The Hong Kong primarily based Ponzi scheme additionally claims it has raised $100 million from the personal promoting of shares.

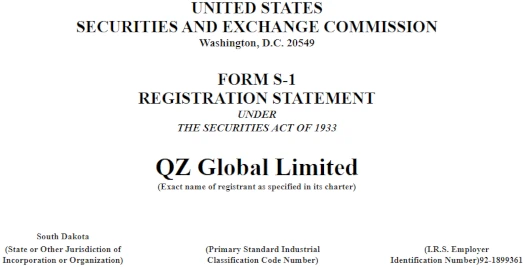

On January ninth, 2023, the shell firm QZ International Restricted was integrated in South Dakota.

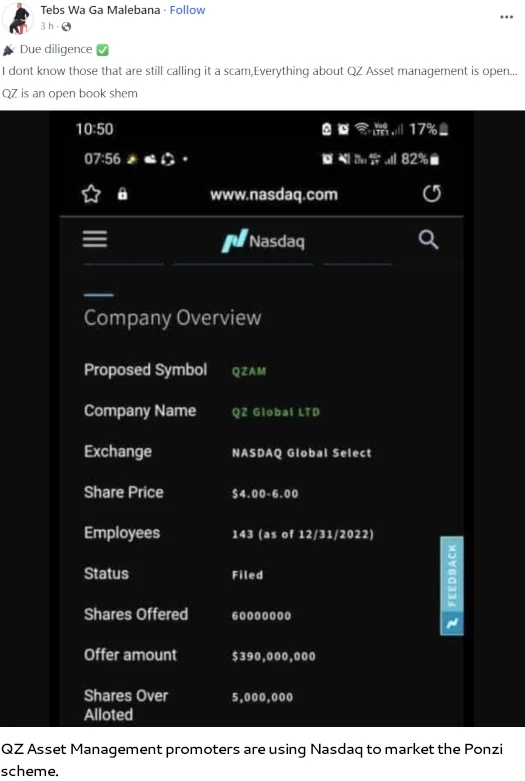

Shortly after, QZ Asset Administration utilized for a Nasdaq itemizing below the image QZAM.

As a part of the applying, QZ Asset Administration claimed to handle “roughly $8.4 billion in belongings”.

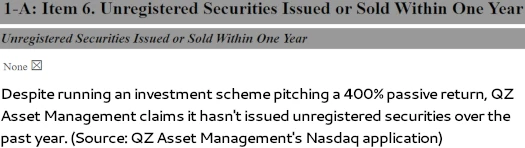

QZ Asset Administration additionally ticked a field certifying they’d not issued or bought any unregistered securities over the previous yr.

On February twenty seventh, QZ Asset Administration, via QZ International Restricted, filed an S-1 kind with the SEC.

An S-1 Type is a requirement if an organization intends to publicly supply new securities.

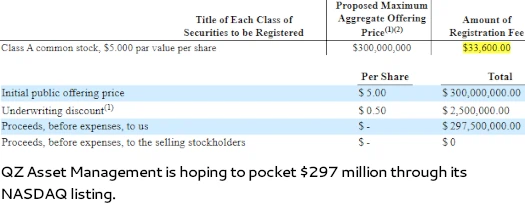

As per QZ International Restricted’s S-1 Type, the corporate intends to boost $300 million by promoting 60 million shares.

The submitting comprises unaudited monetary experiences and representations. Right here’s an instance;

As of December 31, 2022, we had roughly $449.3 million of remaining unfunded capital commitments to our funds.

As well as, as of December 31, 2022, we had $244.9 million of indebtedness excellent below our credit score amenities and secured borrowings and $1,783.2 million of money and money equivalents.

Clearly not being audited these figures and claims are meaningless.

That apart, the main drawback right here is QZ Asset Administration’s day by day returns Ponzi scheme.

Naturally QZ Asset Administration’s MLM funding scheme isn’t talked about anyplace of their SEC submitting or NASDAQ software.

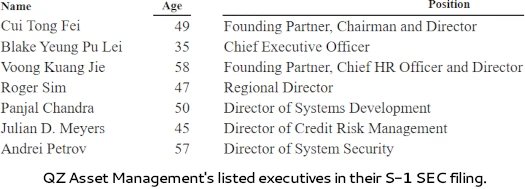

To recap, QZ Asset Administration is run by founder Cui Tong Fei (who we all know nothing about), and CEO Blake Yeung Pu Lei (beneath).

QZ Asset Administration solicits funding on the promise of as much as 3.5% every week. Returns are capped at 400%, after which reinvestment is required to proceed incomes.

QZ Asset Administration represents it trades with a BDAI bot it developed.

To be sincere, making use of for a NASDAQ itemizing and submitting varieties with the SEC is an odd transfer for an MLM Ponzi scheme. I’m not 100% positive on what the end-game is right here.

QZ Asset Administration claims each to have been based in China and keep “important Chinese language operations”.

Getting a NASDAQ itemizing and dumping shares on buyers is a reasonably elaborate exit-scam if that’s what QZ Asset Administration are going for. I suppose Fei and Yeung might dick off to China as soon as that’s carried out – however why go to all the trouble?

Clearly a collapsed Ponzi scheme that dumped shares on its buyers, within the US no much less, continues to be going to draw regulatory consideration.

Maybe Fei and Leung are relying on Chinese language authorities doing nothing if all the things seems above-board within the US.

Outdoors of that no various angle instantly involves thoughts. Clearly QZ Asset Administration’s monetary representations and pretense to seem respectable are baloney. And positively, with out safety from the Chinese language authorities, mendacity to each the SEC and NASDAQ is a harmful sport.

As of February 2023, SimilarWeb tracks prime sources of site visitors to QZ Asset Administration’s web site as South Africa (56%), Philippines (23%) and the Democratic Republic of Congo (13%).

General QZ Asset Administration web site site visitors is on the rise, spurred on by recruitment in South Africa (South African web site visits are up 42% month on month)

From a regulatory standpoint, South Africa and the DRPC are hopeless. The Philippines has an lively SEC however it appears QZ Asset Administration hasn’t tripped their wire but.

In December 2022 Indonesia’s Otoritas Jasa Keuangan declared QZ Asset Administration to be an unlawful funding scheme. No matter QZ Asset Administration recruitment was happening in Indonesia has since collapsed.

I don’t know if this was by chance copy and pasted from some other place or not, however QZ Asset Administration makes this odd disclaimer of their S-1 submitting;

We repeatedly are topic to requests for data and casual or formal investigations by the SEC and different regulatory authorities, with which we routinely cooperate and, within the present setting, even historic practices which have been beforehand examined are being revisited.

If that’s true (and I doubt it’s), I don’t see this nonsense holding up for much longer.

Pending potential motion by US regulators, which QZ Asset Administration admits is a chance…

If the SEC or every other governmental authority, regulatory company or related physique takes concern with our previous practices, together with, for instance, previous funding and co-investment actions, inner working procedures or preparations with our individuals, together with our senior advisors, we might be in danger for regulatory sanction.

…its NASDAQ software is getting used to recruit new buyers.

The above screenshot is from a March seventeenth “information replace” on QZ Asset Administration’s web site.

QZ Asset Administration (“QZ “) right now introduced that it has concluded a non-public placement spherical on 31 January 2023 to promote 100,000,000 shares of the corporate’s widespread inventory at a worth of US$1.00 per share, for mixture proceeds of US$100,000,000 to monetary establishments.

The web proceeds from the Personal Placement are supposed for use for analysis and growth of QZ’s large information and synthetic intelligence (BDAI) know-how, upgrading of present infrastructure and for world growth functions.

In a latest QZ Asset Administration advertising and marketing video, Blake Yeung went so far as claiming the Ponzi scheme was engaged in “optimistic discussions” with the SEC.

Constructive discussions with SEC officers have taken place following our Bangkok journey and we’re on monitor to checklist in August.

Approval is anticipated to come back a while in June and we are going to announce additional information in due time.

And naturally there’s examples from QZ Asset Administration associates:

With QZ Asset Administration shaping as much as be one of many extra fascinating MLM Ponzi collapses to look at, we’ll maintain you posted on any updates.