On GSPartners’ web site and of their advertising and marketing materials Gold Commonplace Financial institution is represented as holding a banking license in Mwali.

If you happen to’ve by no means heard of Mwali, you’re not alone. It’s a tiny island off the jap coast of Africa.

Mwali, often known as Mohéli, is a part of the Union of the Comoros. The Union of the Comoros is regulated by the Central Financial institution of Comoros.

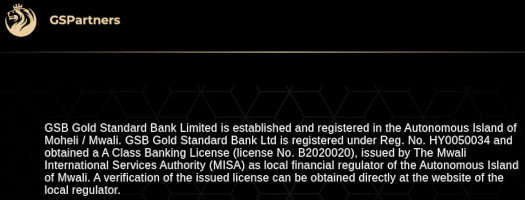

As per GSPartners’ web site phrases and situations;

GSB Gold Commonplace Financial institution Restricted is established and registered within the Autonomous Island of Moheli / Mwali.

GSB Gold Commonplace Financial institution Ltd is registered below Reg. No. HY0050034 and obtained a A Class Banking License (license No. B2020020), issued by The Mwali Worldwide Providers Authority (MISA) as native monetary regulator of the Autonomous Island of Mwali.

This banking license has featured prominently in GSPartners’ advertising and marketing;

The youngest member of the group of firms, GSB Gold Commonplace Financial institution Restricted, with an A-Financial institution licence, banking licence quantity: B2020020, IBC Register: HY0050034, Mohéli, (in banking phrases, a banking licence is the official licence to function a credit score establishment), shall be accountable from 15 October 2020 for consulting, help (help) and itemizing of the assorted trade platforms for G999 blockchain, and this additionally concurrently for the all-round matter of G999 blockchain, staking and telecommunications.

What that is basically stating, is that GSPartners’ makes use of its GSB Gold Commonplace Banking Restricted license for cash laundering.

Particularly, to launder funds into and out of its G999 Ponzi scheme.

To legitimize its Mwali banking license declare, GSPartners factors to “the web site of the native regulator.”

This solely web site GSB Gold Commonplace Banking’s license is referenced is”Mwali Worldwide Providers Authority”.

Positive sufficient, GSB Gold Commonplace Financial institution seems on Mwali Worldwide Service Authority’s “registrar of firms”:

Observe nonetheless that the license quantity (B2020029), differs to what’s quoted by GSPartners on their web site (B2020020).

Additionally observe that Mwali Worldwide Providers Authority isn’t a authorities web site. It operates from a privately registered “.COM” area, hosted on GoDaddy.

If one clicks by to the “contact” part of Mwali Worldwide Providers Authority’s web site, the next textual content seems:

The unique licensed registered agent of the Mwali (Moheli) Worldwide Providers Authority is Moheli Company Service Ltd.

On their web site, Moheli Company Service claims to be a

a specialist firm formation agent.

We’re situated in Moheli, an autonomous island within the Union of the Comoros and we keep a European consultant workplace in Marsa, Malta.

Mainly that is the place you go if you need a shell firm incorporation in Mwali.

One of many providers supplied by Moheli Company Service is an “worldwide banking license”.

The autonomous Comoran island state of Moheli handed its Offshore Banking Act in 2001 and at present has greater than eighty registered establishments.

The Mwali Worldwide Providers Authority (MISA) is devoted to offering as a lot enterprise freedom and suppleness as attainable, together with robust statutory confidentiality for professional offshore banking shoppers, while sustaining a powerful compliance tradition in anti-money-laundering and anti-terrorist financing issues.

The result’s that neither Moheli nor the Comoros have ever been topic to the censure, scandal and worldwide blacklisting which have plagued much less well-regulated jurisdictions over current years.

Mwali banking licenses by Moheli Company Providers price €2500 EUR to use, after which €25,000 EUR yearly for a “normal license”.

So Josip Heit paid Moheli Company Service for a Mwali financial institution license and bing-badda-boom. Proper?

Nicely for starters, Moheli Company Service’s rosy portrayal of Mwali’s non-existent regulatory points is patently false.

As per an advisory issued by the Central Financial institution in 2014, it doesn’t challenge banking licenses for offshore banking actions.

The acknowledged motive for the ban is an try and fight “criminality”. Clearly that hasn’t been as efficient because the Central Financial institution might need hoped.

By promoting banking licenses that don’t exist, Moheli Company Service is a part of the issue. Which places their regulatory claims into context.

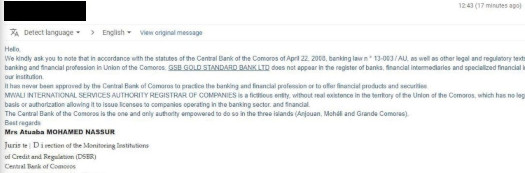

In an try and suss out what precisely is happening right here, a BehindMLM reader reached out to the Central Financial institution of Comoros.

When requested level clean about GSB Gold Commonplace Financial institution and their Moheli Company Service banking license, a consultant from the Central Financial institution acknowledged (related quoted textual content under);

GSB Gold Commonplace Financial institution LTD doesn’t seem within the register of banks, monetary intermediaries and specialised monetary instutions held with our establishment.

It has by no means been permitted by the Central Financial institution of Comoros to apply the banking and monetary career or to supply monetary merchandise and securities.

Mwali Worldwide Providers Authority Register of Corporations is a fictitious entity, with none actual existence within the territory of the Union of the Comoros.

(It) has no legitimacy, no authorized foundation or authorization permitting it to challenge licenses to firms working within the banking sector and monetary.

The Central Financial institution of Comoros is the one and solely authority empowered to take action within the three islands (Anjouan, Moheli and Grande Comores).

So there you could have it. GSB Gold Commonplace Financial institution’s Mwali banking license doesn’t exist. It’s yet one more layer of lies in Heit’s GSPartners Ponzi scheme.

With that out of the way in which, one query does come to thoughts:

Why doesn’t the Central Financial institution take motion with GoDaddy to get Moheli Company Service’s web site taken down?

I in fact can’t reply that.

With GSPartners working a Ponzi scheme primarily focusing on US traders although, maybe that’s one thing the Central Financial institution of Comoros may need to look into.

Secondary considerations can be third-party retailers in Dubai and elsewhere, being tricked into doing enterprise with Josip Heit based mostly on GSPartners’ non-existent banking license.