OmegaPro funds have been seized by UK authorities.

The regulatory motion occurred via OMP Cash, a UK shell firm arrange by OmegaPro to entry banking channels.

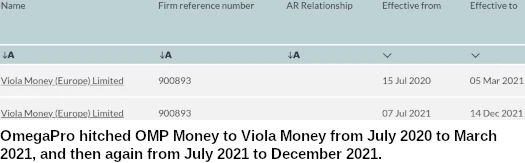

OMP Cash was in flip tied to Viola Cash, which was shut down by UK authorities final December.

The background on these newest developments is a bit difficult so I’ll begin firstly.

OmegaPro is an easy 200% ROI Ponzi scheme.

As a way to entry conventional banking channels, OmegaPro included the UK shell firm OMP Cash in April 2020.

OmegaPro co-founder Andreas Szakacs pitched OMP Cash as “a financial institution”. He offered it as an integral a part of OmegaPro’s regulatory compliance;

A very powerful factor I would like you to do is to go to the FCA register.

On the FCA register you may seek for OMP Cash and see that we’re regulated by the FCA.

This might be one thing distinctive I’d say for our trade and I’m so completely satisfied to lastly announce this.

OMP Cash accessed banking channels via Viola Cash, one other UK shell firm.

OMP Cash first bumped into regulatory issues in June 2021, whereby the FCA deregistered the corporate.

OMP Cash would stay deregistered till December 2021, whereby it was briefly reinstated earlier than being deregistered once more.

Viola Cash was arrange as V-Pockets (Europe) in July 2015. In Might 2019 the corporate was renamed Viola Cash (Europe).

Viola Cash registered with the FCA just a few months after the identify change in November 2018.

Viola Cash supplied shoppers with entry to GBP and EUR fee processor companies, in addition to banking and pay as you go debit card companies.

Viola Cash carried out banking companies via ClearBank (UK) and LHV Financial institution (Estonia)

As reported by Interpath;

On 22 October 2021, ClearBank notified each Viola Cash and the FCA that it had determined to terminate its settlement for the supply of banking companies to the Firm with instant impact.

The explanations given by ClearBank included that following a overview of the Firm’s exercise that they had famous:

-Uncommon fee requests;

-Monetary crime typologies; and

-An lack of ability for the Firm to adequately and successfully monitor transactions.

LHV Financial institution adopted go well with and gave Viola Cash 60 days discover it was terminating their settlement on October twenty ninth.

The FCA initiated motion in opposition to Viola Cash on November 2nd.

On November twenty fifth, LHV Financial institution terminated Viola Cash’s banking settlement “with instant impact”.

The FCA deregistered Viola Cash on December 14th.

Two Interpath workers would later be appointed Joint Particular Directors (Receiver equal).

In a February ninth fifty-six web page report, Interaction disclosed;

The information of the Firm are inaccurate and incomplete – for instance, the Firm doesn’t seem to have beforehand carried out a buyer funds reconciliation and buyer account balances per the Firm information considerably differ to the precise balances held at monetary establishments.

It’s presently unsure whether or not we can make a distribution to clients.

This displays that the shopper funds are largely not presently managed by the JSAs

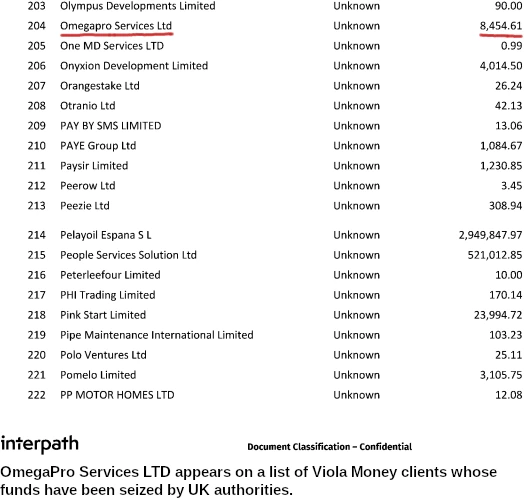

An inventory accompanying the report reveals €8454 EUR belonging to “OmegaPro Companies Ltd” has been seized.

OmegaPro Companies Ltd is yet one more UK shell firm tied to OmegaPro.

OmegaPro Companies Ltd was included in Might 2019 and operates out of a Cardiff PO Field. Per Anders Kagestedt, purportedly a Swedish nationwide, is listed as the only real Director.

Upon Viola Cash working into regulatory issues, the stooges put in cost bailed.

Once more from Interpath’s report;

The shareholders of Viola Cash are Stephen John Davies (90.5%) and David Barclay (9.5%).

David Barclay and Mary-Ann Townsend are administrators of the Firm and are additionally the individuals liable for the administration of its digital cash.

On or round 8 December 2021, Mr Barclay, the CEO and director of the Firm, is known to have resigned with instant impact.

We now have written to each David Barclay and Mary-Ann Townsend as the administrators of the Firm as reported on Firms Home to request they full and return a Assertion of Affairs.

David Barclay has suggested he resigned as a director of the Firm on 8 December 2021 and not has entry to the fabric required to finish a Assertion of Affairs in any significant means.

Mary Ann Townsend suggested that she will not be conscious of the data requested inside the Assertion of Affairs as her position was primarily the Cash Laundering Rules Officer for the Firm.

As such we now have not acquired a Assertion of Affairs to this point.

Stephen John Davies, Viola Cash’s majority shareholder, doesn’t seem to exist. If Interaction’s correspondence with Barclay and Townsend was in writing, I’d proffer they don’t exist both.

UK incorporation and fraud have been synonymous for many years.

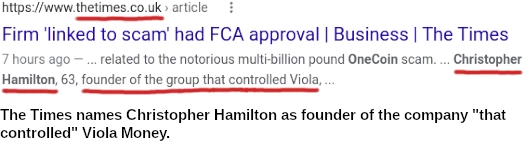

Who was truly working Viola Cash (which was clearly half of a bigger cash laundering syndicate), brings us to an attention-grabbing Feb twenty second article from the Occasions.

Sadly the article is paywalled – however its introduction was sufficient to catch my consideration.

A self-styled “fintech” funds enterprise was authorised by the Metropolis regulator whereas its founder was topic to a cash laundering investigation associated to the infamous multibillion-pound OneCoin rip-off.

A brand new report from directors has revealed that “virtually all” the funds managed by the enterprise are topic to freezing orders from HM Income & Customs or police forces.

Now I’ve searched excessive and low for a “new report” from Interpath, and the most recent I may discover was the Feb ninth report cited above.

If there’s a brand new report it’s not on their web site.

Sadly The Occasions don’t disclose how they’re tying Viola Cash to OneCoin. OneCoin isn’t talked about anyplace in Interpath’s February ninth report.

Nonetheless my very own analysis led me to the tail-end of a dialogue on Viola Cash’s shutdown – referencing a February 2021 UK court docket case.

Sadly this text from Court docket Information UK is additionally behind a paywall.

However like The Occasions’ article, we glean attention-grabbing data from what is obtainable.

A cash launderer rinsed over £75 million from a rip-off based mostly on a nugatory cryptocurrency known as ‘OneCoin,’ a court docket heard.

Christopher Hamilton, 62, is claimed to have laundered as much as US {Dollars} 105m from the American scheme during which traders have been promised implausible charges of danger free revenue.

However the OneCoin was nugatory and Hamilton was arrested at his residence in Cowbridge, close to Bridgend in south Wales in April 2016.

I’ve by no means heard of Christopher Hamilton. Neither is his 2016 OneCoin cash laundering arrest within the UK referenced anyplace on BehindMLM.

What on Earth is happening right here?

Primarily based on what’s publicly out there, I can’t reply that. However bear with me as a result of the rabbit gap will get even deeper…

In April 2019 Dominic Welsh, some schmuck within the UK, was prosecuted over a bungled blackmail try.

WalesOnline fortunately supplies us with a freely accessible article;

An ex-marine blackmailed a “petrified” firm director at his household residence about an alleged $32m debt, a court docket heard.

Cardiff Crown Court docket heard Dominic Welsh positioned his alleged sufferer’s household underneath surveillance and threatened violence in an try and recuperate cash his employers believed they have been owed.

The “sufferer” is none apart from Christopher Hamilton, recognized as “a director for greater than a dozen corporations within the UK and overseas.”

Prosecutor Christopher Rees stated: “It’s notably chilling that the defendant was additionally monitoring Mr Hamilton’s spouse and daughter and even daughter’s boyfriend as a part of the plot to demand cash from him.”

The court docket heard a message was discovered on Welsh’s telephone from June 7, 2017, saying: “On the debt we’re nearly able to make our transfer.

“We’re gonna hit about 4 targets directly. A pair we’re gonna simply slap round and threaten their households however the different two we are going to put it on them closely.”

In his proof Welsh stated he was paid $10,000 a month for his work and was as a result of earn a $30,000 bonus if he helped his shoppers to “recuperate” the cash.

Who was Dominic Welsh, the alleged blackmailer, working for?

Prosecutors allege American businessman Gilbert Armentar and his affiliate William Morro employed Welsh to recuperate funds they believed they have been owed.

That’s Gilbert Armenta, OneCoin founder Ruja Ignatova’s secret lover.

Armenta pled responsible to 5 counts of fraud, and is presently awaiting sentencing.

William Morrow is believed to be a pseudonym utilized by Segun Onibalusi.

Onibalusi, a Nigerian nationwide, seems to be an confederate working with/for Armenta.

Dominic Welsh was acquitted in April 2019.

Curiously, I used to be unable to find out the result of Christopher Hamilton’s OneCoin cash laundering case.

What I can affirm is Christopher Hamilton additionally seems to be The Occasions’ hyperlink between Viola Cash and OneCoin.

Whether or not UK authorities are nonetheless investigating Viola Cash, and whether or not any of that can result in motion in opposition to OmegaPro, is unclear.

OMP Cash markets fee processor companies on its nonetheless lively web site.

OMP Cash has determined to make a custody account service out there to all its customers which is now as simple as a checking account.

Safe your cash with us, now!

Who OMP Cash and OmegaPro are actually offering these companies via will not be disclosed.

OmegaPro is run by co-founders co-owners Andreas Szakacs (Sweden), Mike Sims (US) and Dilawar Singh (Germany).

Szakacs, Sims and Singh run OmegaPro from Dubai, the MLM rip-off capital of the world.

So far OmegaPro has attracted regulatory consideration in Colombia, Spain, France, Peru, Belgium and Chile.

Replace twenty fourth February 2022 – Along with being a pseudonym utilized by Segun Onibalusi, William Morro can be an precise individual working with Armenta.

Armenta and Morrow seem to have been laundering cash for years. Whether or not Morrow is an individual of curiosity to US authorities is unclear.

Replace twenty sixth June 2022 – Extradition proceedings within the UK have shed some mild on Christopher Hamilton’s OneCoin cash laundering case.