The regulator alleges the since collapsed firm operated as a Ponzi scheme.

Mindset 24 International launched in 2017. The corporate was based mostly out of Kentucky within the US.

From no later than July 2017 via a minimum of Might 2018, Defendants operated a web based pyramid and Ponzi scheme via Mindset 24 International, LLC (“Mindset 24”), a multilevel advertising and marketing firm (“MLM”) that they owned and managed.

Throughout that point interval, Defendants raised over $1 million from a whole lot of people in the US and internationally via the unregistered supply and sale of securities in Mindset 24.

As well as, in reference to the supply and sale of these securities, Defendants engaged in a scheme to defraud buyers and additional engaged in practices that operated as a fraud or deceit upon these buyers.

Whereas we didn’t outright label it a Ponzi scheme, BehindMLM emphasised an absence of retail focus in our printed Mindset 24 International overview (August, 2017).

This underscored our general suspicion that Mindset 24 International wasn’t working legitimately.

Regardless of Defendants’ promotion of Mindset 24 as a respectable operation, there have been no gross sales of Sequence Packages to bona fide retail prospects; relatively, all gross sales had been to Members, and thus all of Mindset 24’s payouts to early Members had been made utilizing funds obtained from later Members.

Accordingly, Defendants operated Mindset 24 as a textbook pyramid and Ponzi scheme.

Paradoxically the primary draft of Mindset 24 International’s compensation plan included retail gross sales.

One month previous to BehindMLM’s overview, McClane and Nash sought a authorized opinion on a revised model of Mindset 24 International’s compensation plan.

In July 2017, shortly after they’d ready the ultimate model of the Compensation Plan … Defendants sought recommendation on the legality of the plan from a widely known MLM legal professional who offered them a written authorized opinion dated July 21, 2017.

Amongst different issues, the authorized opinion suggested Defendants to make sure modifications to Mindset 24 so as to function as a respectable MLM firm and never as an unlawful pyramid scheme.

Particularly, the authorized opinion strongly advocated for the Compensation Plan to incorporate a retail gross sales requirement, emphasizing that respectable MLMs rely totally on substantial retail gross sales for compensation functions, whereas pyramid schemes depend on recruiting and promoting to different contributors.

Certainly, the opinion highlighted areas the place Mindset 24 risked working as a pyramid scheme, pointing to the Compensation Plan as incentivizing “purchase to qualify” habits and aggressive recruitment of contributors relatively than retail prospects.

And, the opinion warned of the unsustainability of pyramid schemes.

McClane and Nash took no motion on the authorized opinion and launched Mindset 24 International with the retail absent mannequin.

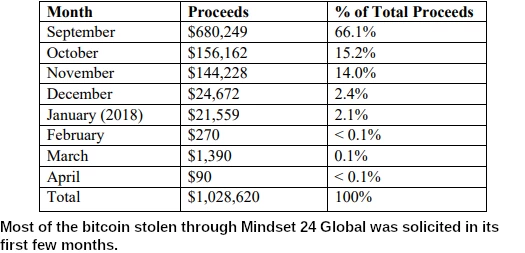

From mid 2017 to early 2018 Mindset 24 International solicited over one million {dollars} in funding, principally paid in bitcoin.

On or round April 2018, Mindset 24 International collapsed.

As a result of the proceeds raised via gross sales of Sequence Packages derived from Members who recruited further Members, the payouts underneath the Compensation Plan had been made based mostly solely on investments from the later Members.

In utilizing the later investments to pay earlier Members, Defendants knew, or had been reckless in not figuring out, that they had been working a traditional Ponzi scheme.

Defendants additionally knew, or had been reckless in not figuring out, that Mindset 24 was not a respectable MLM, however relatively an unlawful pyramid scheme.

Each McLane and Nash had created and operated MLMs earlier than Mindset 24. They’d included retail gross sales incentives within the preliminary draft of the Compensation Plan, however finally omitted these incentives from the proposed ultimate model.

The SEC pegs whole Mindset 24 International investor losses at “a minimum of $1,028,620”.

The overwhelming majority of Members misplaced cash. Of the a minimum of 735 Members who paid for a Sequence Bundle, 92% suffered losses, with a median lack of $1,168.

Little doubt in the event you had been to ask the 8% of Mindset 24 International associates who made cash, they’d let you know, as a result of they made cash, that Mindset 24 International was a respectable enterprise.

Regardless of stating the mathematical certainty that almost all of Ponzi buyers lose cash, BehindMLM routinely comes up towards the argument a Ponzi scheme paying out equals legitimacy.

Throughout 5 counts, the SEC accuses McLane and Nash of

- providing unregistered securities, in violation of the Securities Act;

- committing fraud, in violation of the Securities Act; and

- committing fraud, in violation of the Trade Act.

As a part of their August thirty first, 2020 grievance, the SEC sought a preliminary injunction towards McLane and Nash.

As of October 2020, a choice on the requested injunction remained excellent.

On October twenty seventh Paul Nash requested an indefinite keep on proceedings, whereas he engaged in “good religion settlement discussions” with the SEC.

The court docket denied Nash’s movement on October thirtieth.

At acknowledged in a December third Joint Standing Report;

Previous to the submitting of the Criticism, the SEC and Defendants had settlement discussions, however had been unable to achieve an settlement.

As well as, the SEC and Nash have engaged in further settlement discussions because the submitting of the Criticism however haven’t but reached an settlement.

The events are keen to pursue additional settlement discussions in good religion because the case progresses.

Between March and Might two court-ordered settlement conferences had been held.

An August 18th minute entry then states,

The subject of settlement was mentioned.

The events haven’t had any direct settlement discussions following the court- facilitated settlement convention.

As at October twenty first, no settlement has been reached. The events proceed to work via numerous discovery points.

I’ve added the SEC’s Mindset 24 International lawsuit to our calendar. Keep tuned for updates as we proceed to watch the case.

Replace 1st February 2023 – Each Brian McClane and Paul Nash have settled the SEC’s Mindset 24 International fraud case.