Based mostly on its enterprise mannequin we concluded that, at a minimal, Silver Star Reside was engaged in securities fraud.

We first realized of CFTC motion towards Silver Star Reside in late 2019. Two of the corporate’s co-owners, Candace Ross-Mahmoud and Hassan Mahmoud, settled fraud fees with the CFTC for $75,000.

Silver Star Reside’s third proprietor, David “Quicksilver” Mayer, seems to need to defend comparable allegations towards him.

This prompted the CFTC to file fees towards Mayer on June eleventh.

As per the CFTC’s grievance, David Wayne Mayer resides in Georgia.

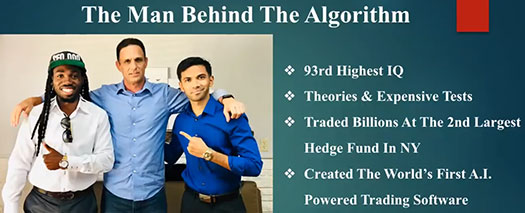

The grievance alleges that from a minimum of July 2018 to March 2019, the defendants fraudulently solicited prospects to open discretionary buying and selling accounts and supplied to commerce these accounts by a completely automated retail international forex (foreign exchange) buying and selling software program system that Mayer created.

Mayer used the pseudonym “Quicksilver” to behave as an unregistered related particular person and to solicit shoppers by movies posted on-line, on social media, and at in-person advertising occasions.

The solicitations contained materials misrepresentations and omissions concerning Mayer’s {qualifications} and buying and selling expertise.

Most of Silver Star Reside’s advertising revolved round Mayer’s purported buying and selling historical past.

To provide you an concept of the extent Silver Star Reside’s buying and selling historical past was fabricated, the CFTC investigation discovered

Mayer by no means opened a dwell buying and selling account utilizing the foreign currency trading system.

As a part of efforts to market Silver Star Reside, Mayer claimed he

- had twenty years of buying and selling expertise;

- had traded for a Wall Road hedge fund price a whole bunch of thousands and thousands {dollars}; and

- tripled mentioned hedge fund account each month.

As a part of the CFTC’s Silver Star Reside investigation, Mayer testified earlier than the CFTC final September.

Throughout his testimony, Mayer admitted that he had no precise buying and selling expertise and his assertion that he had “been buying and selling for just a little over 20 years now” was false.

Mayer additionally admitted in his sworn testimony that his earlier statements concerning his expertise working on the hedge fund have been false.

Extra particularly, Mayer admitted that he by no means traded any accounts on the hedge fund, together with any accounts belonging to a municipal pension fund price “a whole bunch of thousands and thousands of {dollars},” and any representations he made about his efficiency there pertained to so-called “demo accounts” that concerned no precise buying and selling.

Accordingly, Mayer’s illustration that on account of his efforts, “we’re tripling the account each month,” was additionally false.

In an ideal instance of why social media advertising is just not an alternative choice to required regulatory filings, the CFTC famous quite a few Silver Star Reside advertising movies.

Through the Related Interval, Mayer additionally participated in quite a few on-line movies and in-person shows, during which he purported to point out how the Foreign exchange Buying and selling System labored.

In these shows, Mayer presupposed to show the outcomes of buying and selling exercise from his “dwell account,” which evidenced giant and fast returns on his funding.

For instance, in a video posted publicly in a number of places together with Vimeo, Mayer displayed his pc display, and acknowledged, “let me shoot you over a shot of my dwell account . . . this has been working since yesterday.”

Mayer famous that this dwell account began with $10,000 and generated a revenue of $1,568.69 in “in the future.”

Mayer repeated that the trades on the display have been actual: “that is my dwell account proper now.”

In one other advertising video, Mayer presupposed to show the outcomes of a $5,000 funding over one month, which equally demonstrated a revenue over a short while interval.

Mayer acknowledged that when utilizing the Foreign exchange Buying and selling System, “you at all times have a web achieve in your account, . . . and so far, because it has been dwell, it has not had any losses.”

Equally, Mayer acknowledged in a separate video, “for sixteen years in a row, each month I’ve tripled my account.”

In a number of advertising shows, Mayer alleged that such excessive returns in these dwell accounts have been attainable as a result of his “one-of-a-kind” software program used “synthetic intelligence” that created “sensible trades” of international forex pairs.

Once more as a part of his testimony earlier than the CFTC;

Mayer admitted in testimony earlier than the CFTC that he by no means used the Foreign exchange Buying and selling System to commerce a dwell account, utilizing solely so-called demo accounts to simulate buying and selling exercise.

Mayer additionally admitted in testimony that representations he made concerning the efficiency of the Foreign exchange Buying and selling System have been based mostly on the buying and selling efficiency he noticed in these demo accounts.

The CFTC alleges Mayer’s fraudulent exercise violated the Commodity Trade Act.

The CFTC is searching for affirmation Mayer violated the Act through an order, a everlasting buying and selling injunction, disgorgement of ill-gotten positive aspects, a civil penalty and authorized prices.

The CFTC backdates Silver Star Reside’s fraud to July 2018. The regulator alleges Mayer and his co-conspirators scammed “roughly 10,000 shoppers” out of “a minimum of $3 million”.

Keep tuned for updates as we proceed to trace the case.

Replace twelfth September 2020 – Neither Silver Star Reside or David Meyer have responded to the CFTC’s case, prompting the regulator to file a movement requesting an entry of default.

The courtroom clerk recorded an enter of default towards Silver Star Reside and Meyer on August thirty first.

The entry paves the way in which for the CFTC to file for default judgment at a later date.

Replace twenty seventh November 2020 – The CFTC filed for default judgment towards David Mayer, Silver Star FX and Silver Star Reside Software program on November twenty third.

A call on the movement stays pending.

Replace ninth August 2021 – The CFTC has been awarded a $15.6 million greenback judgment towards David Mayer and Silver Star Reside.