Investview CEO Joseph Cammarata has been arrested on restoration rip-off fraud costs.

The SEC has additionally filed parallel civil proceedings in opposition to Cammarata and two co-conspirators.

In early November, the DOJ revealed Cammarata, Erik Cohen and David Punturieri, had been indicted ‘on costs of conspiracy to commit a number of counts of fraud in reference to a securities fraud claims scheme.’

The “securities fraud claims scheme”, aka a restoration rip-off, was perpetrated via Alpha Plus Restoration.

Alpha Plus Restoration ran from 2014 to January 2021.

Whereas within the MLM area we usually see restoration scams straight goal victims (guarantees of refunds after a payment is paid), Alpha Plus Restoration focused civil lawsuits filed in opposition to corporations discovered to violated securities regulation.

Upon reaching a settlement with the offending firm;

As a sensible matter, as a result of such settlements typically contain very giant numbers of injured buyers, they steadily contain very giant quantities of cash.

Even after the cost of lawyer’s’ charges and bills, such settlements end in substantial swimming pools of funds that need to be equitably divided amongst giant numbers of buyers.

Who will get what’s the results of formulation set out in settlement agreements. This course of, which incorporates validating claims filed by victims, is carried out by a court-approved third-party claims administrator.

From Cammarata’s beforehand sealed indictment;

Alpha Plus was a claims aggregator purporting to behave on behalf of purchasers who claimed entitlement to settlements from securities class motion and SEC enforcement motion settlements.

All claimants to such settlements, together with these represented by claims aggregators reminiscent of Alpha Plus, have been required to point out two important information to be able to qualify for an award of funds.

First, claimants wanted to show that they’d purchased shares ofthe topic safety throughout the time interval set forth within the court-approved settlement settlement that resolved the securities class motion lawsuit.

Second, claimants additionally wanted to point out they’d suffered damages on account of their buy of securities.

Alpha Plus’ restoration rip-off noticed the agency submit bogus sufferer declare particulars to a number of claims directors.

Joseph Cammarata, Erik Cohen and David Punturieri and others … created what presupposed to be unbiased entities, however which have been in truth owned or managed by the defendants, and used these entities to make false claims in securities class motion and SEC enforcement motion settlements.

These entities have been represented to be Alpha Plus purchasers, who then, on behalf of the created entities, submitted false claims.

The indictment alleges Cammarata, Cohen, and Punturieri (quoted verbatim)

- made materials misrepresentations to claims directors about securities buying and selling that had purportedly been accomplished by supposed Alpha Plus purchasers;

- created false names of supposed Alpha Plus staff when speaking with claims directors;

- created fictitious brokerage paperwork purporting to point out purchases and gross sales of securities topic to class motion and SEC enforcement motion settlements;

- offered fictitious brokerage paperwork to claims directors to help false and fraudulent claims;

- impersonated people purportedly answerable for Alpha Plus purchasers;

- impersonated people purportedly employed by brokerage companies in;

conversations with claims directors who have been trying to find out the legitimacy of claims submitted by Alpha Ptus; and - falsely denied possession or management of Alpha Plus in conversations with claims directors who have been trying to find out the legitimacy of claims submitted by Alpha Plus.

Between 2014 and 2021, Cammarata, Cohen and Punturieri’s Alpha Plus restoration rip-off netted them ~$40 million.

Their October twenty eighth indictment lists one depend of conspiracy and requested forfeiture.

At time of publication, the Alpha Plus case docket reveals a bench warrant was issued in opposition to Cammarata on the identical day the indictment was filed, initially underneath seal.

Cammarata was arrested on November 4th. The standing of Cohen and Punturieri is unclear.

In a press-release issued on November third, the DOJ advises;

If convicted, every defendant faces a most potential sentence of 20 years in jail.

Parallel civil fraud proceedings have been initiated by the SEC on November third.

The SEC’s criticism names Joseph Cammarata, Erik Cohen, David Punturieri, AlphaPlus Portfolio Restoration Group and Alpha Plus Restoration as defendants.

As alleged by the SEC;

Defendants stole at the least $40 million from roughly 400 distribution funds that fashioned on account of resolutions of securities class actions and Securities and Trade Fee enforcement actions.

Defendants knew, or have been reckless in not figuring out, that their scheme was unlawful.

The conduct detailed within the SEC’s criticism mirrors that of the sealed indictment. Further context is offered nonetheless, by way of obtained communication between the defendants.

In 2015 a Distribution Fund pushed again on what they believed was a false clarification pertaining to “fabricated buying and selling information”.

Punturieri failed to deal with the fund’s concern, prompting Cammarata to e mail Punturieri;

. . . I awakened in the midst of the evening enthusiastic about JAIL, as a result of we waited every week to listen to something from the admin.

After certainly one of Alpha Plus’ sham purchasers, Nimello Holding LLC, obtained by way of a false declare, Cammarata emailed Punturieri;

To not [sic] shabby…Perhaps we have been to [sic] conservative on the numbers ;).

The SEC’s criticism additionally reveals what Cammarata and his co-defendants spent the hundreds of thousands they illegally obtained on;

Defendants funneled the cash they obtained from submitting fraudulent claims via an internet of accounts managed by the Particular person Defendants.

The Particular person Defendants used these stolen belongings to pay for quite a few private bills, reminiscent of jewellery, residence renovations, watercraft, trip properties and different actual property, together with maintenance on Cammarata’s private Caribbean island.

On November 4th the SEC was granted a Non permanent Restraining Order, freezing the defendant’s belongings.

The freeze included sure allegedly joint belongings, which Joseph shared with “estranged partner” Nina Cammarata.

This prompted Nina to file a movement to intervene on November seventh, alleging she knew nothing of Joseph’s fraudulent conduct.

Nina filed a petition for divorce in opposition to Mr. Cammarata in August 2019 within the State of New Jersey, and after a interval of tried reconciliation, served the criticism in July 2020.

The divorce proceedings are ongoing.

The Cammaratas collectively personal three (3) items of actual property (the “Property”) – a home in Monmouth Seashore, NJ, a home within the Pocono Mountains of Pennsylvania, and a Bahamian island generally known as “Sandy Cay.”

The Monmouth Seashore home is Nina’s main residence.

It’s encumbered by a mortgage, which requires the cost of $5,000 per 30 days to keep up.

Throughout their marriage in addition to all through the divorce proceedings, Mr. Cammarata paid for the entire bills related to the opposite Properties.

Nina doesn’t know what these bills are or how they have been paid, however she does know that as a joint proprietor of those properties, she could also be collectively responsible for these bills.

If she doesn’t obtain rapid entry to the Joint Account, she might be irreparably harmed and the Properties could also be topic to waste and presumably opposed authorized motion, together with liens and foreclosures for non-payment of a mortgage, taxes, and HOA charges.

A discover filed by the SEC on November nineteenth detailed “a stipulated intervention and asset carve out” settlement had been reached with Nina.

As per an order issued on December third, the granted TRO has been prolonged via January twenty fifth, 2022.

For his or her half, upon studying of Cammarata’s arrest, Investview distanced themselves with a quickness.

The day after Cammarata’s arrest, November fifth, Investview introduced “interim administration modifications”.

Investview lately realized via media sources that its Chief Government Officer, Joseph Cammarata, and sure different of his enterprise associates, have turn out to be the topic of lately introduced civil and legal costs.

Instantly upon Investview changing into conscious of those authorized issues, the Firm’s Board of Administrators positioned Mr. Cammarata on administrative go away and eliminated him from all duties and obligations, pending the Firm’s personal inside investigation of those issues in live performance with the Firm’s exterior authorized professionals.

The actions attributable to Mr. Cammarata in these reported authorized actions have been unbeknownst to, and utterly unbiased of Mr. Cammarata’s actions on behalf of Investview.

To the perfect of the information of the Firm, all actions in query ended previous to Mr. Cammarata changing into concerned with Investview in December of 2019.

In mild of the present scenario and circumstances, Investview has appointed James R. Bell because the performing CEO to make sure enterprise continuity and coordination of day by day enterprise operations.

Since April of 2020, Mr. Bell, as a director of Investview, has been instrumental within the oversight of the Firm’s operational turnaround to profitability.

It’s price clarifying that the restoration rip-off allegations in opposition to Cammarata stretch into his Investview tenure.

The final documented occasion of Alpha Plus fraud, offered within the SEC’s criticism, is dated December fifteenth, 2020. The communication alternate presumably runs into January 2021, therefore the estimated Alpha Plus vary of fraud.

Regardless, Cammarata had been Investview CEO for a 12 months at that time. The SEC’s criticism alleges a number of cases of Alpha Plus fraud all through 2020.

One other focal point is Investview’s claimed “operational turnaround to profitability”.

This coincides with Investview’s continued securities fraud, via Kuvera World and now iGenius.

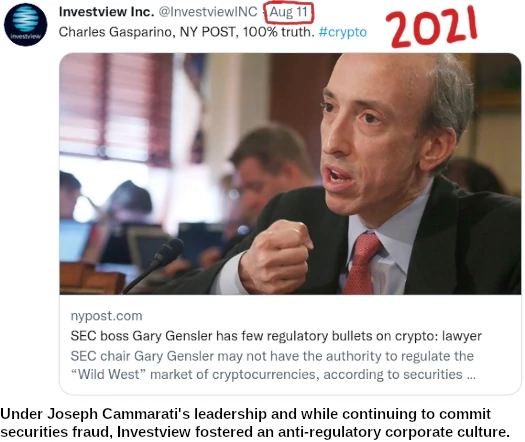

Underneath Joseph Cammarata’s management Investview has and continues to commit securities fraud, on the premise they don’t imagine cryptocurrency is regulated.

Proof of this viewpoint could be discovered on Investview’s social media channels.

For instance, on August eleventh, Investview retweeted an article by Charles Gasparino for the NY Put up:

Gasparino places forth the SEC’s Gary Gensler is losing his time attempting to manage the “unregulatable” crypto commerce market.

With respect to Investview’s securities fraud via iGlobal, whether or not cryptocurrency is regulated or not doesn’t matter.

The difficulty is securities fraud, performed by way of iGenius’ passive funding buying and selling bot.

There isn’t a carve out for securities fraud dedicated by way of cryptocurrency in US securities regulation.

Investview’s regulatory troubles started in 2018, with a $150,000 fraud settlement with the CFTC.

The fallout noticed Investview rename Wealth Mills to Kuvera World. Following investor losses via varied Kuvera World choices, Investview rebooted it once more as iGenius.

In a perfect world Joseph Cammarata’s arrest would immediate a regulatory investigation into Investview’s iGenius NDAU token securities fraud.

Given the secrecy of lively regulatory investigations within the US, BehindMLM can neither verify or deny such an investigation exists.

Wanting ahead, there’s no dispute Alpha Plus Get well wasn’t an MLM firm and, exterior of Cammarata heading up each corporations, wasn’t tied to Investview.

That stated, I’ve a sense Cammarata’s instances may come up ought to the SEC pursue motion associated to Investview and iGenius.

I gained’t be reporting on Cammarata’s case as in depth as BehindMLM usually follows regulatory instances. For the aim of report retaining although, we’ll nonetheless preserve you posted on any vital developments.

Replace 18th January 2022 – Cammarata has plead not responsible on all counts. He was launched on December twenty ninth.

A trial has been scheduled for October seventeenth, 2022.

Replace 14th February 2022 – Cammarata’s SEC case has been stayed pending the end result of his legal case.

In a movement requesting the keep filed on January twenty fourth, the DOJ acknowledged

decision of the Felony Actions will resolve most (if

not all) of the claims asserted in opposition to the defendants within the Civil Motion.

The movement was granted later the identical day.

Replace 14th March 2022 – Joseph Cammarata was caught attempting to flee the US.

Consequently Cammarata’s bail was revoked and he’s been despatched again to jail.

Replace eighth November 2022 – Joseph Cammarata was discovered responsible on eight superseding indictment depend on October twenty seventh.