Following unsuccessful mediation proceedings, the CFTC has moved for abstract judgment in opposition to Alan Friedland.

Defendant Alan Friedland, by and thru two entities he managed, Fintech and Compcoin LLC, falsely and misleadingly solicited prospects to supply funds, understanding that they may not ship what they promised in return.

Friedland and his entities marketed and offered a digital asset he created referred to as Compcoin to prospects by telling them that in the event that they purchased Compcoin, they might have entry to a completely developed, refined algorithmic overseas change (“foreign exchange”) buying and selling program referred to as ART, created and maintained by a licensed Commodity Buying and selling Advisor (“CTA”). The Defendants misled prospects as to the income they might acquire in buying and selling with ART.

And, as Friedland and his entities knew, they may not lawfully present Compcoin purchasers entry to ART as a result of they didn’t have the mandatory approval from the related self-regulatory group, the Nationwide Futures Affiliation (“NFA”), to solicit and settle for funds from prospects to commerce foreign exchange.

They by no means obtained such approval, prospects by no means obtained ART, and Compcoin is now a worthless asset.

Owing to there being “no real difficulty of those materials info”, the CFTC places forth it’s “entitled to judgment”.

The CFTC accuse Friedland of stealing between $1.6 to $1.7 million by CompCoin.

If granted, abstract judgment will see Friedland up for disgorgement and extra monetary penalties.

The CFTC’s movement was filed on July ninth. As of but there was no response filed.

Again in April Friedland downplayed the CFTC’s lawsuit, claiming the regulator had “botched this up very, very badly”.

We’ll proceed to watch the case docket for updates.

After ART flopped, Friedland rebooted the rip-off with NRGY.

On info and perception, a major variety of CompCoin victims had been funneled into NRGY – on the identical promise of passive income.

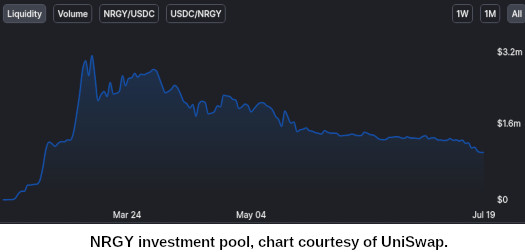

Following the preliminary pump in March, NRGY has continued to say no.

Funding into NRGY dipped under $1 million on July 18th.

Whether or not US authorities take additional motion in opposition to Friedland relating to NRGY stays to be seen.

Replace nineteenth December 2021 – The CFTC has been denied abstract judgment and Friedland.

Replace sixth February 2022 – Friedland’s jury trial kicked off on January thirty first. Day 4 of the trial was held on Thursday February third.

On day 4 of his trial, Friedland settled with the CFTC.