The company also goes by QZ Invest and represents it is based out of Guangzhou, China.

Supposedly heading up QZ Asset Management is Blake Yeung.

Yeung doesn’t have a verifiable digital footprint. This could be due to language-barriers.

While QZ Asset Management doesn’t have an official YouTube channel, marketing videos doing the rounds reveal Yeung has a typical Hong Kong “British” English accent.

Prior to rebranding on or around 2021, QZ Asset Management went by Qianze Asset Management.

Other executives names on QZ Asset Management’s website include:

- Roger Sim – Regional Director

- Panjal Chandra – Director of Systems Development

- Julian D. Meyers – Director of Credit Risk Management

- Andrei Petrov – Director of System Security

I wasn’t able to verify whether any of these people actually exist.

QZ Asset Management operates from the domain (“qzinvest.com”).

Private registration, cross-referenced with the Wayback Machine, suggests Qianze Asset Management acquired the domain sometime in 2021.

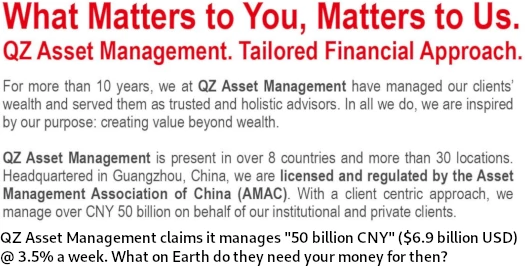

Despite only existing since around 2019 at the earliest, QZ Asset Management falsely claims it has been around “for more than 10 years”.

Read on for a full review of QZ Asset Management’s MLM opportunity.

QZ Asset Management’s Products

QZ Asset Management has no retailable products or services.

Affiliates are only able to market QZ Asset Management affiliate membership itself.

QZ Asset Management’s Compensation Plan

QZ Asset Management affiliates invest funds on the promise of an advertised ROI:

- QZ Basic – invest $100 to $900 and receive 1.75% a week

- QZ Elite – invest $1000 or more and receive 3.5% a week

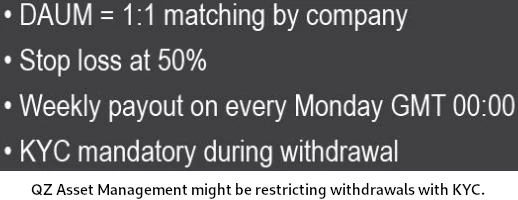

QZ Asset Management caps returns at 400%, after which reinvestment is required to continue earning.

Note that MLM commissions count towards the 400% ROI cap.

Also note that QZ Asset Management penalizes affiliates who withdraw invested funds before 91 days:

- withdrawals within the first 30 days cop a 50% fee

- withdrawals within 31 to 60 days after investing cop a 25% fee

- withdrawals within 61 to 90 days after investing cop a 10% fee

The MLM side of QZ Asset Management pays on recruitment of affiliate investors.

QZ Asset Management Affiliate Ranks

There are five affiliate ranks within QZ Asset Management’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Rank 1 – earn $3000 in accumulated residual commissions

- Vice President – earn $6000 in accumulated residual commissions

- Senior Vice President – earn $20,000 in accumulated residual commissions

- Executive Vice President – earn $50,000 in accumulated residual commissions

- Director – earn $150,000 in accumulated residual commissions

Referral Commissions

QZ Asset Management affiliates receive 10% of funds invested by personally recruited affiliates.

Residual Commissions

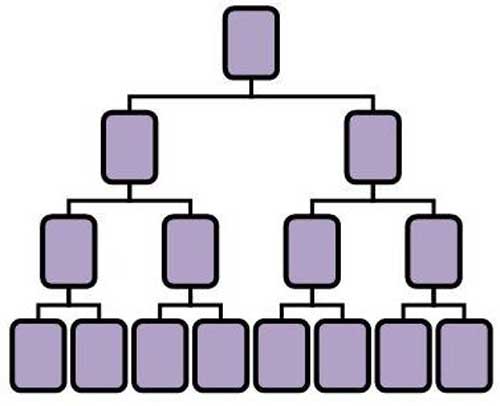

QZ Asset Management pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each day QZ Asset Management tallies up new investment volume on both sides of the binary team.

Affiliates are paid 10% of new funds invested on their weaker binary team side.

Once paid out on, funds are matched against the stronger binary team side and flushed. Any leftover investment volume on the stronger binary team side carries over.

Rank Achievement Bonus

QZ Asset Management rewards affiliates who qualify at Rank 1 and higher, with the following one-time Rank Achievement Bonuses:

- qualify at Rank 1 and receive a $500 investment position

- qualify at Vice President and receive a Samsung Galaxy S22

- qualify at Senior Vice President and receive a Rolex DateJust

- qualify at Executive Vice President and receive a Rolex Submariner

- qualify at Director and receive a Mercedes-Benz GLC

Joining QZ Asset Management

QZ Asset Management affiliate membership appears to be free.

Full participation in the attached income opportunity requires a minimum $100 initial investment.

QZ Asset Management Conclusion

Qianze Asset Management’s original 2019 launch targeted south-east Asia – namely South Korea.

When Qianze Asset Management collapsed (circa 2021), the company rebranded as QZ Asset Management.

This took place in late 2021. For the rest of 2021 and most of 2022, QZ Asset Management went nowhere.

In October 2022, QZ Asset Management hoped to resuscitate itself by targeting low-hanging fruit in South America and Africa.

SimilarWeb currently tracks negligible QZ Asset Management website traffic, suggesting the reboot hasn’t taken off.

As to QZ Asset Management as an MLM company, the ruse behind its returns is the same old AI trading garbage every Ponzi uses:

Through our proprietary and award-winning fintech solution – the QZ Big Data and Artificial Intelligence (BDAI) analytics, we have consistently achieved strong growth momentum in all market conditions.

If we take QZ Asset Management’s “we’ve been around since 2012” claim at face value, at 3.5% a week shouldn’t they be the richest individuals on the planet by now?

In an attempt to appear legitimate, QZ Asset Management claims its registered with the Asset Management Association of China (AMAC).

According to AMAC’s Wikipedia entry;

The Asset Management Association of China (“AMAC”) is a self-regulatory association of fund management companies in China.

We learn from this that QZ Asset Management registering with AMAC is meaningless. This is true regardless of whether QZ Asset Management has in fact actually registered or not.

AMAC isn’t a financial regulator. Securities in China are regulated by the China Securities Regulatory Commission.

Considering MLM itself is illegal in China without a license, it’s not surprising QZ Asset Management doesn’t provide proof of CSRC registration. The company also fails to provide any audited financial reports.

Outside of China QZ Asset Management also fails to provide evidence of registration with financial regulators.

Why does this matter?

Because it means QZ Asset Management is committing securities fraud. MLM companies committing securities fraud lends itself to them running a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve QZ Asset Management of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.