Along with iPro Community and Daniel Pacheco (proper), aid defendants named in the SEC’s Could twenty second lawsuit embrace

- E Revenue Techniques;

- Matthew Lopez (cited as co-manager of Fintact Fee Options, Fintact Options Group and Trident Commerce);

- Fintact Fee Options LLC;

- Fintact Options Group LLC;

- Maritus Regalis LLC; and

- Gabtta LLC

Notably iPro Community CEO Armando Contreras isn’t a named defendant. To this present day we’re nonetheless undecided he even exists.

iPro Community surfaced in Q1 2017. The corporate launched amid OneCoin’s January 2017 withdrawal collapse, and thus was seeded primarily with US OneCoin buyers.

iPro Community’s enterprise mannequin was basically the identical as OneCoin’s, besides that it adopted by means of with a public itemizing exit-scam.

After illegally soliciting funding in PROC on the promise of riches, iPro Community listed PROC on exterior exchanges.

The house owners and prime buyers cashed out through the preliminary pump to 66 cents in July 2017.

At the moment PROC has a public buying and selling worth of 0.14 cents.

iPro Community’s packages had been of the “training” selection, once more borrowed from OneCoin.

In keeping with the SEC, iPro Community’s

packages contained tutorial supplies on tips on how to profitably have interaction in ecommerce, and offered purchasers with a recruitment-based compensation plan and the power to transform “factors” right into a digital asset, or cryptocurrency, that IPro was disseminating to the general public by means of the sale of its packages.

The “training bundle” ruse was arguably pioneered by OneCoin. The mannequin sees an MLM firm bundle Ponzi factors or an altcoin with academic materials.

The corporate pretends buyers are buying the packages with the factors/altcoin given away free of charge.

This nonetheless is pseudo-compliance and doesn’t idiot authorities.

IPro members didn’t buy IPro packages solely for the e-commerce tutorial supplies.

Moderately, purchasers of IPro packages had been paying cash to IPro in alternate for the fitting to promote IPro packages on their very own, in addition to the fitting to obtain compensation for recruiting different contributors to the funding program, recruitment compensation that was not associated to the sale of the e-commerce academic part of the packages to somebody really focused on utilizing these supplies.

Along with deceptively misrepresenting the iPro Community alternative, Pacheco additionally recruited Kevin Harrington and lawyer Scott Warren to advertise the rip-off.

In a single advertising video, Harrington introduced he would keynoting an iPro Community occasion in California.

Within the video Harrington goes on to confer with iPro Community as “a tremendous new alternative”.

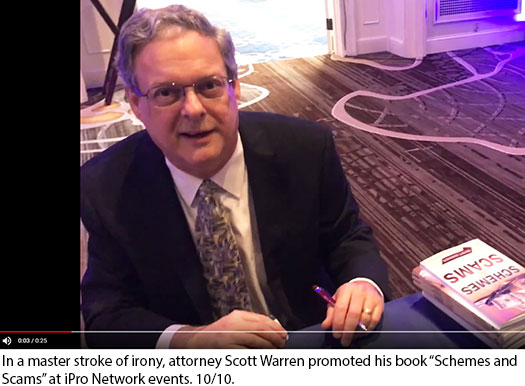

Legal professional Scott Warren of Wellman & Warren LLP, was broadly cited as the corporate’s inhouse lawyer.

In an try and lend legitimacy iPro Community, Warren attended and spoke to buyers at firm occasions.

Within the video above, believed to have been recorded lower than a month earlier than iPro Community collapsed, Warren states he’s

wanting ahead to getting down (to Colombia) with iPro and opening up the nation, making it clean and develop shortly.

The SEC alleges iPro Community, Pacheco and the aid defendants dedicated securities fraud.

Collectively, the iPro Community defendants stand accused of stealing round $26.5 million from buyers.

The mathematics behind iPro Community’s compensation plan dictated that 41.5% to 45.5% was imagined to be put aside for commissions and bonuses.

Forensic evaluation by the SEC reveals that in operation of iPro Community between January 2017 to August 2018, the corporate solely paid out 29.3% of invested funds.

So the place did the cash go?

Throughout operation of iPro Community, Daniel Pacheco

- spent ~$2.5 million on a luxurious dwelling in Redlands, California;

- transferred ~$1.952 million to Settle for Success Company, a shell firm registered in his daughters title;

- transferred ~$2 million to E Revenue Techniques LLC, a shell firm below his management; and

- spent ~$150,000 to buy a Rolls Royce luxurious automotive.

The SEC allege

Pacheco’s misallocation of sources left inadequate IPro funds out there for the fee of commissions and bonuses owed to IPro buyers.

By his Fintact corporations, aid defendant Matthew Lopez acquired roughly half of the $26.5 million iPro Community took in.

$250,000 of that’s traceable to Lopez’s private achieve (private financial institution accounts and a automotive buy).

The remainder of the steadiness stays unaccounted for.

Each Pacheco and Lopez’s use of investor funds for his or her private achieve hastened iPro Community’s inevitable collapse.

iPro Community formally collapsed in March 2018 and ceased enterprise operations shortly thereafter.

Pacheco tried to resuscitate the Ponzi scheme by launching iThrive Community within the second half of 2018.

iThrive Community was short-lived and collapsed shortly after launch.

Daniel Pacheco stands accused of operating iPro Community as a “fraudulent pyramid scheme”.

The SEC alleges the PRO Foreign money part of iPro Community packages had been an funding contract.

Seeing as neither iPro Community, Pacheco or any of the aid defendants had been registered with the SEC, iPro Community’s funding contract providing constitutes securities fraud.

The SEC are looking for judgment and civil penalties in opposition to iPro Community, Daniel Pacheco and the aid defendants.

As a part of these judgments, Pacheco and Lopez will likely be topic to disgorgement of funds obtained by means of iPro Community’s enterprise operations.

Talking on the case, Wein Layne, Director of the SEC’s Los Angeles workplace, acknowledged

We allege that Pacheco hid an previous fraud below the guise of cutting-edge know-how.

He enticed buyers by providing them the chance to invest in cryptocurrency, when in truth he was merely working a pyramid scheme.

Keep tuned for updates on the case as we obtain them.

Replace 1st September 2020 – Over 4 million in default judgments have been handed out to defendants Matthew Lopez, Maritus Regalis LLC and Gabtta LLC.

Replace twenty third December 2022 – Daniel Pacheco has settled his iPro Community fraud case with the SEC.