As a part of the Texas State Securities Board’s April twenty second order, Auratus was cited as an related firm tied to Terry Lee and a Hong Kong shell firm.

Different firms TSSB related to Auratus embrace Primus Liquidity Holding (Marshall Islands), Orbit Conceptum AG and CoinX24AG (Switzerland).

Now a separate Auratus web site has emerged, together with a slew of latest related shell firms.

Auratus has been arrange on the area “auratus.gold”, registered on November twenty ninth, 2023. The non-public registration was final up to date a couple of days in the past on April twenty third.

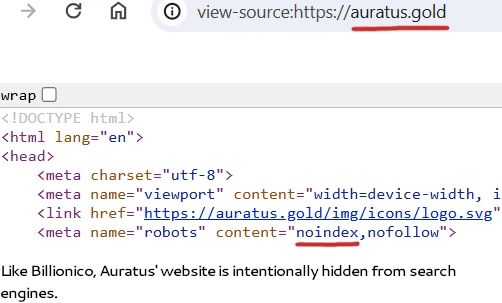

As with Billionico, Auratus’ web site is hidden from serps:

That is believed to be an try to cover Auratus from regulators.

Auratus’ web site fails to reveal who owns or runs the corporate. Given the ties to Billionico, itself a GSPartners spinoff, it’s fairly apparent that is one other GSB Gold Commonplace Company spinoff.

As a substitute of simply being trustworthy about that, listed below are all the brand new shell firms disclosed on Auratus’ web site:

- Helvetic Digital Finance AG (Switzerland)

- TAS Helvetic Gold Buying and selling LLC (Dubai)

- DX and One Belief LTD (Bulgaria)

- MTX Finance LLC (Montana, US)

- Hyperlink Genius Portal LLC (Dubai)

Additionally not disclosed on Auratus’ web site is the specifics of its TAS shitcoin funding scheme.

Earn TAS Gold by way of the Distinctive TAS Vault protocol.

Earn Yields simply by vaulting gold with TAS.

For reference, right here’s how the

On April 19, 2024, Respondents Billionico, Deyle, Daniel von Lison and Rainder introduced that purchasers should purchase investments in a digital gold vault issued by Respondent Auratus.

Respondent Auratus, an organization purportedly working in Hong Kong that’s represented by Respondent Lee, is issuing the investments within the digital gold vault.

The investments are described in better element as follows:

A. Traders buy the usage of a digital vault to retailer gold known as the TAS Vault.

B. The acquisition value of the funding is 150, 500, 2500, 7500 or 10,000 euros relying on the amount and/or weight of gold that will probably be saved within the digital vault,

C. The investments present use of the digital vault for a time period of between 12 and 60 weeks relying on the plan elected by the investor,

D. After buying the funding, traders enter a queue to hitch the digital vault, and, as soon as admitted, the digital vault generates a passive yield shared between the investor and different traders admitted to the digital vault.

E. Traders are paid commissions for recruiting new traders and earn different compensation by way of a multilevel advertising and marketing scheme.

That is your typical staking Ponzi mannequin with an MLM compensation plan hooked up.

As per TSSB’s April twenty second securities fraud stop and desist, Auratus’ TAS shitcoin funding scheme is an unregistered securities providing.

Securities fraud is prohibited within the US at each the state and federal degree.

To that finish, Auratus provides up this pseudo-compliance:

This web site, and any merchandise inside, are usually not supposed to be accessed by USA or Canadian primarily based individuals. Any data supplied inside is for informational functions solely and shouldn’t be thought-about as monetary recommendation.

The issue with that is securities fraud can be unlawful exterior of the US and Canada.

Neither Auratus, Billionico or GSB Gold Commonplace Company are registered to supply securities in any jurisdiction.

With the majority of GSPartners victims being US and Canadian residents, it’s assumed Auratus is now additionally useless within the water.

As a part of ongoing US regulatory investigations, Texas and Alabama have reached out to GSPartners, Billionico and Auratus traders.