On December sixteenth, GSPartners filed a harassment lawsuit towards Grit Grind Gold and proprietor Chris Saunders.

Saunders is the only named defendant in GSPartners’ Virginia swimsuit.

Saunders owns and operates a YouTube Channel named “Grit, Grind, Gold,” an Instagram account named “Grit, Grind, Gold,” a Fb web page named “Grit, Grind, Gold,” and a Twitter Deal with named “@24KaratChris”.

By means of his numerous Grit Grind Gold accounts, Saunders has been publishing content material essential of GSPartners all through most of 2021.

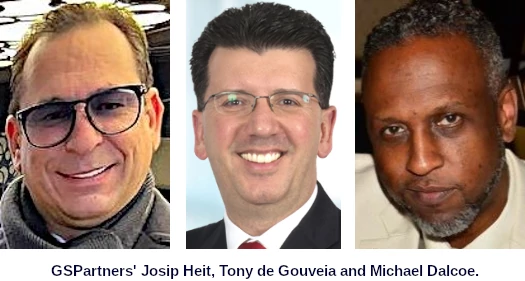

Named Plaintiffs in GSPartners swimsuit are

- Gold Commonplace Financial institution, integrated in Germany;

- GSB and GSPartners proprietor Josip Heit, a Croatian nationwide with ties to Germany and Dubai;

- Antonio Euclides Meneses de Gouveia, a South African GSPartners promoter and prime earner; and

- Michael Dalcoe, a US-based GSPartners promoter and prime earner.

GSPartners alleges Saunders

started broadcasting movies on the GGG YouTube Channel that included a sequence of false and defamatory statements about GSB, its principals, and brokers.

As of the submitting of this motion, Saunders has since revealed a minimum of ninety-nine (99) movies on the GGG YouTube Channel.

Hilariously, GSPartners’ lawsuit objects to Saunders highlighting the ties between it and Harald Seiz’s Karatbars Worldwide Ponzi.

On data and perception, Karatbars was created in 2011 by Harald Seiz, Karatbars’ founder and Chief Govt Officer.

From 2011 by means of to 2020, Karatbars employed hundreds of gross sales brokers who earned sizeable commissions promoting numerous gold merchandise to clients the world over.

From 2018 by means of 2020, Karatbars additionally offered a cryptocurrency referred to as V999, which Karatbars claimed was the one cryptocurrency backed by gold (the “V999 Token”).

On data and perception, Karatbars’ enterprise actions got here underneath prison and regulatory investigation in a number of jurisdictions:

In Could 2019, authorities in Namibia declared Karatbars a pyramid scheme.

In October 2019, the Florida Workplace of Monetary Regulation refuted claims that Karatbars was working underneath a banking license in Florida.

In November 2019, South Africa’s Monetary Sector Conduct Authority (FSCA) issued a warning for the general public to not take care of Karatbars.

In November 2019, Germany’s banking watchdog, BaFin, issued a stop and desist order to Karatbit Basis and ordered the corporate to settle excellent claims.

In Could 2021, the Monetary Markets Authority of New Zealand issued an advisory warning towards Karatbars.

On additional data and perception, Karatbars has gained a popularity as being a fraudulent, pyramid scheme that has harmed buyers as decided by these numerous prison and regulatory investigations.

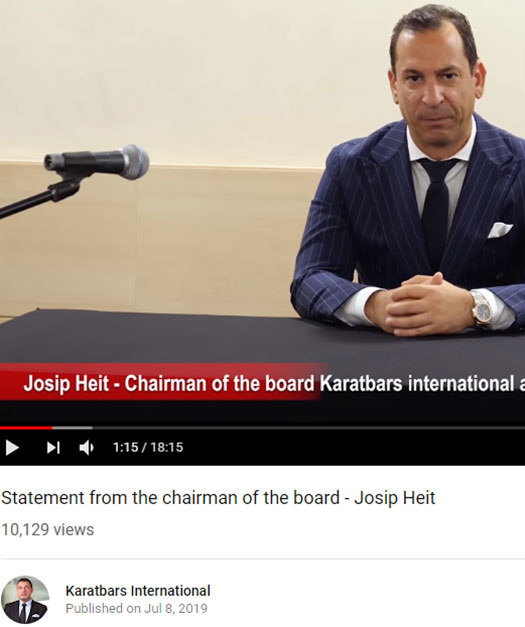

The explanation this outrage is hilarious is as a result of Josip Heit is Karatbars’ former Chairman of the Board.

Harald Seiz introduced on Heit to orchestrate Karatbars’ failed cryptocurrency Ponzi scheme.

After it flopped in 2019, Heit, as Karatbars’ Chairman of the Board, fronted indignant buyers.

Heit cut up from Seiz in late 2019. GSPartners launched in early 2020 as a Karatbars spinoff.

Fairly than tackle any of that although, GSPartners as a substitute seeks to create confusion across the two firms.

In each authorized and sensible phrases, Karatbars and GSB are usually not the identical entity.

First, Karatbars and GSB are two separate authorized entities.

Karatbars is a company entity that was registered underneath the legal guidelines of Germany in 2011 as Karatbars Worldwide GmbH, whereas GSB was registered in 2020 as GSB Gold Commonplace Company AG.

Second, Karatbars and GSB don’t get pleasure from a mum or dad, subsidiary, sister, associated, or affiliated firm relationship of any form in any way.

Third, Karatbars and GSB don’t share the identical homeowners. On data and perception, Karatbars is wholly owned by its founder, Mr. Harald Seiz, whereas GSB is wholly owned by Josip

Heit.Fourth, Karatbars and GSB wouldn’t have any j Dint enterprise, partnership, or comparable enterprise relationship. In sum, Karatbars and GSB are usually not the identical entity.

Whereas all of that’s true, it doesn’t change Heit’s time at Karatbars, or the truth that GSPartners is a by-product.

However, Saunders has repeatedly made false and defamatory statements alleging that Karatbars and GSB are the identical entity.

Virtually talking GSPartners’ launch was a clone of Karatbars on the time. This isn’t stunning, seeing as Heit was behind Karatbars’ failed transition to crypto fraud.

Heit and GSB used a free script to create Karatbars’ numerous shitcoins. They did the identical for GSPartners and G999.

Previous to Heit’s and GSB’s involvement, Karatbars operated as a gold-based pyramid scheme.

The 2 named GSPartners promoter plaintiffs, Tony de Gouveia…

…and Michael Dalcoe?

They’re each former Karatbars prime earners.

De Gouveia and Dalcoe jumped ship with Heit. As did various then Karatbars prime earners and their downlines.

GSPartners gave Karatbars scammers a possibility to advertise the identical fraudulent enterprise mannequin underneath a brand new title.

V999 is to Karatbars what G999 is to GSPartners.

Collectively, Saunders’ statements falsely conflating Karatbars with GSB have been seen a minimum of 205,283 instances as of the submitting of this Grievance.

Always, Saunders has made every of those statements conflating GSB with a company internationally recognized for fraud and deceit with the information that his statements have been false and that GSB and Karatbars are separate entities.

Properly geez, anybody would suppose GSPartners wasn’t a clone Ponzi scheme. Go determine.

In abstract, whereas GSPartners have surpassed Karatbars’ securities fraud by launching a number of shitcoins and an NFT scheme, it stays a by-product of Karatbars.

That’s GSPartners’ origin story. It’s what it’s.

Fairly than tackle GSPartners committing securities fraud and working a Ponzi scheme, the cliche “iF wE wErE iLlEgAl We’D hAvE bEeN sHuT dOwN!” protection is raised.

GSB, its principals, and brokers are usually not engaged in a Ponzi scheme.

Neither GSB nor its principals or brokers have been charged should much less convicted of collaborating in a Ponzi scheme, nor has there been any prison or regulatory investigations into GSB in connection

with allegations that it could be working a Ponzi scheme.GSB, its principals, and brokers, together with, extra particularly, Plaintiffs, haven’t and are usually not engaged in prison acts or acts of ethical turpitude.

Neither GSB nor its principals or brokers have been charged should much less convicted of any crimes or acts of ethical turpitude, nor has there been any prison or regulatory investigations into GSB, its principals, or brokers in reference to attainable crimes or acts of ethical turpitude.

By this flawed logic Bernie Madoff’s Ponzi scheme wasn’t a Ponzi scheme, till the SEC filed swimsuit in December 2008.

Investigation into Madoff’s Ponzi scheme dates fraud again as early as 1964. However uh yeah, the Ponzi scheme didn’t exist till 2008.

“However we haven’t been shut down” is a typical unhealthy religion argument raised by scammers. It ignores that regulation is reactionary, and that unlawful conduct is illegitimate regardless of whether or not authorities do or don’t step in.

Right here GSPartners and Heit current the dearth of regulatory motion towards themselves as proof of legitimacy.

Let’s say the SEC and/or DOJ took motion towards GSPartners and Heit subsequent week. What would that motion be based mostly on?

It’d be based mostly on GSPartners’ and Heit’s conduct, specifically working a Ponzi scheme by means of G999 and different shitcoins.

Whether or not the SEC and/or DOJ take motion, that conduct stays the identical. It’s unlawful as per US securities regulation (providing/promoting unregistered securities) and the US Code (wire fraud and cash laundering) – regardless of whether or not GSPartners and Heit are ever charged.

The shortage of regulatory motion, civil or prison, shouldn’t be proof of legitimacy.

Collectively, Saunders’ statements falsely alleging that GSB, its principals, and brokers are engaged in a Ponzi scheme have been seen a minimum of 205,283 instances as of the date of submitting of this Grievance.

Saunders has made every of those statements, whereas understanding that such statements are false and that GSB, its principals, and brokers are usually not engaged in a Ponzi scheme and with the malicious intent that his statements would hurt the enterprise and popularity of GSB, its principals, and brokers.

Tellingly, GSPartners offers no proof Saunders knew or is aware of GSPartners shouldn’t be a Ponzi scheme.

Subsequent up we have now GSPartners and Heit upset over comparisons to the OneCoin Ponzi scheme.

What made OneCoin a Ponzi scheme is buyers invested in onecoin, obtained extra onecoin and cashed out subsequently invested funds.

That is exactly what occurs in GSPartners. And certainly each MLM crypto Ponzi.

Fairly than tackle that although, GSPartners incorrectly attributes OneCoin’s fraud solely to the mining lie;

OneCoin was alleged to have been mined utilizing mining providers maintained and operated by OneCoin however its value was actually decided internally slightly than being based mostly upon market provide and demand.

That was definitely a part of OneCoin’s fraud but it surely’s not explicitly why OneCoin was a Ponzi scheme. It’s additionally not why GSPartners and OneCoin are comparable with respect to each being shitcoin Ponzi schemes.

Once more, slightly than tackle that although, GSPartners waffles on concerning the two firms being legally separate entities;

In each authorized and sensible phrases, GSB and OneCoin are usually not the identical entity.

First, GSB are two separate authorized entities. OneCoin was a company entity that was registered underneath the legal guidelines of Bulgaria in 2014 by Konstantin Ignatov and Ruja Ignatova, whereas GSB was

registered in 2020 as GSB Gold Commonplace Company AG.Second, OneCoin and GSB don’t get pleasure from a mum or dad, subsidiary, sister, associated, or affiliated firm relationship of any form

in any way.Third, OneCoin and GSB don’t share the identical homeowners. On data and perception, OneCoin was wholly owned by its founders, Konstantin Ignatov and Ruja Ignatova, whereas GSB is wholly owned by Josip Heit.

Fourth, OneCoin and GSB wouldn’t have any three way partnership, partnership, or comparable enterprise relationship.

In sum, OneCoin and GSB are usually not the identical entity.

None of that adjustments each OneCoin and GSPartners working comparable Ponzi schemes through their respective tokens.

In July 2021 BehindMLM discovered of a kangaroo courtroom ruling, purportedly handed down ex-parte within the Ukraine.

Seems this failed technique to censor criticism of GSPartners wasn’t solely directed at BehindMLM.

On June 18, 2021, a Ukrainian District Courtroom issued an order in reference to a criticism introduced by GSB towards Saunders and his GGG YouTube Channel and GGG Instagram Account (the “Ukraine Grievance”).

The Ukraine Grievance alleged that Saunders falsified photos, in addition to revealed factually unfaithful statements about GSB, its brokers, and its principals.

After an in depth examination of Saunders’ statements, in addition to proof offered by GSB pertaining to the substance of statements and representations made by Saunders on his GGG YouTube Channel, the Ukrainian District Courtroom dominated in favor of GSB and issued an injunction demanding Saunders take away the “deliberate defamations” he revealed on his GGG YouTube Channel and GGG Instagram Account.

As with the BehindMLM ruling, Saunders wasn’t conscious of the Ukraine proceedings and there was no due course of.

Tellingly, GSPartners and Heit haven’t any ties to the Ukraine.

Each BehindMLM and Saunders ignoring kangaroo courtroom ex-parte proceedings within the Ukraine has evidently infuriated Heit.

However the Ukrainian Take-Down Discover, Saunders refused to take away the “deliberate defamations,” and has since revealed fifty (50) movies on his GGG YouTube Channel making equally defamatory statements, with the complete information that these statements have been false and defamatory, and in direct contempt of the Ukrainian Take-Down Discover.

GSPartners once more offers no proof Saunders knew any of the alleged statements made within the fifty movies have been “false and defamatory”.

Saunders mocking GSPartners’ November stop and desist has additionally infuriated Heit.

Saunders is at the moment utilizing the Stop and Desist Letter not as a information to assist him determine which false and defamatory statements to retract however to actively promote these false and defamatory statements to his viewers by posting a replica of the Stop and Desist letter on his GGG Fb Channel and making movies about it on his GGG YouTube Channel.

And these ways are working the video Saunders posted on his GGG YouTube Channel on November 18, 2021 the place he mocked the Stop and Desist Letter, is now one in every of Saunders’ prime movies of all time.

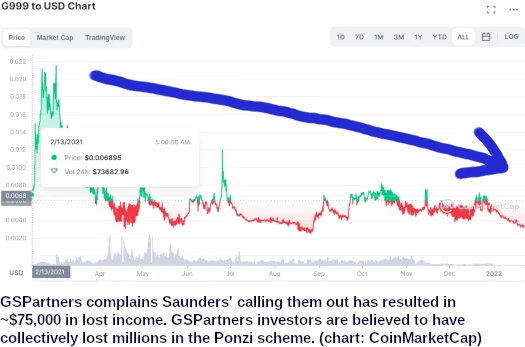

On account of Saunders calling out Heit’s GSPartners Ponzi scheme, the corporate complains Saunders’ content material

present up on Google, YouTube, and different engines like google when GSB’s potential clients are looking on-line for details about GSB.

Consequently … GSB, its principals, and brokers have misplaced, and proceed to lose, hundreds of {dollars} in month-to-month revenues from clients, misplaced enterprise relationships, and misplaced potential enterprise alternatives, together with considerably greater than $75,000 in misplaced revenue.

How a lot GSPartners associates have misplaced investing in G999 since 2020 is unknown.

Throughout two causes of motion, GSPartners allege Saunders calling out the G999 Ponzi scheme constitutes

- defamation per se; and

- tortious interference with enterprise expectancy.

Trying on the case docket, Saunders was served on December twenty ninth.

Saunders has been given until February eleventh to reply to the lawsuit.

Keep tuned as we proceed to trace the case.

Replace twelfth February 2022 – Chris Saunders has filed a movement to dismiss on February eleventh.

A listening to on the movement has been scheduled for March eleventh. I’ve marked my subsequent case docket test for March twelfth.

Replace twelfth March 2022 – The GSPartners filed for an extension to reply to Saunders’ movement to dismiss on February fifteenth.

The courtroom gave the GSPartners defendants an extension until March 4th.

Consequently, the movement to dismiss listening to has been pushed again to March sixteenth. I’ve marked my subsequent case docket test for March seventeenth.

Replace twenty ninth August 2022 – GSPartners has deserted its lawsuit towards Chris Saunders.