The CFTC alleged of their lawsuit that Mayer, by Silver Star Stay and Silver Star Stay Software program, defrauded “greater than 9000 purchasers out of hundreds of thousands of {dollars}”.

Mayer, the creator of the Foreign exchange Buying and selling System offered by SSL and SSLS, defrauded members of the general public (“Shoppers”) by fraudulently soliciting them to commerce foreign exchange by accounts managed by the Foreign exchange Buying and selling System.

Financial institution information for each SSL and SSLS set up that Defendants’ conduct brought about purchasers to incur losses totaling $3,910,178.96, which displays the entire funds Defendants fraudulently solicited for the acquisition and licensing of the Foreign exchange Buying and selling System.

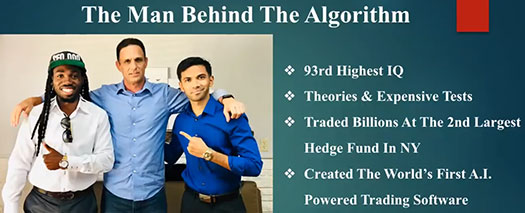

Silver Star Stay was marketed on the premise (quoted verbatim from the judgment order);

- Mayer had 20 years of buying and selling expertise;

- Mayer had traded for a Wall Road hedge fund;

- Throughout his time on the hedge fund, Mayer was “answerable for buying and selling” for a pension fund for workers of a giant municipality, a fund value “a whole bunch of hundreds of thousands of {dollars}”; and

- Mayer “tripled the account each month,” guaranteeing giant funding returns for the consumer and hedge fund.

On September 12, 2019, Mayer offered sworn testimony earlier than the CFTC.

Throughout his testimony, Mayer admitted that he had no precise buying and selling expertise and his assertion that he had “been buying and selling for a bit over 20 years now” was false.

Mayer additionally admitted in his sworn testimony that his earlier statements relating to his expertise working on the hedge fund had been false.

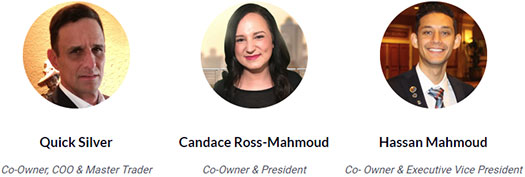

Mayer, a resident of Georgia, adopted the alias “Quicksilver” to additional defraud Silver Star Stay members.

The CFTC filed go well with towards Mayer and his Silver Star Stay firms in June 2020. Mayer was personally served later the identical month.

By the tip of August 2020 Mayer had failed to reply to the lawsuit, prompting the CFTC to file for default judgment.

On July twenty seventh the courtroom granted default judgment.

The Court docket has rigorously thought-about the Criticism, the allegations of that are well-pleaded and hereby taken as true.

As a part of the judgment, restitution and financial penalties issued are as follows:

- $198,143 in restitution, payable by Silver Star Stay;

- $3.71 million in restitution, collectively payable by Mayer and Silver Star Stay Software program;

- a $594,429 civil penalty, payable by Silver Star Stay;

- a $9.79 million civil penalty, payable by Silver Star Stay Software program; and

- a $1.33 million civil penalty, payable by David Mayer.

The courtroom has appointed the Nationwide Futures Affiliation to function Monitor. As Monitor the NFA will gather restitution funds for disbursement to Mayer’s victims.

Mayer’s default judgment additionally consists of an injunction, prohibiting him from, amongst different issues;

dishonest or defrauding, or trying to cheat or defraud, different individuals; issuing or inflicting to be issued false reviews; and willfully deceiving or trying to deceive different particular person in or in reference to any order to make, or the making of, any contract of sale of any commodity for future supply, or foreign exchange contract that’s made, or to be made, for or on behalf of, or with, every other particular person.

Default judgment was granted on July twenty seventh, bringing the CFTC’s case towards Mayer and Silver Star Stay to a detailed.

Mayer based Silver Star Stay with Hassan and Candice Mahmoud.

The Mahmoud’s had been additionally sued for fraud. They settled with the CFTC for $75,000 in 2019.

BehindMLM reviewed Silver Star Stay in January 2019, six months previous to the CFTC submitting go well with.

In our overview we appropriately recognized buying and selling fraud the CFTC would finally take motion over.

Replace fifth August 2022 – In violation of his default judgment injunction, David Mayer continues to promote automated foreign currency trading by Autobot Buying and selling.