What scammers don’t understand is that there are checks and balances in place to make sure this doesn’t occur, as evidenced by a latest SEC submitting.

Earlier than we get into it I wish to preface by stating that to this point, the Receivership estimates round 80% to 85% loss restoration for Zeek Rewards victims with a legitimate declare.

Precise restoration is presently sitting someplace between 70% and 80%.

In a world of unending scams inflicting incalculable losses that’s no imply feat.

That stated, the SEC latest submitting is considerably disturbing.

The SEC’s thirty-page submitting is an objection to charges claimed by the Receivership for the third quarter of 2017.

Within the submitting, the SEC states it additionally plans to file separate objections for charge purposes filed for 4Q 2017 and 1Q and 2Q 2018 respectively.

The SEC has taken objection to billing practices and undisclosed fee will increase by the Receivership and its companions.

As early as August 2016 the Receivership has repeatedly referenced that it’s within the means of winding down.

One would suppose this might correspond with a lower in requested charges, but because the SEC factors out;

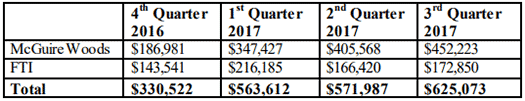

charges requested by McGuireWoods have elevated dramatically over the prior 4 quarters, whereas FTI additionally continues to invoice substantial quantities on a quarterly foundation.

An included desk exhibits charges claimed between Q1 2016 and Q3 2017 growing by slightly below 189%.

Primarily based on what the Receivership has communicated to the SEC and “the spirit of (the courtroom’s) billing directions”, the regulator claims ‘the charges requested are unreasonable underneath the circumstances‘.

Cited billing discrepancies embody;

- numerous “imprecise and repetitive” billing entries that “lack adequate element” ($91,894)

- twenty-six “nearly equivalent” entries marked “calls and correspondence re settlements” ($12,172)

- twenty-four legal professional entries vaguely marked, e.g. “work on opening temporary” and “work on appelant’s reply temporary” ($50,335)

- thirty-one “nearly equivalent” paralegal entries ($22,727)

- fifty equivalent entries by one paralegal particularly ($42,138)

- failure to particular precise quantities of time spent on duties when a number of duties are carried out over an recorded timeblock

- billing rounded to hourly or half-hour increments, versus the ordered one tenth of an hour increments

- “using excessive billing fee attorneys to carry out non-legal duties”

- an unapproved 30% charge improve above what was agreed on, following on from “substantial undisclosed” fee will increase from 2014

Charges billed per hour additionally fluctuate, inexplicably starting from $285 to $684 an hour.

To be clear, the problem right here isn’t the work carried out however fairly the data offered – which the SEC falls wanting what the courtroom ordered.

The billing is thus objectionable, given the courtroom can’t make an knowledgeable choice on work carried out because of a scarcity of particular info offered.

Taken collectively, the Receiver’s billing practices – imprecise, repetitive entries, lumping and block billing – dovetail with one another to make it nearly inconceivable to conduct the associated fee profit evaluate contemplated by the Billing Directions.

Nonetheless, the Receiver and McGuireWoods have repeatedly declined to deal with these points.

Counsel for the Fee has repeatedly raised the problem of cost-effective staffing with the Receiver, together with the “the other way up” staffing mannequin described above, and the in depth use of attorneys and paralegals to carry out non-legal duties, however neither the Receiver nor McGuireWoods has meaningfully addressed this follow.

When these points have been introduced up by the SEC, the Receiver did agree to cut back Q3 2017 billing by $10,000 – attributed to charges billed by single timekeeper.

Something past that the Receiver “has to this point been unwilling to debate” – which actually doesn’t look good.

Neither does charges by the Receiver requested after 1Q 2013 accounting for “practically 40% of the overall quantity recovered after January 15, 2013”.

Primarily based on their evaluation (and keep in mind that is only for Q3 2017 thus far), the SEC are requesting charge purposes for the quarter be “considerably lowered”.

Given the amount and complexity of the time data concerned, the Receiver’s obvious unwillingness to adapt to the necessities of the Billing Directions, and the substantial impression of the Receiver’s inefficient staffing mannequin and unilateral, undisclosed fee will increase, a share or lump sum discount of the quantity requested within the 3Q 2017 Charge Purposes is suitable.

In mild of the SEC’s issues, they’ve additionally requested the courtroom to

seek the advice of with the Fee and the Receiver to develop a complete plan for the rest of the Receivership.

The SEC’s movement is at the moment earlier than the courtroom and awaiting a choice.

Whereas I don’t wish to take something away from what the Zeek Rewards Receivership has completed because it’s institution in 2012, there’s no excuse for doubtlessly short-changing victims due to shoddy billing practices.

I’m actually not, and I don’t suppose the SEC are both, suggesting something nefarious has gone on. However based mostly on submitted info and non-adherence to the agreed-upon billing practices, it appears the SEC have made some convincing factors.

If the Receivership and its companions can’t present an sufficient accounting of time spent as beforehand agreed upon, that’s not one thing Zeek Rewards victims ought to must cowl.