Of observe is affirmation that the corporate’s executives are fleeing to Dubai.

HyperFund at the moment doesn’t present a company tackle on its web site.

Xu, who refers to himself as “considered one of China’s 4 Bitcoin Kings”, has ties to Australia and south-east Asia.

Since funding into HyperFund took off earlier this yr, Xu hasn’t been seen in public.

Based mostly on a advertising video from round April, exhibiting Xu in Dubai with prime HyperFund promoters Kalpesh Patel and Rodney Burton, we assumed Xu had relocated there.

In HyperFund’s newest FAQ the corporate all however confirms this:

The place are the Hyperfund places of work positioned?

Hyperfund is relocating places of work to Dubai.

This isn’t a co-incidence. Attributable to lack of energetic regulation, Dubai has emerged as a hotbed of MLM associated monetary fraud.

Armed with residential visas and residing off ill-gotten features, MLM Ponzi scammers in Dubai prey on victims at arm’s attain from authorities.

Kalpesh Patel and Rodney Burton being prime examples of this in motion.

Kalpesh, a UK citizen, targets his MLM Ponzi promotion at a Hindi talking viewers within the UK and India:

Burton, a US citizen, promotes MLM Ponzi schemes from Dubai to English-speakers again house.

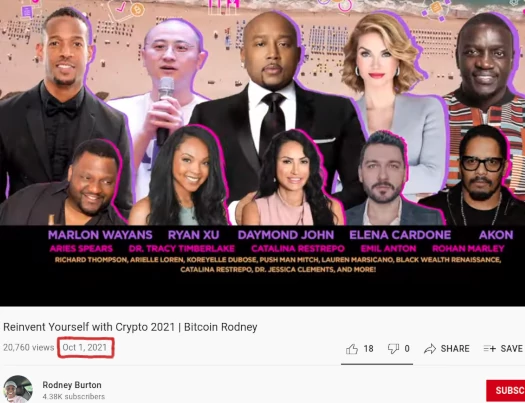

To that finish Burton, as “Bitcoin Rodney”, is selling a cryptocurrency fraud occasion in Miami subsequent month:

As above, HyperFund’s Ryan Xu seems in Burton’s promo for the occasion. In a separate video Xu confirms he will probably be attending Burton’s occasion as a “keynote speaker”.

Different fascinating tidbits from HyperFund’s October FAQ embody;

Was KPMG concerned with organising the HyperFund Rewards plan, and are they at the moment auditing the Rewards?

KPMG has by no means been concerned with HyperFund, and don’t at the moment audit HyperFund Rewards.

This seems to stem from a declare made by HyperFund, in response to BehindMLM’s unique HyperFund overview (April 2021).

ASIC and KPMG work hand in hand to commonly audit monetary corporations and second of all, whatever the deceptive displays made my non compliant sources, it is a membership that pays rewards very very like airline miles or bank card factors.

Naturally neither ASIC or KPMG have something to do with HyperFund. However that didn’t cease “HyperTech Group Company Workforce” from namedropping.

Whether or not KPMG bought involved with HyperFund and informed them to cease it’s unclear.

I can’t consider why else HyperFund would put this of their FAQ.

In any occasion, what with regulators in a number of jurisdictions issuing securities fraud warnings, HyperFund has little question discovered it harder to feign affiliation with regulators and auditors.

Is Hyperfund registered as an organization? Is it regulated?

Hyperfund is a buyer acquisition undertaking beneath the umbrella of the Hypertech Group of corporations.

As a result of it isn’t an funding and doesn’t provide any monetary merchandise, it doesn’t qualify for oversight by funding regulatory businesses.

That is only a straight-up lie. HyperFund is a passive funding scheme.

MLM corporations providing passive funding schemes constitutes securities providing, very a lot requiring them to register with monetary regulators.

You’ll be able to see the results of HyperFund not working legally by means of securities fraud notices issued in the UK, New Zealand and Guernsey.

It’s possible we’ll see extra HyperFund securities fraud notices issued over the next months.

This subsequent one is a mixture of two FAQ questions.

Is it attainable to obtain greater than thrice my membership bought worth?

It isn’t. Every membership expires as soon as thrice its bought worth has been reached.

The “added” percentages achieved by referring new members just isn’t a fee, however merely an acceleration of a member’s personal earned Rewards.

How do I earn commissions?

There aren’t any commissions paid in Hyperfund.

Too humorous fellas. I’m certain with that cleared up regulators will certainly drop any energetic HyperFund investigations.

My account at xxxxxx trade mentioned they received’t enable me to ship USDT to HYperfund. What can I do?

Select a special trade.

Gee, I’m wondering why crypto exchanges is perhaps blocking transfers to HyperFund?

I’ve additional USDT in my Deposit account. How do I get that despatched again to me?

Unused USDT held in your Deposit account won’t be refunded.

It may possibly’t be refunded as a result of the second you make investments, HyperFund use that USDT to pay referral commissions and ROI withdrawals.

Lastly in the direction of the tip of the FAQ, HyperFund drops a touch at its exit-scam of selection:

Do I want a passport to join a Hyperfund account?

Hyperfund doesn’t require a passport to register a brand new account.

If there may be later an allegation of fraud or different wrongdoing, Hyperfund might require extra KYC with a view to confirm identification and resolve any points.

A Ponzi scheme working out of cash will surely be an “challenge”. Keep tuned…

Replace twelfth April 2022 – This text initially featured a hyperlink to considered one of Kalpesh Patel’s Hindi focused HyperFund advertising movies.

As on the time of this replace, Kalpesh has deleted the video. Consequently I’ve disabled the beforehand accessible hyperlink.

Replace twenty fourth July 2022 – The deletion of proof continues. This text initially included a hyperlink to the April video that includes Ryan Xu in Dubai.

That video has now been marked non-public. As such I’ve disabled the beforehand accessible hyperlink.