Full Velocity’s web site area (“fullvelocity.commerce”), was privately registered on December thirty first, 2021.

Additional analysis reveals James Ward showing in Full Velocity advertising and marketing movies as CEO:

James Ward (proper) first popped up on BehindMLM’s radar in 2010, because the CEO of LGN Prosperity.

LGN Prosperity marketed journey vouchers, with every voucher producing a place in a matrix 2×2 cycler.

Following months of associates not getting paid, in mid 2011 LGN Prosperity morphed into LGN Worldwide.

This name-change introduced on the addition of commissions paid on journey companies booked by means of LGN.

LGN Worldwide ultimately collapsed in mid to late 2013, with Ward heading up iBizWave as CEO and co-founder in early 2014.

In 2015 Ward launched 2SL Begin Residing, which noticed him return to the journey MLM area of interest.

2SL Begin Residing was short-lived, prompting Ward to launch Pangea in 2016.

Pangea’s authentic enterprise mannequin was a matrix cycler hiding behind journey.

By early 2017 Pangea had collapsed. Ward rebooted Pangea with a brand new compensation plan.

The one materials distinction was the cycler expanded to a few tiers, so it’s not stunning that Pangea 2.0 additionally didn’t final lengthy.

In late 2019 Ward resurfaced with Sports activities Buying and selling BTC, a crypto Ponzi scheme.

Sports activities Buying and selling BTC collapsed by December 2019, prompting Ward to reboot the scheme as International Credit Community.

As per web site site visitors charts supplied by Alexa, International Credit Community collapsed in or round April 2020.

In late June 2020 Ward launched his first smart-contract Ponzi scheme, Lion’s Share.

Lion’s Share collapsed by early 2021, prompting Ward to launch Apex Monetary April 2021.

Apex Monetary was a joint-venture with Hitesh Juneja and Jason Rose. The scheme noticed associates spend money on AFT tokens, on the promise of as much as 0.85% paid day by day for 360 weekdays.

Apex Monetary’s web site continues to be up. Alexa site visitors estimates to its web site nevertheless reveal a collapse all through late 2021.

There seems to have been an try and reboot Lion’s Share as “Lion’s Share Velocity” mid 2021. No matter that was it flopped so quick we missed it.

In any occasion, all of that brings us to Full Velocity’s launch final month.

Learn on for a full evaluation of Full Velocity’s MLM alternative.

Full Velocity’s Merchandise

Full Velocity has no retailable services or products.

Associates are solely capable of market Full Velocity affiliate membership itself.

Full Velocity’s Compensation Plan

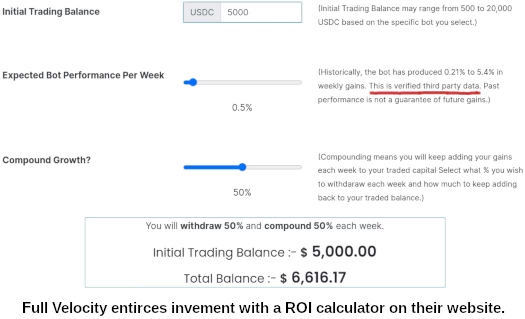

Full Velocity markets passive weekly returns of 0.21% to five.4%.

Returns are purportedly generated by way of “FV Bot”. FV Bot is a passive crypto buying and selling bot which Full Velocity sells entry to.

Full Velocity calculates weekly subscription charges as 30% of returns paid out.

The FV Bot minimal funding quantity is $200.

Be aware all compensation transactions in Full Velocity are made in tether (USDT).

The MLM facet of Full Velocity pays on weekly subscription charges paid by recruited associates.

Full Velocity Affiliate Ranks

There are six affiliate ranks inside Full Velocity’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- Gear 1 – recruit one affiliate

- Gear 2 – recruit three associates

- Gear 3 – recruit 5 associates

- Gear 4 – recruit seven associates

- Gear 5 – recruit ten associates

- Full Velocity – recruit twelve associates

Residual Commissions

Full Velocity pays residual commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel workforce, with each personally recruited affiliate positioned instantly underneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel workforce.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

Full Velocity caps payable unilevel workforce ranges at twenty.

Residual commissions are paid out as a share of weekly subscription charges paid throughout these twenty ranges as follows:

- Gear 1 ranked associates earn 25% on stage 1 (personally recruited associates) and 10% on ranges 2 and three

- Gear 2 ranked associates earn 25% on stage 1, 10% on ranges 2 to five and 5% on stage 6

- Gear 3 ranked associates earn 25% on stage 1, 10% on ranges 2 to five, 5% on ranges 6 and seven and a couple of.5% on ranges 8 and 9

- Gear 4 ranked associates earn 25% on stage 1, 10% on ranges 2 to five, 5% on ranges 6 and seven, 2.5% on ranges 8 to 14 and 1.25% on stage 15

- Full Velocity ranked associates earn 25% on stage 1, 10% on ranges 2 to five, 5% on ranges 6 and seven, 2.5% on ranges 8 to 14 and 1.25% on ranges 15 to twenty

Becoming a member of Full Velocity

Full Velocity affiliate membership is charge.

Ongoing subscription charges, calculated as 30% of weekly generated returns, should be paid as a way to proceed incomes.

Full Velocity Conclusion

Full Velocity signing anybody up at no cost and gathering charges from income is an attention-grabbing method.

Sadly it doesn’t negate regulatory non-compliance pertaining to securities fraud.

Full Velocity claims its FV Bot

is a hedged primarily based buying and selling system that concurrently takes lengthy and brief positions to create a pure hedge.

It calculated the proper positions to exit the place the loss from the shedding place is smaller than the acquire from the profitable place.

That is NOT like a typical “greenback price averaging” bot that continually repurchases positions after which will get caught for weeks in trades.

There isn’t any technique to confirm this, resulting from Full Velocity failing to supply audited monetary studies. This can be a potential violation of the FTC Act.

Moreover taking James Ward’s buying and selling worth claims at face worth raises additional questions.

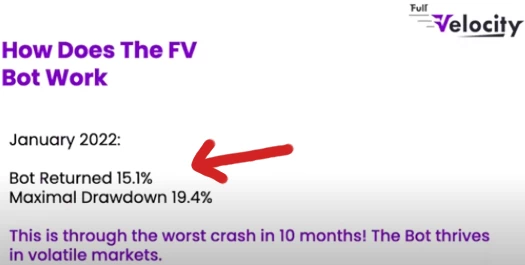

As above, Ward claims FT Bot generated 15.1% in January 2022.

If you happen to had a buying and selling bot able to producing ~15% a month (Ward claims FT Bot has been working since March 2021), why would you give away entry at no cost?

What somebody with a 15% buying and selling bot would really do is run it themselves quietly. Compound and retire because the richest individual on the planet in just a few years.

Once more, all of that assumes you are taking James Ward’s buying and selling income claims at face worth – which you completely shouldn’t.

Full Velocity’s web site claims weekly returns courting again to March 2021 are “verified third occasion knowledge”.

The place is that this knowledge? Why hasn’t it been filed with the SEC?

Nevertheless they’re generated, MLM firms providing passive returns are providing securities.

Securities choices are required by regulation to be registered with the SEC.

A search of the SEC’s Edgar database reveals neither Full Velocity or James Ward are registered with the SEC.

If Ward is to be believed Full Velocity and its FT Bot are above-board. If that’s the case, why is the corporate working illegally?

While you mix this with Ward’s historical past of launching rip-off after rip-off, you get a clearer image of what Full Velocity is.

Full Velocity is a “lulz can’t contact our cash!” scheme. To that finish the corporate makes the standard claims of “you’re in command of your cash!” and many others.

In actuality no matter funds you allocate to Full Velocity’s bot are in actual fact out of your management.

There’s nothing stopping Full Velocity cleansing out your account. This happens by way of rigged trades; both blowing the bot up or arising with another excuse.

In each cases admins exit-scammed by means of rigged trades of their favor.

That’s the end-game of each “lulz can’t contact our cash!” scheme. Full Velocity gained’t finish any totally different.

Replace twenty eighth Could 2022 – Full Velocity’s bot has generated upwards of 90% in losses.

As such Full Velocity collapsed on Could eleventh, 2022.

Replace thirteenth June 2022 – James Ward has rebooted Full Velocity with a brand new buying and selling bot.