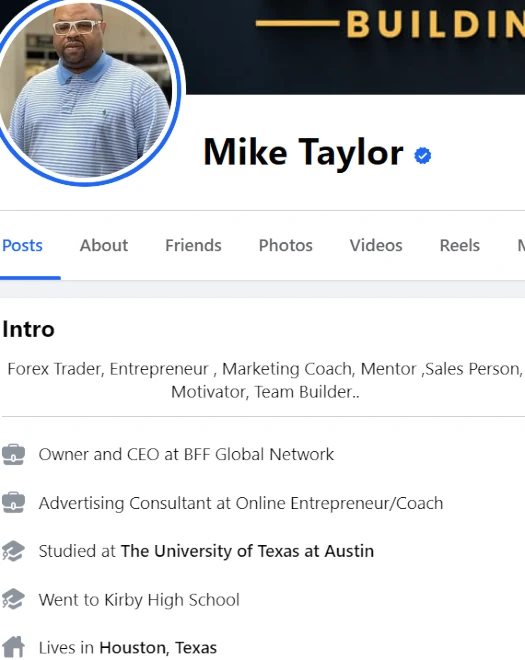

BFF Crowdfunding, which additionally glided by BFF International Community, was a 400% ROI Ponzi cycler. The rip-off was run by Mike Taylor, a US resident of Texas.

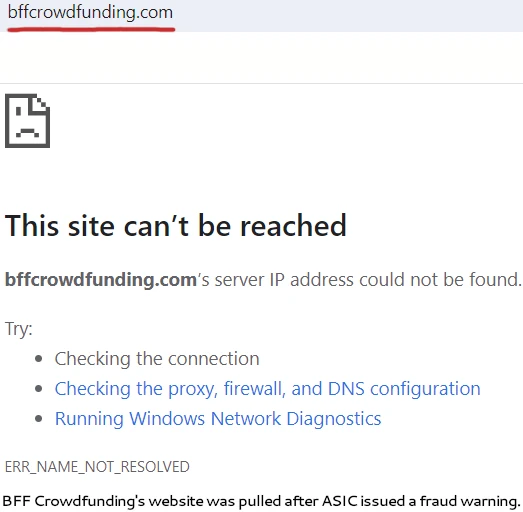

On April eleventh ASIC issued a BFF Crowdfunding fraud discover, warning the MLM firm

is more likely to offer monetary companies to Australian shoppers [and] doesn’t maintain an Australian monetary companies licence or Australian credit score licence from ASIC, and isn’t authorised by a licensee.

That is the equal of a securities fraud warning in different jurisdictions.

At time of publication BFF Crowdfunding’s web site has been pulled offline.

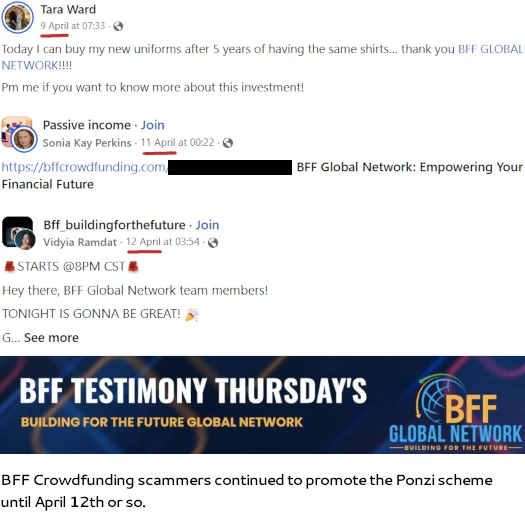

BFF Crowdfunding scammers had been nonetheless selling the Ponzi scheme up till April twelfth or so…

…so it seems the collapse and BFF Crowdfunding’s web site being pulled coincides with ASIC’s fraud warning.

One other doubtless contributing issue is BFF Crowdfunding’s continued decline in web site visitors all through 2024.

SimilarWeb tracked ~55,000 month-to-month visits to BFF Crowdfunding’s web site in January 2024. This plummeted to only ~12,000 month-to-month visits in March.

High sources of visitors to BFF Crowdfunding’s web site for March 2024 had been the US (37%, down 94% month on month), Australia 33% (up 83% month on month) and the UK (18%).

The spike in BFF Crowdfunding recruitment in Australia all through March is probably going what triggered ASIC’s warning.

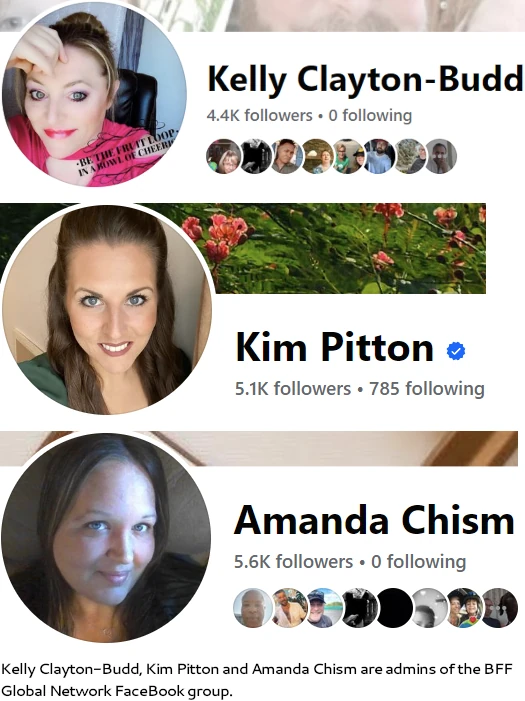

BFF Crowdfunding’s social media operates by BFF International Community, a personal FaceBook group numbering ~6000 members.

Along with Mike Taylor, admins of the group embrace Kim Pitton, Kelly Clayton-Budd and Amanda Chism.

Within the wake of BFF Crowdfunding’s collapse, Taylor doesn’t seem carried out scamming folks but. On April fifteenth Taylor posted a “new alternative alert”:

Feels like one other Ponzi cycler however at time of publication I don’t have something additional. Pending any further particulars, we’ll maintain you posted.