The order, issued on November 16th, 2023, prohibits promotion of GSPartners’ “MetaCertificates” unregistered securities offering.

Specific breaches of British Columbia law cited by the BCSC included:

- illegal distribution of securities;

- illegal trading of securities;

- prohibited representations; and

- fraud

In addition to GSPartners and parent company GSB Gold Standard Corporation, the order also pertains to promoters Haidy Nitsa Nakos, Tanya Sue Cloete and James Bruce Gardiner.

BCSC notes that after the temporary order was issued, a hearing was held on November 29th to determine whether it should be extended.

Based on evidence presented by BCSC’s Executive Director, demonstrating “prima facie evidence” of fraud, the GSPartners temporary order was extended for “up to one year” on November 30th, 2023.

On April 4th the BCSC published reasons for the ruling.

The document provides insight into the BCSC’s investigation into GSPartners, GSB Gold Standard Corporation and owner Josip Heit.

The executive director tendered extensive evidence by way of three affidavits of a Commission intelligence analyst to show possible contraventions of the Act.

Those affidavits exhibited lengthy slide decks and made reference to a number of videos and photos posted to YouTube, Facebook and Instagram pages evidencing presentations and representations made by promoters of the MetaCertificates and blockfolios to investors and prospective investors.

Specific fo Cloete and Gardiner;

Cloete and Gardiner run what they call the “Team Olympus Facebook Group”.

Team Olympus has its own YouTube channel. In a video hosted by Cloete and Gardiner in March 2023 titled “Top 5 Most Asked Questions on GSPartners” posted to that channel, Cloete states that a 4.15% weekly return is possible through a compounding of all the investments being made.

Gardiner states that an amount loaded to the certificate is being traded by SkyGround traders. He says quarterly revenue of up to 18% is earned on that loaded amount.

Cloete and Gardiner hosted an event at the Pinnacle Hotel in Vancouver on April 16, 2023.

In a video posted by Cloete advertising the event in advance, she says that all someone has to do to earn passive income is to “INVITE, INVITE”.

Separate posts to Facebook show Cloete and Gardiner making presentations at the event. A subsequent video by Cloete and Gardiner said 400 people attended the session at the Pinnacle Hotel.

The BCSC notes that following it adding GSPartners to its Investment Caution List on May 30th, 2023, in July 2023

Cloete posted to the Team Olympus Facebook Group stating in part:

• “Lydian World has paid out a total of 11.5 million USDT in value to its Citizenships – Get Your NFT Passports now and begin building your wealth.”

• “As suggested on our leadership call – I encourage you all to go to your social media platforms and search 4.15% archived stories, lives, posts, and DELETE! DELETE! DELETE ALL THOSE OLD POSTS to remain compliant.”

Notwithstanding urging investors to delete information to “remain compliant”, Cloete and Gardiner continued to promote MetaCertificates.

In August 2023 on the Team Olympus YouTube channel, a video was posted titled “Testimonials – Meet everyday people who have changed their lives!”

In the video, Cloete states that Team Olympus has close to 700 people and it is “part of an ecosystem that has well over a million users”.

Gardiner states that the ecosystem is just “shy of three years old” and that in four months they are “slated to be valued as a billion dollar company”.

In two videos in October 2023, well after the cautions were issued by the securities regulators and after losses had been suffered, Cloete is seen promoting MetaCertificates.

In one, she is promoting a new series of MetaCertificates called the “Success Series”.

She states in part: “RECEIVE 7X On Original Exchange After 18th [sic] Months! 6X if you withdraw & load other certificates!”

In the other video titled “THE POWER OF COMPOUNDING ON SUCCESS SERIES”, she states that it is a good idea to do a “full compound”.

And specific to the BCSC’s collected evidence against Nitsa Nakos;

In a YouTube video posted by Nakos in April 2023, she describes herself as one of six individuals who founded GSPartners.

She says she was a member of the GSB executive council and the first to reach the rank of “Crown Ambassador”. She also describes herself as a “7 Figure Per Year Earner”.

She describes how promoters earn not only commissions on the sales they make but also from the people downstream that they refer to the network.

The number of people promoters have downstream determines their level within the network.

Also in that video, Nakos claims “This team has never lost a penny for any clients and have never had a month in the red, but anything can happen in a market.”

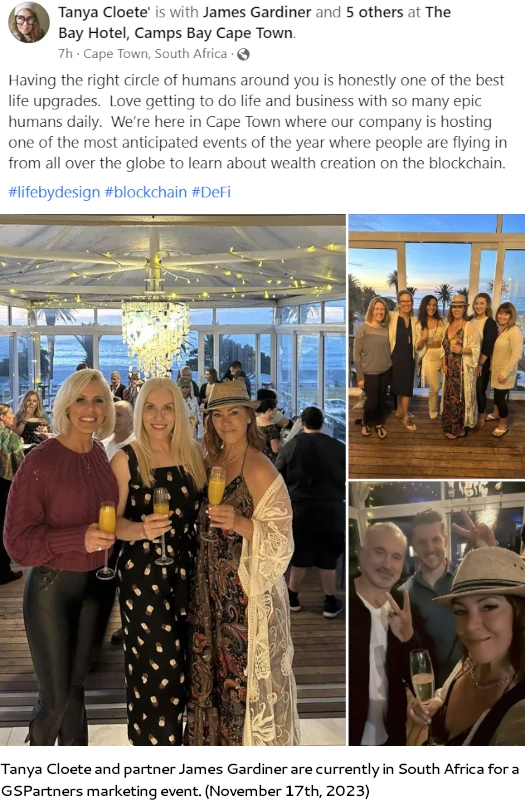

GSPartners’ October 2023 Cape Town, South Africa promotional event was cited as evidence of defying the previously issued temporary order.

On November 18, 2023, two days after the Temporary Order was issued, GSPartners hosted a conference for investors in Cape Town, South Africa.

Nakos, Cloete and Gardiner were there.

A Facebook post by Cloete said that 5,000 people were at the conference. It featured multiple speakers, product launches and recognition sessions.

Nakos gave a speech where she said in part that many who are part of her team had “10x’d their income” and then she asked, “who can do that out in the outside world in the corporate world? Who can 10x their income?”

Also in Cape Town on November 17, 2023, there was an “Ambassador” party attended by the highest earners.

Cloete posted photos to her Facebook profile showing her, Nakos and Gardiner at the party.

On November 19, Cloete and Gardiner hosted a yacht party. Nakos also hosted breakout training sessions during this period.

Anticipating Cloete, Gardiner and Nakos feigning ignorance as to the temporary order, BCSC writes;

It is evident that Nakos, Cloete and Gardiner knew about the Temporary Order.

On or about November 24, 2023, Gardiner was recorded in a video posted by Cloete to the Team Olympus Telegram channel called “Team Olympus Broadcast” where Gardiner and Cloete were informing viewers about an upcoming GSPartners corporate call.

Gardiner is heard saying in part:

A lot going on. There’s been a coordinated effort by the commissions, by the regulators across the world to kind of slow the role of GSP.

So much so that yes, Tanya and myself alongside Nitsa Nakos in BC, so we, the three of us have a cease and desist order meaning we are being investigated for selling securities.

Also in that video, Cloete states in part:

There is also an announcement that we want to share with you which pertains specifically to James and myself and Nitsa Nakos.

We want to make sure that everybody is informed on protocol, communication etc. And then of course, we’re going to be going through tomorrow on the corporate call the exciting offerings regarding Lydian World, Lydian Lions, the offering on the promotion that’s been extended, along with the BOOST…

BCSC notes that while collected evidence is produced in its reasoning document, that it is only

a sampling of that adduced by the executive director.

There is much more evidence demonstrating the promotion of MetaCertificates by GSPartners, Nakos, Cloete and Gardiner.

Additional evidence was tendered by the BCSC Executive Director, establishing that GSPartners, Cloete, Gardiner and Nakos have “ever been registered under the Act or with any Canadian securities regulators”.

GSPartners and GSB Gold Standard Corporation had also never “filed a preliminary prospectus, offering memorandum or report of exempt distribution under the Act”.

The executive director also submitted that an extension of the Temporary Order is necessary and in the public interest as the Subjects pose an immediate risk to investors through their continued operation in the markets.

The executive director pointed to evidence showing that the Subjects are continuing to promote GSPartners.

For example, the Cape Town events took place after the Temporary Order was issued, and Cloete continued to make posts after the Cape Town events.

The executive director submitted that the seriousness of the alleged contraventions is a consideration, since fraud is the most serious misconduct under the Act.

The executive director also submitted that statements made by GSPartners establish that there may be hundreds of investors who have invested millions of dollars.

The recent withholding of returns may be an indication that the suspected fraudulent scheme is about to collapse.

GSPartners did go on to collapse in December 2023. Following a failed GSPro reboot, investor victims are now being strung along with unsubstantiated claims of settlements with US regulators.

The executive director submitted that the integrity of the markets will be harmed and there will be a significant loss of public confidence in the system if the Subjects are allowed to continue to perpetrate their scheme.

The executive director also pointed to the specific nature of the Temporary Order and the fact that he is only seeking an extension for at most one year.

He submitted that the extension is necessary because of the risk of future harm to investors posed by the Subjects’ continued

conduct.

Based on the submitted evidence and no response from GSPartners, GSB Gold Standard Corporation, Cloete, Gardiner and Nakos, it was concluded:

- “GSPartners’ MetaCertificates are investment contracts and therefore securities”

- “there is prima facie evidence that [GSPartners and GSB Gold Standard Corporation] have illegally distributed MetaCertficiates”

- “none of GSPartners, Nakos, Cloete or Gardinare is registered under the Act”

- “there is prima facie evidence to establish that each of GSPartners, Nakos, Cloete and Gardiner acted in furtherance of the sale of MetaCertficiates and therefore was engaged in unregistered trading, contrary to … the Act”

- “GSPartners Nakos, Cloete and Gardiner contravened … the Act by making statements about the returns on MetaCertificates that are likely false and misleading, given that the advertised returns are likely impossible to achieve through legal means”

- “there is prima facie evidence showing many of the typical indicia of fraud surrounding the promotion of the MetaCertificates”

BCSC also concluded submitted evidence suggested GSPartners was running a Ponzi scheme.

We do agree with the executive director … that the implementation itself of the MPS suggests GSPartners are operating a Ponzi scheme.

The MPS allows GSPartners to withhold returns. At the same time, promoters are continuing to solicit new investment.

This indicates that GSPartners likely requires a continued stream of new investment in order to pay existing investors their promised returns.

As was noted by the executive director, the conclusion that GSPartners is operating a Ponzi scheme is also supported by the claims of unreasonably high and consistent returns of the MetaCertificates, the referral network structure, and the unreasonably high commissions paid to promoters.

MPS refers to “Market Protection Strategy“, a withdrawal fee scheme GSPartners came up with after disabling weekly returns in the lead up to its collapse.

We find that there is prima facie evidence of both the actus reus and the mens rea necessary to establish that GSPartners has committed fraud, contrary to section 57(2) of the Act.

We find that there is sufficient prima facie evidence that each of Nakos, Cloete and Gardiner has engaged in conduct that they know or reasonably should know is contributing to the fraud perpetrated by GSPartners, contrary to section 57(1) of the Act.

We have before us clear and ample evidence of conduct which, on a prima facie basis, establishes illegal distribution, unregistered trading, prohibited representations and fraud.

Finding submitted evidence “established ongoing efforts by GSPartners, Nakos, Cloete and Gardiner to promote trading of MetaCertificates” and “the promoters have indicated an intention to continue their promotional activities even in the face of regulatory actions”, BCSC concluded;

It is essential to clearly signal to investors that they should stop investing in MetaCertificates.

Without the regulatory intervention that a temporary order represents, the promoters might be able to continue to entice new investors.

Many investors could be harmed in the time required to investigate the alleged misconduct and to hold a hearing.

The allegations of misconduct include fraud, which is among the most serious contraventions of the Act.

The pattern of misconduct has been repeated on several occasions over at least several months.

It appears from comments made by the promoters that there may be thousands of investors who have collectively invested millions of dollars.

There is prima facie evidence that many of the investors reside in British Columbia. The amount that investors stand to lose is very significant.

We find there is an ongoing and significant risk to the public.

We therefore conclude that it is necessary to extend the Temporary Order in order to prevent likely future harm.

BCSC’s temporary order was ordered extended through “November 29th, 2024, or until a hearing is held and a decision rendered in the matter”.

It should be noted that the BCSC’s investigation and subsequent securities fraud order is part of a “coordinated U.S.-Canada enforcement action”.

Despite representations from GSPartners corporate and promoters, the only regulator GSPartners is known to have responded to is Arizona.

A hearing on the Arizona Corporation Commissions’ GSPartners securities fraud cease and desist is scheduled for September 16th, 2024.

There is no known other instances of GSPartners requesting a hearing in regulatory proceedings against it, much the less being involved in settlement proceedings with any regulator.