Defendants on the chopping block are Trevon Brown (aka Trevon James), Craig Grant, Joshua Jeppesen, Ryan Maasen, Michael Noble (aka “Michael Crypto”).

Jeppesen’s fiancee, Laura Mascola, is the only real named reduction defendant.

As described by the SEC, these had been BitConnect’s “most profitable promoters in the USA”.

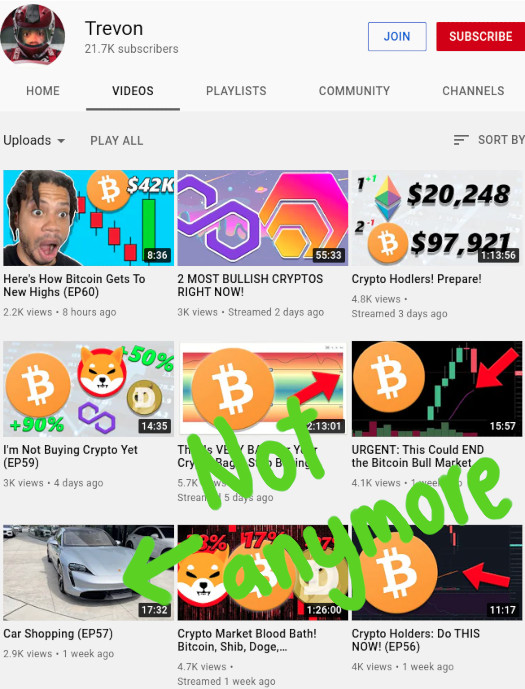

- Trevon James (31) is a resident of Myrtle Seaside, South Carolina

- Craig Grant (46) is a resident of Kissimmee, Florida

- Joshua Jeppesen (37) and Laura Mascola (33), are residents of East Falmouth, Massachusetts

- Ryan Maasen (39) is a resident of Tulsa, Oklahoma

Michael Noble (51, proper) is a resident of Pacific Palisades, California

The SEC’s promoter lawsuit marks the primary BitConnect judicial motion taken by US authorities.

As alleged by the SEC,

From roughly January 2017 to January 2018, BitConnect, an unincorporated group, raised roughly $2 billion by conducting an unregistered providing and sale of securities within the type of investments into BitConnect’s “lending program.”

Defendants Brown, Grant, Maasen, and Noble, together with BitConnect itself and others, supplied and bought the lending program as securities with out registering the providing with the SEC as required by the federal securities legal guidelines and and not using a legitimate exemption from this registration requirement.

Brown, Grant, Maasen, and Noble promoted and touted investments into the lending program to potential retail buyers, together with by creating “testimonial”-style movies promoting the deserves of investing in this system after which publishing the movies on YouTube, generally a number of occasions a day, with a referral hyperlink to the BitConnect lending program.

For every new mortgage that Brown, Grant, Maasen, or Noble introduced in, BitConnect paid the respective promoter a share of that new funding as “referral commissions.”

[1:55] The world, the folks on the earth … have the power to assume what they need to about me.

However um… I can’t permit myself to get caught up in that.

I’ve sympathy for those who had been damage… however I’ve to recollect who I actually am. And that’s what I need to give attention to right here and that’s what I’m making an attempt to remain centered on day by day.

I’m a toddler of god.

Whether or not he tries the identical shtick with the SEC stays to be seen.

The SEC’s lawsuit seeks to claw again these referral commissions, in addition to any returns made via BitConnect’s BCC Ponzi scheme.

Brown obtained no less than $480,000, Grant over $1.3 million, Maasen over $475,000, and Noble over $730,000 as “referral commissions” and “growth funds” from selling and touting investments into BitConnect’s lending program to retail buyers

By aiding and abetting BitConnect’s unregistered gives and gross sales of its lending program investments, Jeppesen obtained over $2.6 million, of which he transferred over $500,000 to Mascola, his fiancée.

Jeppesen can be credited as having a hand in growing BitConnect’s MLM alternative.

In roughly October 2017, the BitConnect Founder, with Jeppesen’s help in his function as “continental promoter,” developed “promoter guidelines” for nationwide promoters and regional promoters.

BitConnect’s high promoters had been instructed to “promote small quantity(s)” of their offered growth fund “via out week [sic]”, in order to not crash the Ponzi scheme.

One attention-grabbing tidbit from the SEC is what occurred within the aftermath of BitConnect’s Texas and North Carolina stop and desists.

In January 2018, BitConnect requested Jeppesen to rent a United States lawyer who specialised in securities legislation, given the cease-and-desist orders.

BitConnect despatched Jeppesen 200 Bitcoin (then value roughly $2.87 million) for use for a authorized retainer.

Jeppesen saved ten Bitcoin from that quantity, though BitConnect didn’t in the end retain a United States lawyer.

The SEC’s claims of reduction towards the US promoter defendants embrace

- violations of the Securities Act

- violations of the Alternate Act

- aiding and abetting violations of the Securities Act (Jeppesen)

- unjust enrichment (Mascola)

The SEC is looking for a everlasting injunction towards the defendants.

The requested injunction will prohibit the defendants from committing additional securities fraud violations, in addition to

completely prohibiting Defendants from

(a) providing, working, or taking part in any advertising and marketing or gross sales program by which the participant is compensated or promised compensation solely or primarily

(1) for inducing one other particular person to develop into a participant in this system, or

(2) if such induced particular person induces one other to develop into a participant in this system; and

(b) taking part, instantly or not directly, in any providing of digital asset securities.

There may be an exemption carve out for private cryptocurrency transactions.

This must be of explicit concern to Trevon James, who since BitConnect has relentlessly continued to advertise unregistered securities on YouTube.

James’ newest rip-off is OurGlass, a Binance SmartChain smart-contract Ponzi scheme.

Moreover the defendants must disgorge their ill-gotten features, in addition to pay a to be decided civil penalty.

Sadly the SEC don’t unmask who’s behind BitConnect, solely referring to the person as “BitConnect’s founder”,

an Indian citizen and resident who based, managed, and managed BitConnect in any respect related occasions.

Noticeably absent from the defendant record are Grenn Arcaro, Nicholas Trovato (aka “Crypto Nick”) and Ryan Hildreth.

Whereas he’s not a defendant, Glenn Arcaro does characteristic within the SEC’s lawsuit.

He’s credited as “United States Nationwide Promoter;

a California resident who served as BitConnect’s nationwide promoter in the USA from roughly August 2017 to January 2018.

In that function, he was chargeable for, amongst different issues, speaking data and directions from BitConnect to its regional promoters in the USA, together with Defendants Brown, Grant, Maasen, and Noble.

I’m assuming there can be a separate SEC lawsuit pertaining to Arcaro filed in some unspecified time in the future.

I’d even be very stunned if parallel felony proceedings haven’t been ready by the DOJ.

Nicholas Trovato (aka “Crypto Nick”) I imagine was a minor throughout BitConnect’s run.

I’m unsure if that had any bearing on the SEC’s resolution to not embrace him as a defendant.

Trovato hasn’t been seen or heard from since BitConnect collapsed.

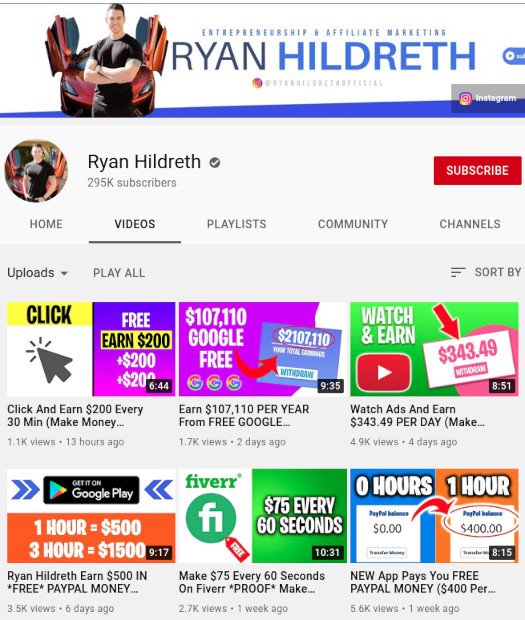

Ryan Hildreth doesn’t seem to have made sufficient to qualify as a high US BitConnect promoter.

He’s nonetheless on YouTube representing himself as an “entrepreneur” and shilling numerous earnings alternatives.

In case anybody’s questioning the place Carlos Mattos is, whereas he undoubtedly grew to become the face of BitConnect submit collapse via memes (see under), I don’t imagine he was an precise net-winner.

BehindMLM first discovered of the SEC’s investigation into BitConnect again in July 2018. We’ve been doing our greatest to maintain you up to date since.

Affirmation by the SEC that BitConnect was a Ponzi scheme is welcome. In 2018 Glenn Arcaro equated BitConnect to playing, arguing it wasn’t a securities providing.

BehindMLM maintains any MLM passive funding cryptocurrency alternative is a securities providing.

Keep tuned for updates as we proceed to observe the US BitConnect promoter case docket.

Replace ninth July 2021 – Joshua Jeppesen, Ryan Maasen, Michael Noble and Laura Mascola have reached settlements with the SEC.

Michael Noble (51, proper) is a resident of Pacific Palisades, California

Michael Noble (51, proper) is a resident of Pacific Palisades, California