That mentioned, on April twenty second the Supreme Court docket handed scammers a victory. That victory has ramifications for MLM fraud associated lawsuits.

Earlier than we get into the heavy lifting, I need to preface by stating I’m not a lawyer. I don’t get a boner getting caught into authorized idea and that’s not what I’m doing right here.

My curiosity in AMG v. FTC extends solely as far as the affect the choice can have on regulatory instances towards MLM firms.

At subject in AMG v. FTC is part 13(b) of the FTC Act.

Part 13(b) pertains to non permanent restraining orders and preliminary injunctions.

With respect to MLM fraud instances; the FTC usually seeks an ex-parte TRO after which a preliminary injunction.

What the FTC has been doing for many years is utilizing 13(b) to hunt financial reduction, in the way in which of restitution or disgorgement.

That is used to safe funds from scammers, that are in the end returned to harmed customers.

At subject isn’t the FTC clawing again proceeds of fraud from scammers or returning them to victims, however somewhat how that is achieved.

To that finish the Supreme Court docket dominated

Part 13(b) doesn’t explicitly authorize the Fee to acquire court-ordered financial reduction, and such reduction is foreclosed by the construction and historical past of the Act.

It’s extremely unlikely that Congress, with out mentioning the matter, would grant the Fee authority to bypass its conventional §5 administrative proceedings.

To summarize, the FTC has means to hunt financial reduction by different sections of the FTC Act. Part 13(b) streamlines the method, nevertheless Congress by no means explicitly included financial reduction as a part of Part 13(b).

The courtroom’s ruling was a unanimous 9-0 determination towards the FTC.

So what occurs now?

As per a press-release issued by the FTC, the regulator has engaged Congress to allow them to proceed holding scammers financially accountable.

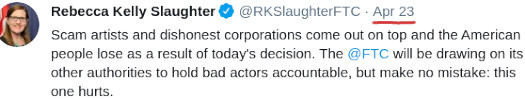

Federal Commerce Fee Appearing Chairwoman Rebecca Kelly Slaughter issued the next assertion concerning at present’s determination from the U.S. Supreme Court docket within the matter of AMG Capital Administration LLC v. FTC:

“In AMG Capital, the Supreme Court docket dominated in favor of rip-off artists and dishonest firms, leaving common Individuals to pay for unlawful conduct,” Appearing Chairwoman Rebecca Kelly Slaughter mentioned.

“With this ruling, the Court docket has disadvantaged the FTC of the strongest instrument we had to assist customers once they want it most. We urge Congress to behave swiftly to revive and strengthen the powers of the company so we will make wronged customers complete.”

On Tuesday, the complete Fee testified earlier than the U.S. Senate Committee on Commerce, Science, and Transportation and submitted testimony on the necessity for 13(b) laws.

The Appearing Chairwoman will seem earlier than the Subcommittee on Shopper Safety and Commerce of the Home Committee on Vitality and Commerce to advocate on behalf of customers for Congress to behave shortly and advance laws to guard and strengthen the FTC’s powers.

My take is the Supreme Court docket has deliberately punted this subject again to Congress, to ensure that them to explicitly make clear the financial reduction subject. Be it by an modification to 13(b) or various means.

It’s a no brainer that the FTC has to have the ability to observe by enforcement with financial penalties, in any other case what’s the purpose.

Fortunately we don’t see it in MLM associated securities fraud instances, nevertheless it’s a working joke that penalties issued by the SEC in relation to buying and selling fraud are merely the price of doing enterprise.

Ought to defendants in FTC fraud instances be permitted to retain funds obtained in violation of the FTC Act, that is by no means a win for customers.

Right this moment the Supreme Court docket dominated in favor of AMG Companies, Inc. and Scott Tucker who stole greater than $1.3 billion from customers by a misleading payday lending scheme.

By misrepresenting mortgage phrases, the defendant precipitated debtors to pay greater than seven occasions the curiosity they have been informed they’d pay.

We’re not speaking chump change right here.

MLM instances I’m conscious AMG has been introduced up in embody Redwood Scientific Applied sciences and Success by Well being.

The pondering appears to be “do what you need as long as we get to maintain what we stole”. Not in contrast to what seems to be happening with AMG – and little question now each different 13(b) case nonetheless being litigated.

With respect to Success by Well being, an April twenty second order directs the events

to fulfill and confer about these points after which submit a joint memorandum by April 29, 2021, to not exceed seven pages, that summarizes their positions and factors of settlement (and disagreement).

As soon as the Court docket has a possibility to overview the joint memorandum, it’ll schedule a standing listening to so these points will be additional addressed.

An identical April twenty second order was made within the Redwood Scientific Applied sciences case.

In its Order re Cross-Motions for Abstract Judgment, the Court docket ordered the events to file a joint standing report concerning treatments on this case inside 15 days of the Supreme Court docket’s determination in AMG Capital Administration, LLC, et al. v. Federal Commerce Fee.

The Court docket expects the events to submit one joint standing report, due on April 30, 2021, and to debate the results of this determination on the Might 7, 2021 standing convention.

In each cases it’ll be fascinating to see how the instances proceed. Significantly what the FTC comes up with.

One potential interim workaround until Congress acts is freezing belongings to “forestall future hurt”.

That is introduced up by the courtroom within the Success by Well being April twenty second order;

As for the continued validity of the receivership, the evaluation is extra sophisticated as a result of it was imposed each to protect belongings and to forestall future hurt and it’s not clear that AMG Capital casts any doubt on the latter goal.

Thus, AMG Capital might name for the receivership to be narrowed in scope however not eradicated.

Simply so we’re clear, the 13(b) ruling doesn’t change Success by Well being’s and Redwood Scientific’s fraudulent conduct in violation of the FTC Act, solely how the FTC goes about acquiring financial reduction.

In the event you’re within the authorized idea behind the Supreme Court docket’s determination, Kevin Thompson of Thompson Burton approaches the choice from an lawyer’s perspective.

At no level am I suggesting that scammers must be allowed to maintain their cash.

I’m suggesting that, every now and then, the FTC pursues harmless firms that settle as a result of they’re not in a position to endure the hell of 13(b) litigation.

Because the saying goes, higher 9 responsible folks go free than 1 harmless go to jail. I consider in Due Course of. So does the Supreme Court docket. So do you have to.

Finally as long as scammers aren’t in a position to preserve what they’ve stolen, I don’t have an issue with how financial reduction is obtained.

Each the Success by Well being and Redwood Scientific instances are on our docket calendar. Keep tuned for protection of the submitted standing studies as soon as they’re filed.

Replace twenty third June 2021 – The FTC has introduced it’s reviewing the Enterprise Alternative Rule.

This implies the beforehand granted MLM exemption will probably be eliminated, permitting the regulator to hunt reduction it may possibly not get by 13(b).