A fast search via YouTube nonetheless, returns loads of movies citing “Joshua Nicholas Gregg” as EmpiresX’s Grasp Dealer.

Supposedly, Gregg, typically credited as simply Joshua Greg/Gregg or Josh Greg/Gregg, works for Goldman Sachs in New York.

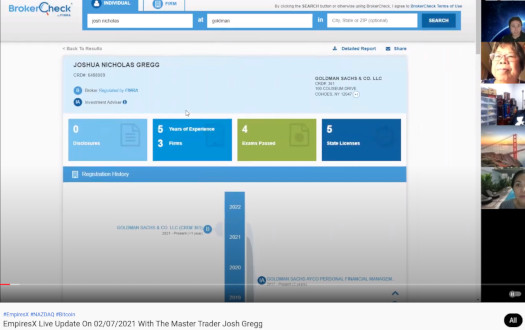

In an EmpiresX webinar held earlier this month, Joshua pulled up the FINRA BrokerCheck web page for Joshua Nicholas Gregg:

You’ll be able to pull up the similar report right here and, positive sufficient, Joshua Nicholas Gregg does certainly work for Goldman Sachs.

Only one drawback although, so far as I can inform EmpiresX’s Joshua isn’t Joshua Nicholas Gregg.

As a complement to the essential report linked above, right here’s a extra detailed FINRA report for Joshua Nicholas Gregg.

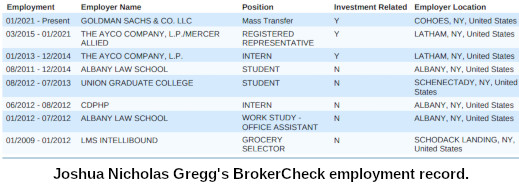

If we scroll all the way down to web page 7, we discover Gregg’s employment historical past.

Based mostly on Gregg’s time as a pupil at Albany Legislation College and Union Graduate School, he seems to be primarily based out of New York.

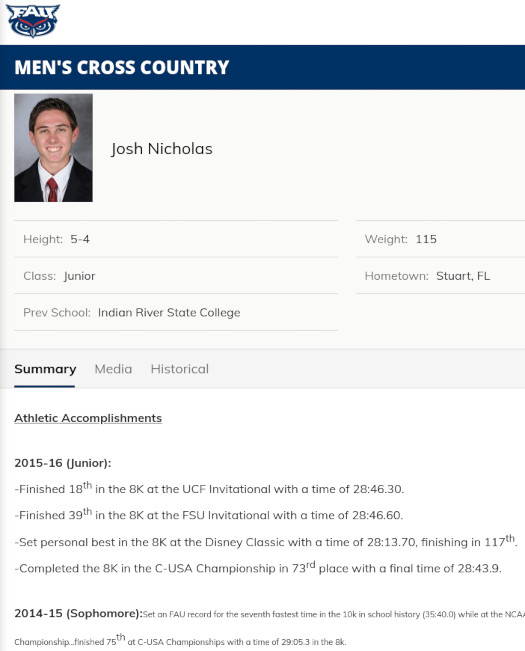

Meet Josh Nicholas, who in 2014 was a Sophomore at Florida Atlantic College (FAU).

Look acquainted?

Within the “private” part of Nicholas’ bio, it’s revealed he’s an accounting main, trades equities as a pastime and “hopes to change into a Chief Monetary Officer”.

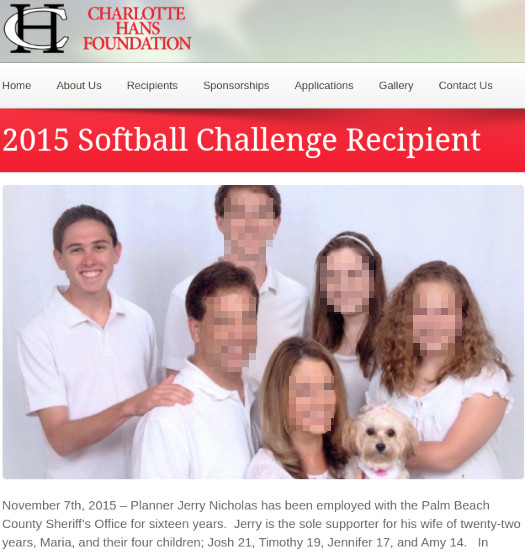

In 2015 Josh’s father, Jerry Nicholas, was the recipient of the Charlotte Hans Basis’s Softball Problem.

Jerry Nicholas is credited as an worker of the Palm Seashore County Sheriff’s Workplace, once more in Florida.

On the time, Jerry was additionally

the only real supporter for his spouse of twenty-two years … and their 4 kids; Josh 21 …

If we return to Joshua Nicholas Gregg’s FINRA report, in 2015 he was working with The Ayco Firm, an Funding Advisor Agency primarily based out of New York.

Extra importantly, Gregg attended Albany Legislation College from 2011 to 2014. He graduated and was admitted as an legal professional in New York in 2015.

These two males clearly don’t look like the identical individual.

Maybe the ultimate nail within the coffin is the NFA’s Enterprise Conduct Committee (BCC), taking motion in opposition to Joshua David Nicholas and his agency JDN Capital LLC.

JDN Capital seems to be the end result of Josh Nicholas’ aspirations as a pupil at FAU.

As per the BCC’s December 2020 criticism;

From October 10, 2018 to November 16, 2020, JDN Capital was a member of NFA.

JDN Capital is positioned in Stuart, Florida. JDN Capital was registered with the CFTC as a commodity buying and selling advisor from October 9, 2018 to November 16, 2020, when the agency withdrew its CFTC registration and NFA membership statuses.

Nicholas is the only real proprietor of JDN Capital.

As varied occasions between August 2016 and Could 2017, Nicholas was an AP of Fortune Buying and selling Group LLC, a agency completely barred from NFA membership for gross sales apply fraud and abusive buying and selling practices.

As a CTA, JDN Capital supplied one buying and selling program, known as the Inexperienced Leaf Buying and selling Program.

In 2019 and 2020, JDN Capital’s managed account clients buying and selling the Inexperienced Leaf Buying and selling Program suffered vital losses, and JDN Capital ceased buying and selling the client’s accounts.

On August 26, 2020, one among JDN Capital’s former managed account clients telephoned NFA’s Info Middle and reported that he and his spouse had entered right into a promissory observe with JDN Capital and Nicholas for an “unregulated safety.”

Mr Doe defined that he and his spouse had been receiving curiosity funds from JDN Capital, however they’d not obtained month-to-month statements from Nicholas or heard from him over the previous two weeks.

Mr. Doe additionally talked about that he was rising suspicious of Nicholas and the promissory observe settlement with JDN Capital.

Mr Doe’s name prompted NFA to start an investigation regarding JDN Capital and Nicholas’ coping with Mr. and Mrs. Doe.

Info obtained by the NFA revealed

- JDN Capital had no energetic buyer accounts since March 2020; and

- JDN Capital had misplaced $2 million for the Does, sending their account right into a debt of “roughly $250,000”.

An interview with the Does’ legal professional revealed;

Nicholas had traveled to Mr. and Mrs. Doe’s residence in North Carolina and promoted the promissory observe as a solution to make up for among the futures buying and selling losses they’d sustained in February 2020.

In line with the legal professional, Nicholas beneficial that Mrs. Doe make investments the belongings of a household belief established for the advantage of Mrs. Doe and her disabled grownup sister … in an funding technique that Nicholas claimed would assure revenue of at the very least 17% yearly.

In early Could, Mrs. Doe loaned $300,000 from (the household belief) to JDN Capital.

In return, Mrs. Doe obtained a promissory observe dated April 30, 2020, during which JDN Capital promised to repay the principal of $300,000 to Mrs. Doe’s Household Belief, along with annual curiosity of 17%, with the ultimate fee to be made on Could 1, 2021.

Nicholas offered the Does with a June 2020 exercise assertion from a “well-known funding agency”.

The exercise assertion was closely redacted to hide the account worth, details about any money exercise within the account, and nearly all data in regards to the investments.

Nonetheless, unredacted parts of the assertion confirmed dividends of just about $90,000 (year-to-date) and a 12.82% return for June.

NFA eliminated the redactions that obscured parts of the exercise assertion and seen vital discrepancies within the underlying assertion.

For instance, sure columns within the assertion didn’t sum up correctly, and inventory symbols didn’t match the listed securities.

These statements raised questions in regards to the assertion’s legitimacy and, due to this fact, NFA contacted the funding agency.

The funding agency knowledgeable NFA that the account quantity didn’t correspond to any account on the agency and confirmed that it had no accounts within the identify of JDN capital and none within the identify of, or managed by, Nicholas.

NFA subsequently requested Nicholas to supply the identify and make contact with data for the account consultant on the funding agency; nonetheless, Nicholas failed to supply the requested data.

As a part of its investigation, NFA additionally spoke to Mr. and Mrs. Doe.

Through the name, the Does indicated that Nicholas had repeatedly informed them earlier than they entered into the mortgage that they may receive a return of the principal at any time.

Nonetheless, when Mrs. Doe requested a return of the principal on July 17, 2020, Nicholas denied her request.

On August 3, Mrs. Doe once more sought to terminate the promissory observe, however Nicholas by no means responded to Mrs. Doe.

Different data obtained by the NFA reveal;

Nicholas had an open private buying and selling account at a Member FCM.

Information that FCM A offered to NFA for Nicholas’ private buying and selling account revealed that Nicholas had traded within the account at varied occasions commencing in April 2018 and engaged in futures buying and selling when JDN Capital was energetic as a CTA.

Between April 2018 and April 2020, Nicholas deposited roughly $80,000 into the account and withdrew over $40,000.

As of April 30, 2020, the account stability had declined to roughly $2300 as a result of buying and selling losses.

Extra importantly, Nicholas’ account assertion confirmed that in early Could – quickly after JDN Capital obtained the mortgage proceeds from Mrs. Doe’s Household Belief – Nicholas made 4 deposits that totaled $225,000 to his buying and selling account at FCM A.

The entire deposits got here from Nicholas’ private checking account.

The NFA suspected Nicholas deposited funds loaned to him by Mrs. Doe into his private buying and selling account.

Nicholas would go on to fail to supply the NFA with a replica of the promissory observe he offered Mrs. Doe.

He additionally failed to supply proof to again up a declare that the mortgage proceeds had been used to ‘make investments in “securities and laborious belongings” within the identify of JDN Capital, not Mrs. Doe’s Household Belief.’

Nicholas informed the NFA he wouldn’t present them with any account statements to confirm what occurred to the mortgage proceeds, as a result of he didn’t need them to “steal his technique”.

The NFA requested Nicholas present JDN Capital checking account statements, which he failed to supply.

NFA additionally requested Nicholas to clarify the supply of the $225,000 in deposits to his private buying and selling account at FCM A to substantiate that JDN Capital and Nicholas had not misused the mortgage proceeds, opposite to the phrases of the promissory observe.

In response, Nicholas claimed the deposits to his account at FCM A consisted of belongings from his private financial savings, together with money and funds from his cash market and cryptocurrency accounts.

NFA requested Nicholas to supply his private financial institution statements to show the supply of those funds, in addition to different documentation to substantiate his representations.

Nonetheless, Nicholas failed to supply these paperwork to NFA.

The reference of “promissory notes” in a name lead the NFA to consider Nicholas had

entered into promissory notes with different lenders.

Nonetheless, when NFA tried to query him additional on the problem, Nicholas refused to substantiate whether or not JDN Capital and he had entered into different promissory notes.

Along with not offering the NFA with requested paperwork, Nicholas additionally lied to the NFA.

Nicholas willfully offered deceptive data (to the) NFA.

For instance, throughout the September 4th name, Nicholas claimed that he didn’t start buying and selling in his private account at FCM A till after JDN Capital’s managed accounts closed.

Nonetheless, as alleged above, Nicholas was actively buying and selling in his private account whereas JDN Capital was working as a CTA.

Nicholas additionally claimed throughout the name that he was nonetheless employed by the FINRA member agency as a registered consultant, although FINRA’s BrokerCheck system confirmed that Nicholas’ employment with the FINRA member agency had ended on July thirty first, 2020.

If we carry up Joshua David Nicholas’ BrokerCheck report, we will affirm the expelled agency referenced by the NFA, and Nicholas leaving Merril Lynch on July thirty first, 2020.

We are able to additionally affirm Nicholas’ educational historical past at FAU on web page 5.

Lengthy story quick, Nicholas repaid the misappropriated $300,000 from his private buying and selling account.

Nicholas deregistered himself and JDN Capital from the NFA in November 2002, simply previous to the BCC’s December 2020 criticism.

Nicholas and JDN Capital settled the BCC’s criticism in April 2021.

As per the settlement;

- JDN Capital won’t apply for NFA membership “at any time sooner or later”;

- Nicholas is barred from making use of for NFA membership for 8 years;

- Nicholas pays a $125,000 high quality if he applies for NFA membership after the eight-year ban; and

- Nicholas agreed “to not act or change into a principal of an NFA member at any time sooner or later.

In abstract;

We’ve Joshua David Nicholas, aka Josh Nicholas, a deregistered NFA member and resident of Florida, impersonating Joshua Nicholas Gregg, a present NFA member and resident of New York.

After settling his NFA fraud criticism, during which it was revealed he misplaced tons of cash buying and selling, Joshua David Nicholas now fronts EmpiresX as a “Grasp Dealer”.

EmpiresX being an MLM Ponzi scheme co-founded by Emerson Pires, additionally a resident of Florida, and Flávio Gonçalves, who just lately fled to Dubai, the MLM rip-off capital of the world.

Oh I’m positive that is gonna go down effectively.

Replace third August 2021 – This text initially had two YouTube video hyperlinks; one to an EmpiresX webinar during which Joshua Nicholas falsely claimed to be Joshua Gregg, and the opposite to a video during which Flávio Gonçalves revealed he had fled to Dubai.

As on the time of this replace YouTube has eliminated each movies citing TOS violations. As such I’ve eliminated the beforehand accessible hyperlinks.