Proprietor James Ward has introduced a International Credit Community reboot.

Sports activities Buying and selling BTC was a easy sufficient Ponzi scheme.

Buyers invested bitcoin on the promise of 0.25% to 2% each day returns, which Ward claimed have been generated by way of sports activities buying and selling.

Had that been the case, Sports activities Buying and selling BTC wouldn’t have collapsed. But right here we’re.

[4:33] Lots of people are like, “Why are you altering the corporate so… you simply launched on October 1st. You realize, why didn’t you make any of those selections beforehand?”

Nicely, the reality of it’s this … we had no concept that we have been gonna get tossed into each single class that each different firm that accepts crypto falls in.

[5:44] With the brand new branding, with the brand new firm, with the brand new route, the one factor that we needed to do is separate ourselves from any of that stuff that’s on the market.

Though Ward doesn’t handle securities head on till later within the webinar, the “stuff” he’s referring to is securities fraud.

It’s at the moment not unlawful to supply a passive buying and selling funding alternative within the US, supplied you do it legally by registering with the SEC.

A giant a part of that’s having to reveal audited accounting that proves to the SEC, buyers and the general public that an MLM firm is definitely doing what it claims it’s.

Within the case of Sports activities Buying and selling BTC, that will be paying returns with precise buying and selling income.

As a substitute of proving that although, Ward opted to drag the plug. Protecting in thoughts recycling newly invested funds constitutes a Ponzi scheme, make of that what you’ll.

[7:12] When you enable somebody to earn a fee of any sort with out having any exercise by any means, it classifies you as a safety.

We’re not attempting to be a safety. We’re not a safety, we’re not an funding.

If I can simply interject right here, Sports activities Buying and selling BTC’s passive funding scheme was very a lot a safety.

Not persevering with to commit securities fraud nevertheless, is a big a part of why Sports activities Buying and selling BTC collapsed.

[7:24] So from our perspective, we thought that we … wanted to make a change as quickly as potential.

Now that change that we made, it occurred virtually in a single day. It effected many individuals on the market and we didn’t talk it as correctly as we should always of.

That change? Scrapping passive returns that Sports activities Buying and selling BTC was actually constructed round.

[8:35] Since when did community advertising change into that you simply simply sit there and earn?

Oh I dunno… most likely across the identical time folks like James Ward began advertising alternatives that promised precisely that?

[8:42] I don’t ever do not forget that till simply a few years in the past when this began occurring and folks thought that they might simply earn for nothing.

I’m not bashing on any corporations on the market, I’m not bashing on you personally if that’s your philosophy; I’m simply merely telling you that the place we’re coming from as an organization is one which we care about our folks, we care in regards to the route that we’re entering into as an organization, and we need to be right here to serve you, proper?

We need to be right here to have the ability to shield you. We don’t need to sit right here and three months from now be shut down, when one thing that we are able to management is so simple as making a easy change to our comp plan.

Ward downplays the modifications made beneath International Credit Community as “minute”.

Kinda sounds something however when you ask me;

[12:00] We’ve to cease advertising this as a passive alternative.

In case you are utilizing the phrase passive, if you’re utilizing the phrase funding, investor, um charge of return – any of that stuff, you might as properly simply go to a different firm as a result of the fact is you’re gonna get us into critical hassle. And also you may even get your self into critical hassle.

Below International Credit Community’s enterprise mannequin, all associates shall be required to promote 0.01 (BTC?) in quantity to a recruited affiliate or retail buyer.

This requirement nevertheless is waived for current Sports activities Buying and selling BTC associates… till December 2020.

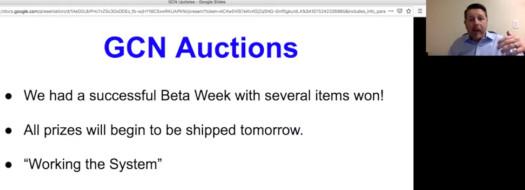

International Credit Community’s credit seem to have one thing to do with penny auctions. The sports activities buying and selling funding alternative is gone.

Penny auctions are horrible for shoppers. For every merchandise offered just one bidder receives the merchandise. Everybody else loses cash.

Penny public sale corporations and house owners nevertheless revenue handsomely.

Legalities apart, Sports activities Buying and selling BTC associates have been undoubtedly offered on a passive funding alternative.

The International Credit Community is a penny public sale reboot. Chalk and cheese.

From a regulatory perspective, once more securities fraud apart, Ward must be refunding each Sports activities Buying and selling BTC buyers no matter they invested.

After that and assuming a regulator doesn’t go after him for operating a Ponzi scheme (even when it was just for just a few months), he’s free to launch no matter he desires.

That doesn’t appear to be what’s occurring although, and that’s an issue.

As of December 1st, Ward is planning to host a December 14th International Credit Community launch occasion at Tropicana in Las Vegas.

International Credit Community isn’t prepared for the general public but. Ward states {that a} new firm web site is “coming very quickly”.