The report, filed by the Mashreq Financial institution’s Audit, Fraud & Compliance Group, is dated September 1st, 2015.

Affected prospects listed are

OneCoin Restricted, a shell firm arrange within the UAE in June 2014;

- Prosperia FZE, one other shell firm arrange within the UAE in Could 2014;

- Martin Rudolf Alexander Breidenbach, a OneCoin director and named companion of of the regulation agency Breidenbach Rechtsanwalte;

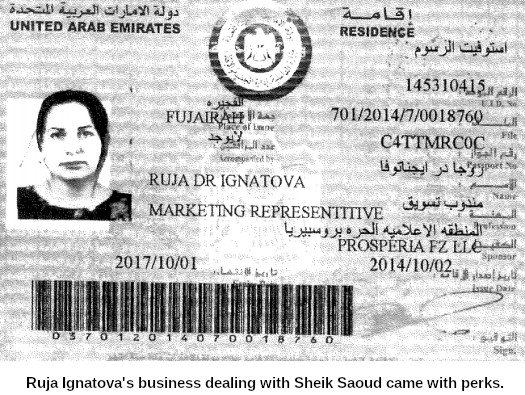

- Ruja Ignatova (above proper), OneCoin co-founder and CEO; and

- Sebastian Greenwood, OneCoin co-founder Grasp Distributor.

OneCoin represented to Mashreq Financial institution that each OneCoin Restricted and Prosperia FZE had been “administration consultancy” companies.

- OneCoin Restricted was arrange by Martin Breidenbach (German passport), Ruja Ignatova (German passport) and Sebastian Greenwood (Swedish passport)

- Propseria FZE was arrange by Martin Breidenbach (German passport), Ruja Ignatova (German passport) and Nicholas David Cully (British passport)

Ignatova, Greenwood and Cully had been designated Energy of Attorneys.

Nicholas Cully is a brand new identify to me.

The Sovereign Group seem to focus on shell firm formation in dodgy jurisdictions.

Mashreq Financial institution’s information present that accounts arrange by way of OneCoin’s shell corporations transferred over $200 million {dollars}.

Stolen OneCoin investor funds seem to have been primarily routed from HSBC accounts in Hong Kong.

Triggered by the sum of money flowing between the accounts, Mashreq Financial institution launched an investigation.

The financial institution concluded

the corporate declared on the time of the account opening (that) OneCoin Restricted is into administration consultancy companies; nonetheless, this exercise has not been noticed within the account.

The account turnover is far larger than the one declared on the time of the account opening.

Account was funded by means of inward remittances from a number of people and entities positioned in Bulgaria, Kuala Lumpur, Estonia, Hong Kong, Vietnam, Cambodia, Mexico, US, Gibraltar, and Australia and having function of fee as “username”, “Advertising and academic packages”, “fee for tools” or “fee for training”.

When queried on outward transactions, OneCoin produced bogus contract invoices displaying the corporate was buying “flash video games” (suppose crappy browser video games that had been a factor within the late 2000s).

It was famous that the funds had been initiated for buy of “Flash Video games” which isn’t in step with firm’s line of enterprise.

The contract, with no reference of our prospects, was dated 3 August 2015. I.e. publish our EDD question.

Moreover, the value talked about on the contract gave the impression to be inflated.

As an illustration EUR 70,000/- for about 80 video games; nonetheless, as per public area, such video games are quoted as lower than EUR 100/- per recreation.

Mashreq Financial institution’s prolonged due-diligence efforts on OneCoin led them to various publications on the web, together with BehindMLM.

Contemplating the above data corroborated with the bizarre account exercise, we suspect OneCoin Restricted could also be engaged in a pyramid / Ponzi scheme.

In view of the above talked about salient factors of our evaluation, we contemplate the account exercise suspicious / a Ponzi scheme.

We’re subsequently reporting our suspicion as required by the regulation.

Contemplating the danger related to these relationships, we’re in strategy of closing all of the accounts.

An connected “motion memo” reveals a suggestion from the Anti-Cash Laundering and Suspicious Instances Unit of the Central Financial institution of the UAE, directing Mashreq Financial institution to “freeze all obtainable balances within the accounts.”

The memo additionally notes “issues” from Bulgaria’s Monetary Intelligence Directorate had been acquired. No particular particulars are offered.

There’s additionally “particular emphasis on workers collusion” talked about, suggesting Mashreq Financial institution workers might need been in on OneCoin’s cash laundering efforts.

Finally authorities in Dubai took no additional motion in opposition to OneCoin or its principals.

Ruja Ignatova maintained UAE residence by way of Prosperia FZ, regardless of monetary authorities linking it to suspected monetary fraud.

Coinciding with Sebastian Greenwood’s arrest in Thailand in 2018, Dubai has emerged because the MLM rip-off capital of the world.

Many scammers have relocated there. The UAE has restricted extradition treaties and little to no native lively regulation of MLM associated fraud.

Amid the COVID-19 pandemic, the UAE, Dubai specifically, is likely one of the few locations on the planet that also permits scammers to host stay advertising and marketing occasions.

One could level to Mashreq Financial institution’s SAR as proof of lively regulation, nonetheless since 2015 the kind of scammer that relocates to Dubai is greater than seemingly scamming by way of cryptocurrency.

Issues have gotten so dangerous over the previous few years that, anytime you see somebody in MLM having relocated to Dubai, assuming they’re forsaking a path of fraud elsewhere is a protected wager.

OneCoin Restricted, a shell firm arrange within the UAE in June 2014;

OneCoin Restricted, a shell firm arrange within the UAE in June 2014;