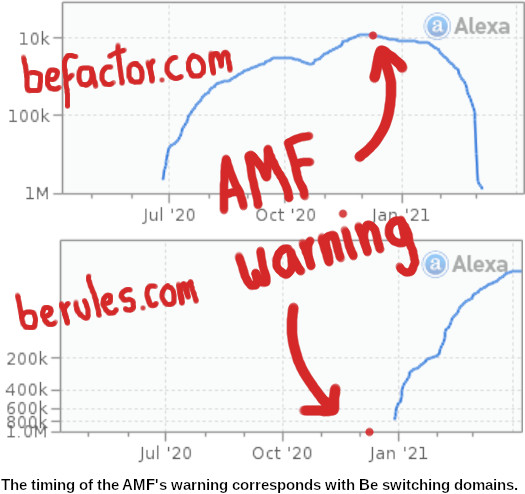

On the time I famous Be had modified their web site area from “befactor.com” to “berules.com”.

Contemplating the Be reboot of Melius was not that previous itself, I flagged this as a wierd.

MLM firms don’t change their web site area on a whim.

For all my poking round although, I couldn’t work out why Be abruptly modified their web site area.

Right now that thriller was solved.

Again on December 2nd, Quebec’s Autorite Des Marches Financiers issued a fraud warning towards BeFactor.

As per the AMF’s warning,

BE Issue just isn’t registered with the AMF in any capability in anyway and is subsequently not approved to behave as a securities or derivatives seller or adviser in Québec.

BE Issue relies in Dubai, United Arab Emirates. It isn’t registered with Firms Canada or the Québec enterprise registrar (REQ).

BE Issue entices folks with the promise of buying wealth with little effort and no overseas change or cryptocurrency information.

Quite a few people and teams working in Québec have been recognized as selling BE Issue services and products.

The AMF is at the moment taking steps to place an finish to solicitation by these people and teams, which is being carried out primarily by social media.

The AMF reminds the general public that there isn’t a such factor as a excessive return with out a excessive diploma of danger and that overseas change and cryptocurrency markets are complicated and unstable.

That is an fascinating take from the AMF, as sometimes non-passive funding schemes aren’t seen as securities.

Apparently as per the legal guidelines in Quebec, Offer alerts by their apps requires them to register as a “securities or derivatives seller or adviser”.

They’re 100% proper on their pyramid issues although (recruitment of recent members). We’ve flagged Be as a pyramid scheme since its unique Melius launch in 2018.

What particular impact the AMF’s warning had on Be’s enterprise operations I can’t say. One risk is fee processors and banking channels flagging the corporate as suspicious.

No matter occurred, Be was undeniably spooked.

You possibly can plot the impact the AMF’s warning had on Alexa visitors charts for Be’s two web site domains:

On the time of publication Alexa ranks the highest sources of visitors to Be’s new web site because the US (57%), Colombia (8%) and Canada (2%).

Keep in mind the AMF’s jurisdiction is Quebec. I’m not conscious of Canada’s different provinces issuing their very own Be warnings.