Win on Wealth’s web site area (“wow-winonwealth.com”), was privately registered on February twenty sixth, 2022.

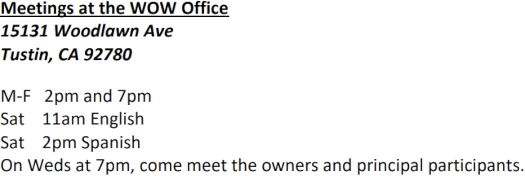

Within the footer of Win on Wealth’s web site a residential handle in Tustin, California is offered.

This handle corresponds to WOW Win On Wealth, a California Inventory Company.

Wow Win On Wealth was integrated on February eleventh, 2022. Trong Hoang Luu is listed because the registered agent for the corporate.

Trong Hoang Luu will not be a standard title. I can’t affirm it’s the identical particular person however I’ll word {that a} Trong Hoang Luu with ties to California has a everlasting FINRA ban.

The ban, issued in 2002, prohibits Luu from “appearing as a dealer or in any other case associating with a broker-dealer agency.”

The ban is in connection to WMA Securities Inc., an insurance coverage rip-off run by World Cash Group Inc.

WMA Securities was integrated in Georgia. Luu labored for the agency’s Anaheim, California department.

In April 2022 World Cash Group and WMA Securities have been fined $200,000 for a number of violations of FINRA’s guidelines.

Luu copped his FINRA ban for ignoring requests for documentation by the Nationwide Affiliation of Securities Sellers, as a part of their investigation into WMA Securities.

One other title I can tie to Wow Win on Wealth is somebody going by AJ Lewis. AJ Lewis is Arthur J. Lewis, a resident of Homestead, Florida.

As above, Lewis is represented to be a banker. As I perceive it he was internet hosting Win on Wealth advertising shows circa April 2022.

Sadly the advertising movies that includes Lewis have since been deleted.

As all the time, if an MLM firm will not be brazenly upfront about who’s working or owns it, assume lengthy and exhausting about becoming a member of and/or handing over any cash.

Win on Wealth’s Merchandise

Win on Wealth has no retailable services or products.

Associates are solely in a position to market Win on Wealth affiliate membership itself.

Win on Wealth’s Compensation Plan

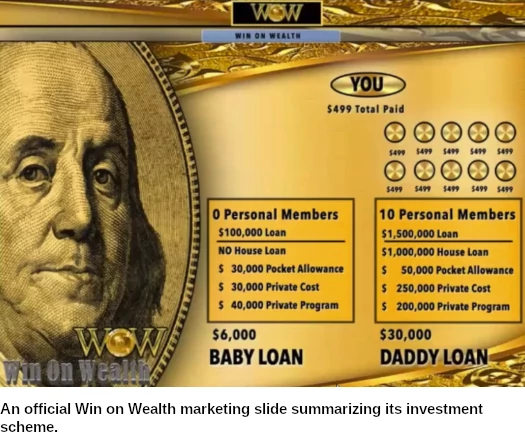

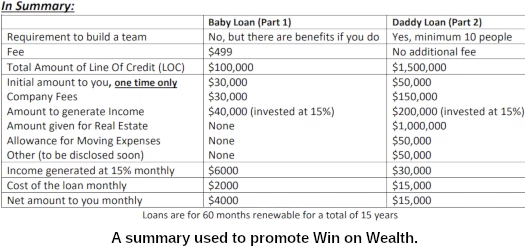

The funding aspect of Win on Wealth’s compensation plan is cut up into two elements.

The MLM aspect of the compensation plan pays on recruitment of Win on Wealth affiliate buyers.

Win on Wealth Funding Scheme Half 1 (Child Mortgage)

Win on Wealth refers back to the first a part of its funding scheme as acquisition of a “Child Mortgage”.

Win on Wealth associates pay $400 for the corporate to arrange an organization for them.

A $100,000 mortgage is acquired by way of this company, which is damaged up as follows:

$30,000 goes on to you to make use of as you please (can be utilized to leverage in different methods you’ll be taught to generate extra wealth)

$30,000 goes to the corporate charges working bills and to fund different issues just like the compensation plan, and so forth

$40,000 is used to generate earnings to your company at 15% month-to-month which can generate $6000 per 30 days.

From the $6000, you’ll pay again the mortgage at $2000 per 30 days, which leaves you $4000 per 30 days for five years!

In abstract, Win on Wealth associates make investments $400 on the promise of an instantaneous $30,000 ROI after which $4000 a month for five years.

Win on Wealth Funding Scheme Half 2 (Daddy Mortgage)

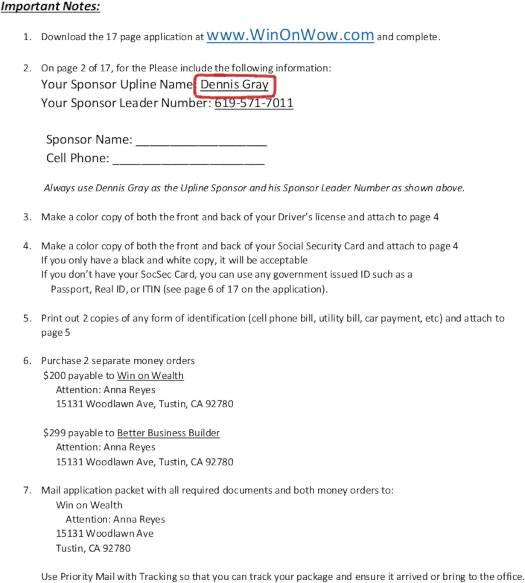

Win on Wealth refers back to the second a part of its funding scheme as acquisition of a “Daddy Mortgage”.

To qualify for a Daddy Mortgage, Win on Wealth associates should recruit ten Child Mortgage associates (particulars see above).

Presumably by way of the identical arrange company, Win on Wealth states the Daddy Mortgage consists of a “$1,500,000 line of credit score”.

The $1.5 million line of credit score is damaged up as follows:

You’ll obtain $50,000 upfront one time solely.

$150,000 goes to the corporate for charges.

$200,000 is invested with a 15% return. This can generate $30,000 per 30 days.

$15,000 might be paid to the mortgage, leaving you $15,000 every month for five years!

You are actually left with $1,000,000 to make use of for Actual Property! There may be additionally $50,000 given to you for shifting bills.

In abstract; Win on Wealth associates purchase credit score, obtain $1,100,000 upfront after which $15,000 a month for 5 years.

MLM Commissions

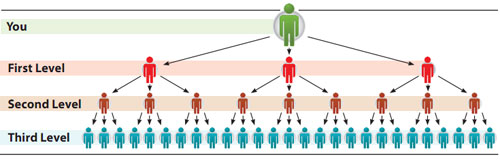

Win on Wealth pays MLM commissions through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel staff, with each personally recruited affiliate positioned instantly below them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel staff.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

Win on Wealth caps MLM commissions down twenty ranges of recruitment.

Commissions are paid on invested funds down eighteen ranges of recruitment as follows:

Half 1

- stage 1 (personally recruited associates) – $400 per 30 days

- stage 2 – $200 per 30 days

- ranges 3 to eight – $100 per 30 days

- ranges 9 to 18 – $80 per 30 days

Half 2

- stage 1 – $2000 per 30 days

- stage 2 – $1000 per 30 days

- ranges 3 to eight – $500 per 30 days

- ranges 9 to 18 – $400 per 30 days

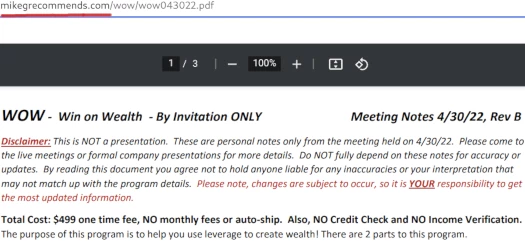

Becoming a member of Win on Wealth

Win on Wealth affiliate membership prices $499.

Further liabilities on account of companies arrange for associates might complete no less than $1.6 million {dollars}.

Win on Wealth Conclusion

Given Win on Wealth don’t even divulge to associates how they generate 15% a month…

$200,000 is invested with a 15% return. This can generate $30,000 per 30 days.

$40,000 is used to generate earnings to your company at 15% month-to-month which can generate $6000 per 30 days.

…it must be apparent that any loans and credit score obtained is finished so below false pretenses.

The lengthy and the wanting it’s if Win on Wealth’s 15% a month returns have been respectable, they’d simply quietly earn from them themselves.

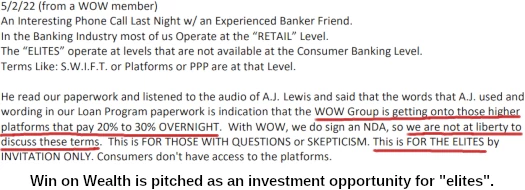

As a substitute you’ve got nonsense about “the elites” to sucker individuals into mortgage, credit score and funding fraud;

Win on Wealth commits mortgage and credit score fraud by acquiring each below false pretenses.

The corporate will purchase a $100,000 Line of Credit score for you- Straightforward Qualification with No Credit score Test and No

Earnings Verification.Half 2 Mortgage is named the Daddy Mortgage with a $1,500,000 Line of Credit score.

I can assure you there isn’t a lender or credit score firm on the market placing this type of cash up for participation in what in all chances are a Ponzi scheme.

With nothing being marketed or bought to retail prospects, the MLM aspect of Win on Wealth operates as a pyramid scheme.

Potential Win on Wealth associates are instructed to go to the corporate’s workplace in Tustin, California:

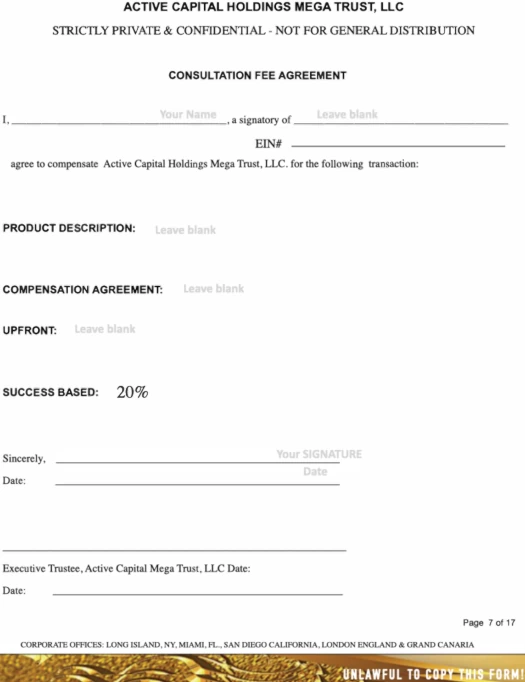

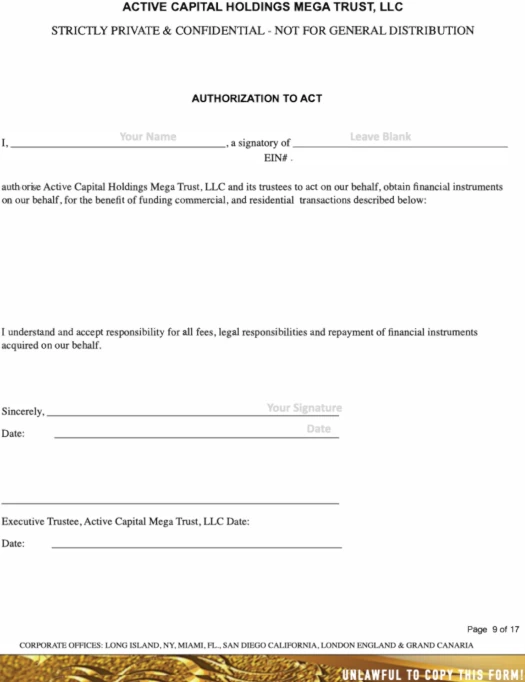

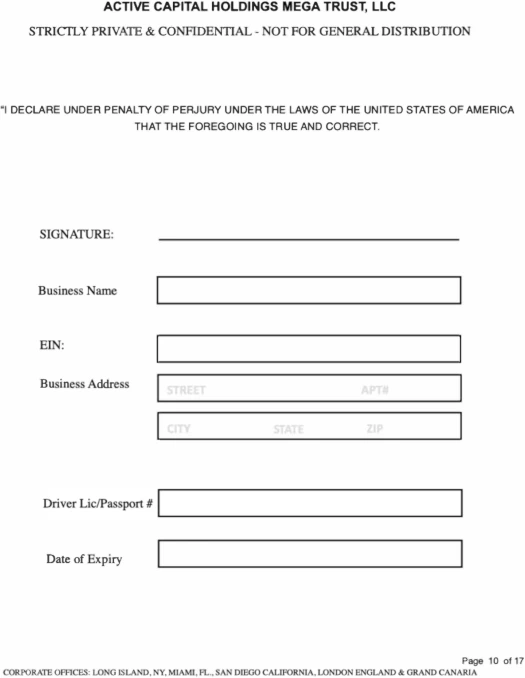

In the event that they agree to enroll and take part, they’re then given a seventeen web page kind to fill out.

This way reveals Win on Wealth are utilizing Energetic Capital Holdings Mega Belief LLC to arrange shell firms to commit fraud by way of:

Energetic Capital Holdings Mega Belief LLC represents it has “company workplaces” in New York, Florida, California, the UK and Grand Canaria [sic].

Energetic Capital Holdings Mega Belief LLC nonetheless may be very a lot run by US residents, as per referenced “legal guidelines of america of America”.

Additional analysis reveals Energetic Capital Holdings LLC. Energetic Capital Holdings LLC is a Florida company, integrated in 2019 by Arthur J. Lewis.

Web page 11 of Win on Wealth’s affiliate kind additionally attaches one other title to the scheme; Anna Reyes.

I couldn’t discover something additional on Reyes instantly tied to Win on Wealth. The title seems in any other case too widespread to get a fortunate hit on.

On the promotional aspect of Win on Wealth now we have infamous serial scammer Michael “Mike G. Deal” Glaspie:

In addition to “Jody” (Jodi?), “Tony”, “Charles”, Jack Riley and Dennis Grey (proper).

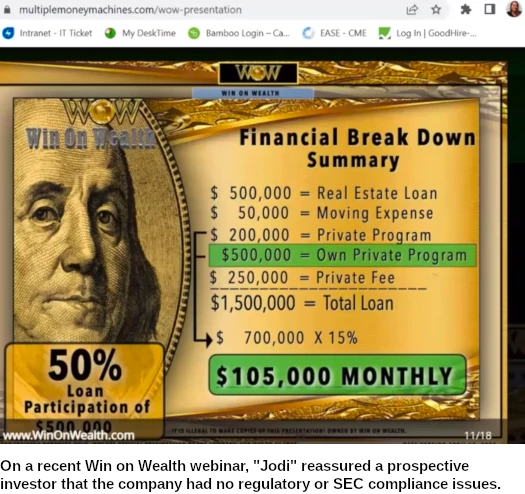

Along with mortgage and credit score fraud, Win on Wealth can be committing securities fraud.

Nonetheless it’s obtained, Win on Wealth’s 15% a month passive funding scheme constitutes a securities providing.

Neither Win on Wealth, Energetic Capital Holdings Mega Belief LLC, Energetic Capital Holdings LLC, Arthur J. Lewis or Anna Reyes are registered with the SEC.

Regardless of committing securities fraud, on a current Win on Wealth webinar “Jody” fielded a query in regards to the SEC from a possible affiliate investor;

Q: Are there any regulatory points or SEC considerations?

A: That’s what they don’t need. They don’t need to have us break the regulation or do issues like that.

What they need to do, is that they need to say, “Look”, y’know… what, it’s attention-grabbing however… any of you guys have heard about reverse mortgage?

It’s similar to this. However in reverse mortgage they by no means provide the house. They preserve the house.

However but they provide the cash up entrance after which they take your property and leverage towards it and earn money on it however they nonetheless by no means provide you with your own home.

So all they’re doing is making a mechanism to offer you cash and keep throughout the tips and defend themselves and also you. In a way.

For sure calling securities fraud a “reverse mortgage” doesn’t make it authorized.

Suggesting Win on Wealth could have already collapsed, we word the area “winonwealth.com”, which seems on Win on Wealth’s affiliate signup kind, has been disabled:

We additionally word the area “wow-winonwealth.com” advises the corporate is

TEMPORARILY NOT HAVING ANY BUSINESS PRESENTATIONS UNTIL FURTHER NOTICE!

AS OF JUNE 1, 2022, WE HAVE PAUSED ACCEPTING LOAN APPLICATIONS!

If Win on Wealth has collapsed, complete sufferer numbers and funds misplaced is unclear. SimilarWeb pegs 96% of site visitors to “wow-winonwealth.com” as originating from the US.