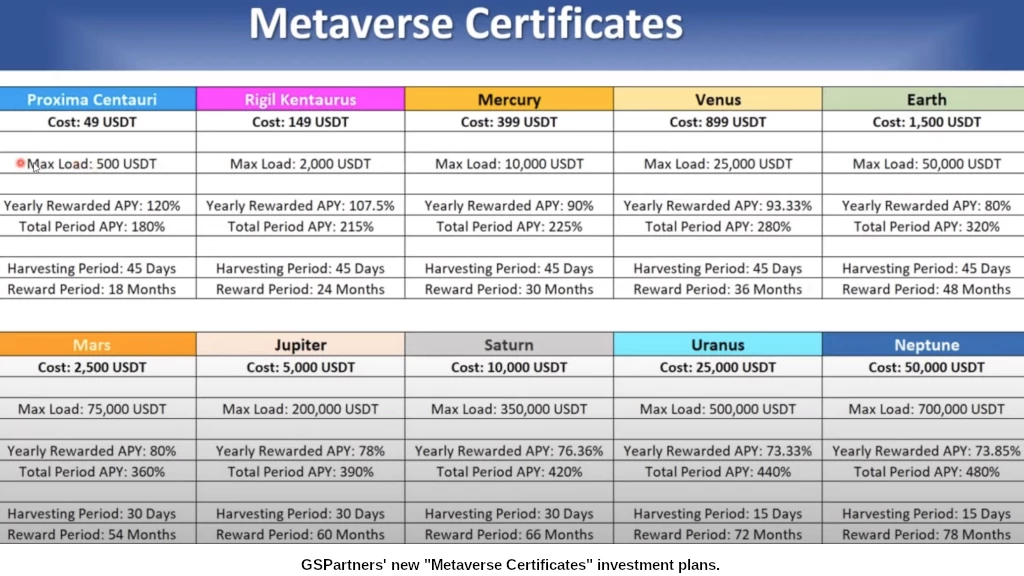

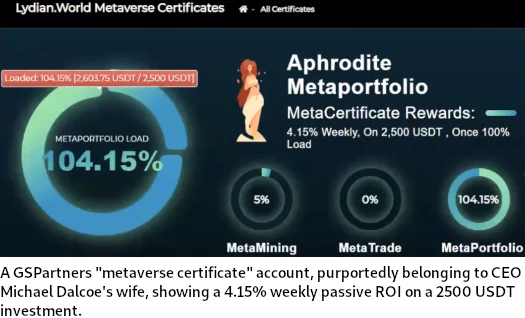

The metaverse certificates scheme is a simple Ponzi; GSPartners affiliates pay a fee and then invest up to 700,000 USDT on the promise of a 480% annual ROI (click to enlarge):

On a GSPartners webinar directed at US investors held a few days ago, here’s how US-based CEO Michael Dalcoe described GSPartners’ metaverse certificates;

We put our money on the blockchain, and our trading partner trades the funds for us and it grows it at a rate of around 72% a year and higher.

Yes, I did not stutter. Around 72% per year and even higher. I can’t even give you real numbers. That means your money doubles every year.

And honestly, your money really doubles about every six or seven months.

Metaverse certificate returns are paid in USDT but they aren’t withdrawable.

Instead GSPartners affiliates have to put the USDT towards LYS token mining, allowing them to eventually cash out in LYS.

Here’s the problem:

To remedy the Ponzi scheme coming undone, GSPartners has launched GEUR.

GEUR doesn’t exist outside of GSPartners and is represented to have parity with the euro.

If a GSPartners affiliate cashes out their metaverse certificate ROI to GEUR, they then have to convert GEUR to USDT through the GSPartners backoffice.

Up to 5000 GEUR can be cashed out in one transaction and GSPartners takes a 2.5% cut of all transactions.

GSPartners’ GEUR webinar was hosted by Steven London Morris, one of Dalcoe’s downline based in California.

If you’re wondering how GSPartners is funding withdrawals and why now, that’s answered through GSPartners’ recent website stats:

GSPartners has been busy recruiting US investors over the past year. Those investors want to cash out and, up until recently, all GSPartners has been able to do is watch LYS decline and their attempts to wash trade pump G999 fail.

As you can see in the SimilarWeb data above, GSPartners has spread to Cuba, South Africa (this is a resurrection after GSPartners already collapsed in SA), and Switzerland.

This new injection of funds directly correlates to the launch of GSPartners’ metaverse certificates investment scheme.

What you can also see in the chart above however is that overall visits to GSPartners’ website haven’t changed much. It’s stagnant.

Pending a dramatic increase in recruitment of new soon-to-be victims, GSPartners is just kicking exponentially increasing ROI liabilities down the road.

It’s one thing to trap people’s money in an endless chain of shit tokens. Once you represent something is pegged to real money, and allow investors to cash out that real money – you’ve just created a financial black hole that’ll drain invested funds.

It should be noted that, despite marketing representations to the contrary, GEUR isn’t pegged to the euro – it’s pegged to how much invested USDT GSPartners is willing to play out.

Michael Dalcoe of course knows this and so, on behalf of GSPartners corporate, discourages withdrawals by claiming it’s something only “poor and middle-class people do”.

How GSPartners’ inevitable USDT crunch manifests itself is yet to be seen, but watch for GEUR withdrawal problems over the next 6 to 9 months.

In violation of securities law in the US, neither GSPartners, owner Josip Heit, Michael Dalcoe or Steven London Morris are registered with the SEC.

External revenue to pay metaverse certificates is purportedly generated via forex trading by BDSwiss.

In violation of the Commodities Exchange Act, neither GSPartners or BDSwiss are registered with the CFTC.

GSPartners and its promoters are not registered to offer securities in any country.