The regulator alleges mom and son founders, Brent Carson Kovar and Pleasure Irene Kovar (86), had been behind a $12 million greenback Ponzi scheme.

As alleged by the SEC, from mid 2018 the Kovars “raised not less than $12 million from over 277 buyers via their firm, Revenue Join”.

Defendants promised buyers that their cash could be invested in securities, bitcoin and different cryptocurrencies primarily based on suggestions made by an “Synthetic intelligence supercomputer.”

Revenue Join claims that its supercomputer constantly generates huge returns, which in flip permits Revenue Join to ensure buyers mounted returns of 20%-30% per yr with month-to-month compounding curiosity.

Nonetheless, Revenue Join is a fraud. The vast majority of funds obtained by Revenue Join didn’t come from any investments or income generated by a “supercomputer.”

As an alternative, over 90% of Revenue Join’s funds got here from buyers.

That is consistent with BehindMLM’s Revenue Join evaluation, revealed December 2020.

One factor I’m confused about nevertheless is Eddie Kona citing himself as Revenue Join’s founder.

I initially thought Brent Kovar was an alias for Kona, however they’re in reality two totally different folks.

Kona remains to be citing himself as “founder/proprietor” of Revenue Join:

He was additionally selling Revenue Join on social media, proper up till mid Might:

Kona isn’t talked about within the SEC’s lawsuit. I’m undecided what’s happening there (anybody?).

In 2010, the SEC obtained a everlasting injunction, a penny inventory bar, and an officer and director bar towards B. Kovar for his position in a pump-and-dump providing fraud.

To lure new buyers in, Brent Kovar represented Revenue Join had a magic buying and selling bot. By means of this bot buyers had been promised mounted annual returns of as much as 30%.

Right here’s what truly occurred:

Defendants misused investor cash by, amongst different issues, transferring hundreds of thousands of {dollars} to J. Kovar’s private checking account, paying hundreds of thousands of {dollars} to promoters who introduced buyers to the Revenue Join web site to take a position, and making funds to different buyers in a Ponzi-like trend.

Revenue Join financial institution accounts don’t present any income or income being generated.

Brent Kovar misappropriated “nearly $353,000” of investor funds. He additionally bought a home to stay in, placing it in Revenue Join’s title.

Along with being the recipient of stolen Revenue Join investor funds, Pleasure Kovar’s title was used to set it up.

Revenue Join Wealth Providers Corp. is a Nevada company shaped on Might 2, 2018. Its principal place of work is Las Vegas, Nevada. Revenue Join was shaped by J. Kovar, who has served as its president and treasurer since its inception.

Pleasure Irene Carson Kovar, age 86, resides in Las Vegas, Nevada. J. Kovar shaped Revenue Join on Might 2, 2018 with herself as its president, treasurer, secretary and director.

In April 2019, J. Kovar named her son B. Kovar because the director of Revenue Join in her place.

J. Kovar remained the president and treasurer of Revenue Join and she or he holds these positions at present. J. Kovar has opened not less than eight financial institution accounts within the title of Revenue Join at three totally different banks.

J. Kovar was the only real signatory on six of the Revenue Join financial institution accounts, together with the first account that obtained investor funds, till she just lately added her son, B. Kovar, as a signatory to 2 present Revenue Join financial institution accounts and to 2 new financial institution accounts within the title of Revenue Join.

Right here’s the particular breakdown of funds invested into Revenue Join over time:

Over $3 million of investor funds was used to make funds to numerous promoters who solicited buyers in Revenue Join utilizing their social media platforms.

Roughly $1 million went to different people related to Revenue Join, together with people who’ve been issued bank cards within the title of Revenue Join.

As of April 12, 2021, J. Kovar had used not less than $1.679 million of investor funds for her personal use, together with for bank card purchases, in-person money withdrawals, and an vehicle.

Very current financial institution information present that between April 21, 2021 and June 9, 2021, J. Kovar made ten transfers of not less than $120,000 every from the Revenue Join Investor Account to her personal private checking account – for a complete of greater than $1.2 million in lower than two months.

Over $250,000 went to costs for images, attire and a charity associated to B. Kovar.

Not less than $629,000 was used to repay different buyers.

Not less than $440,000 was used to buy a residential house in January 2021 which B. Kovar facilitated by signing the grant deed.

$1.6 million of investor funds went to make funds on plenty of totally different bank cards, together with a bank card within the title of Revenue Join.

These bank card costs included nearly $353,000 charged on the Revenue Join bank card assigned to B. Kovar for bills associated to eating places, grocery shops, Amazon and Costco between June 9, 2020 and April 8, 2021.

On April 2, 2021 alone, B. Kovar charged over $23,500 at Costco.

Revenue Join wasn’t even a “good” Ponzi scheme. $12 million in, $629,000 out in returns.

By March 2021 Revenue Join was nonetheless bringing near $2 million a month.

In March 2021, the Revenue Join Investor Account obtained $1,841,227.31 in deposits.

Not less than $1,745,269.66 of the deposits (94.7%) had been from people who look like buyers. $90,648 of those deposits (4.9%) had been from different people or entities.

Of that quantity

- Brent Kovar paid $519,400 to himself;

- $172,340 was used to pay Revenue Join bank cards;

- $67,657 was used to pay Revenue Join buyers (approx 5%); and

- $54,340 was used to pay MLM pyramid commissions (approx 4%).

Forensic accounting performed by the SEC revealed that, regardless of providing associates a “a refund assure”, by March 2021

Revenue Join had lower than 20% of the whole investor funds raised in its financial institution accounts and couldn’t probably return all investor funds.

The SEC alleges ‘the Wealth Builder accounts provided by Revenue Join are securities’.

The regulator has charged Brent and Pleasure Kovar with 5 violations of the Securities and Alternate Act.

The SEC’s sealed criticism, movement for a TRO and movement for a preliminary injunction had been filed on July eighth.

On July 14th the courtroom granted the SEC an emergency ex parte TRO, freezing Revenue Join’s and the Kovar’s property.

The Revenue Join case was unsealed on July sixteenth.

The Kovar’s lawyer, representing each of them and Revenue Join, entered an look on July nineteenth.

Keep tuned for updates as we proceed to trace the case.

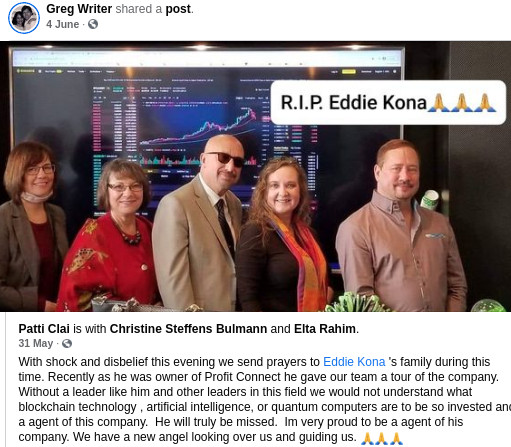

Replace twenty first July 2021 – It appears the rationale Eddie Kona is lacking from the SEC’s lawsuit is as a result of he died in late Might or early June.

This can be a put up from a publicly accessible Revenue Join Fb group:

The SEC’s lawsuit does point out an unnamed “secretary”;

In April 2019, J. Kovar named her son B. Kovar because the director of Revenue Join in her place. She additionally named one other particular person because the secretary of Revenue Join.

This could possibly be a reference to Kona. It’s nonetheless a bit odd although that Kona wasn’t talked about within the criticism.

Replace twenty fifth December 2021 – The Kovars have settled with the SEC.