The Massachusetts Securities Division has issued a securities fraud stop and desist towards CryptoBit and considered one of its executives.

Barrows is a 62-year-old resident of Florida whose harmless look belies her true nature, permitting her to persuade buyers to belief her earlier than she accepts their investments with no intent to return their cash.

Barrows solicited investments in unregistered securities on behalf of a number of false firms that assured buyers income by using propriety buying and selling software program that purportedly might by no means fail.

“Buying and selling software program” has turn into to the go-to ruse of selection for MLM cryptocurrency scams.

Barrows, a sixty-two Florida resident, personally promoted NexusOne on-line to “dozens of buyers”.

NexusOne is the now defunct predecessor to CryptoBit.

Barrows solicited funding on behalf of NexusOne and CryptoBit by means of an entity she arrange referred to as E-Vest Miners.

After receiving these funds, Barrows bought anonymously held belongings in an try to hide the cash she stole from dozens of buyers within the Commonwealth and a minimum of 5 different states.

Barrows’ scheme got here undone after she stole $20,000 from a Massachusetts resident, who in late December 2018 filed a criticism with the state’s Securities Division.

Upon receiving the $20,000, Barrows set about laundering the cash by means of Guillermo Cortes Florez, who goes by “guillermex” on the “localbitcoins.com” web site, and Monarch Metals Brokers.

Subpoenas served on each events revealed

that Barrows is a part of a a lot bigger community of scams that span the globe.

The rip-off community, by means of which Barrows defrauded a minimum of one Massachusetts investor, entails dozens of people and corporations and tens of tens of millions of {dollars} stolen from buyers across the nation.

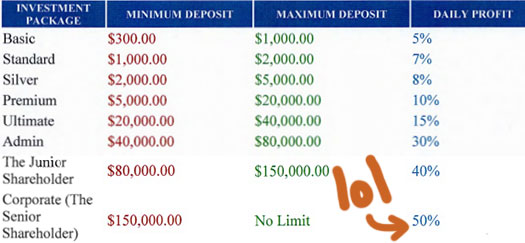

Earlier than it collapsed and was relaunched as CryptoBit, Nexus One billed itself as an “auto dealer” cryptocurrency funding alternative.

Traders dumped $300 or extra into the scheme, sat again and picked up a passive return, purportedly generated by way of cryptocurrency buying and selling.

The Massachusetts sufferer invested in early 2018. A while later Nexus One went beneath and CryptoBit appeared.

CryptoBit’s web site remains to be on-line at “cryptobitmarkets.biz”, nevertheless the “our options part” of the location has been disabled.

NexusOne started demanding further funds from its buyers on or round September tenth, 2018.

On September thirteenth the scheme collapsed and pulled its web site offline.

On September seventeenth an e mail was despatched out to NexusOne buyers informing them of the CryptoBit reboot.

NexusOne backoffice balances had been carried over to CryptoBit, nevertheless the corporate demanded a $3800 withdrawal payment.

As soon as the “firm” receives the funds, the fraudsters peddle each conceivable excuse as to why the sufferer can not withdraw funds, regardless of the huge income exhibiting within the account.

The scammers preserve this facade simply lengthy sufficient to make sure the cash is tough to hint after which go silent – taking all hope of recovering the cash with them.

After months of conversations and makes an attempt to withdraw his principal funding and income, Massachusetts Sufferer was not in a position to get better any funds.

So far, Massachusetts Sufferer has obtained no funding income and has not recovered any of his principal.

As famous by the Sec Div;

A search of the Securities and Alternate Fee’s (“SEC”) EDGAR database didn’t reveal a single submitting by Nexus One or CryptoBit.

A search of the Division’s Company Finance database didn’t reveal a single submitting by Nexus One or CryptoBit.

Neither Nexus One nor CryptoBit securities or choices are registered with the Division or the SEC

The Sec Div’s July tenth criticism alleges securities fraud associated violations of Massachusetts Normal Legal guidelines.

Part 301 of the Act gives:

It’s illegal for any particular person to supply or promote any safety within the commonwealth except:

(1) the safety is registered beneath this chapter;

(2) the safety or transaction is exempted beneath part 402; or

(3) the safety is a federal lined safety.

The criticism points Susan Barrows with a stop and desist and requires her to

- present an accounting for these losses attributable to the alleged wrongdoing;

- present an accounting for these losses attributable to the alleged wrongdoing; and

- disgorge all income and different direct or oblique remuneration obtained from the alleged wrongdoing.

An administrative high quality has additionally been sought.

After making contact with Barrows in April 2019, it was agreed she would give testimony by way of video teleconference on Could thirty first, 2019.

April twenty third was the final date the Sec Div had any contact with Barrows.

It seems she’s since gone underground, together with no matter she managed to steal by means of NexusOne and CryptoBit.

Contemplating the Masachusetts Sec Div have recognized CryptoBit and Barrows as being half of a bigger scheme involving ‘dozens of people and corporations and tens of tens of millions of {dollars} stolen‘, you’d hope the SEC are investigating on the federal degree.

So far nevertheless the SEC has didn’t take motion towards a single MLM cryptocurrency scheme.

N.B. BehindMLM has beforehand reviewed My CryptoBit and CryptoBit Commerce.

Whereas together with CryptoBit all three schemes are fraudulent, I can’t say for positive but it surely seems there’s no connection between them.