Heading up Uulala is CEO Oscar Garcia, a resident of California.

As per Garcia’s LinkedIn profile;

For the past 20 years as an entrepreneur, Mr. Garcia has built companies, and accelerated the growth of small businesses.

Mr. Garcia has over 20 years in technology and web development.

Circa 2014 Garcia held the Executive Vice President position at the Lucrazon Global Ponzi scheme.

Prior to Lucrazon Global, Garcia was a Melaleuca affiliate.

In January 2014 Garcia was a named defendant in a lawsuit filed by Melaleuca.

In the suit filed last week in U.S. District Court in Pocatello, Melaleuca is alleging that one of its former “marketing executives,” Oscar Garcia, now a vice president with Lucrazon Global, a network marketing e-commerce company based in Irvine, Calif., is pitching his newest business to current and former Melaleuca marketing executives.

“Lucrazon seeks to swell the ranks of its brand partners by raiding Melaleuca’s marketing executives,” the suit alleges.

In October 2016 Garcia settled with Melaleuca. A $5000 judgment was entered against him.

Lucrazon Global collapsed by the end of 2014. As revealed in a civil lawsuit filed in 2016, Lucrazon Global targeted elderly victims and fleeced them out of millions.

After Lucrazon Global Garcia reinvented himself as a crypto bro. This brings us to Uulala’s launch in 2017.

Uualala’s original business model saw the company sell UULA and EUULA tokens.

The company’s ICO raised over $9 million dollars.

In August 2021 the SEC announced a civil complaint against Uulala, Garcia and co-founder Matthew Loughran.

From December 2017 through January 2019, Uulala sold UULA tokens, which were allegedly to be used to record transactions in a financial application (“app”) that Uulala was developing and promoting to those without access to traditional banking services.

Uulala, Garcia, and Loughran made materially false and misleading statements to investors throughout their offering of UULA about having “patent pending” technology that had been incorporated into their app and having a proprietary algorithm to assign credit scores to users of their app.

Uulala, Garcia and Loughran settled the lawsuit.

Uulala, Garcia and Loughran respectively paid civil penalties of $300,000, $192,768 and $50,000.

If you’re wondering why those amounts are tiny compared to the $9 million raised, Ualala claims;

The revenue generated from the ICO was put back into the company to continue to enhance our technology, to pay our employees, our operating expenses and to help sustain us during the first three years of our business.

Today there is no mention of Matthew Loughran on Uulala’s website. The SEC’s complaint states Loughran stood down as Uulala’s Chief Marketing Officer shortly before it was filed.

Whether Loughran is still involved with Uulala is unclear.

Despite its initial UULA and EUULA token scheme being “dismantled”, Uulala is still around and operating as an MLM company.

Read on for a full review of Uulala’s MLM opportunity.

Uulala’s Products

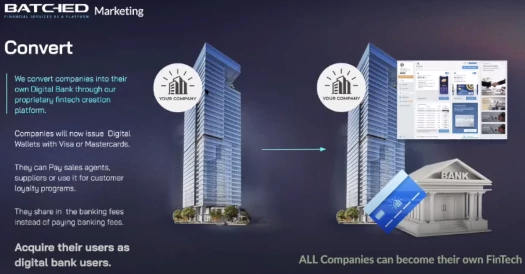

Oscar Garcia claims the Batched platform can “turn any company into their own digital bank”.

Batched is intended to be sold to third-party companies looking for a cheaper payment processing solution.

Uulala claims it charges much less than traditional banks. Companies can also set their own fee rates, collecting these back as profit as opposed to paying fees to a bank.

Uulala prices Batched between $5000 to $150,000.

- Plan 01 – $5000 and then $500 a month for up to 100 users

- Plan 02 – $25,000 and then $3000 a month for up to 5000 users

- Plan 03 – $50,000 and then $5000 a month for up to 5000 users

- Plan 04 – $150,000 and then $5000 a month for up to 10,000 users

In addition to user limits, Uulala offers additional services the more a company pays in fees.

Uulala’s Compensation Plan

Uulala’s compensation plan pays on referral of companies to its Batched finance platform.

Attached to this is a “validation node” investment scheme.

Batched Referral Commissions

Uulala affiliates receive a 5% transaction fee override on any companies they personally refer to the Batched platform.

Validation Node Investment Scheme

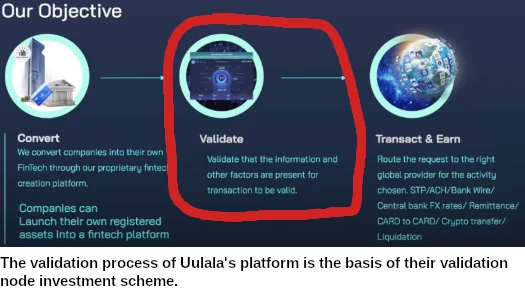

Uulala represents validation of transactions is a key component of Batched.

Rather than just validating transactions in the background, Uulala has made it the center of an investment scheme.

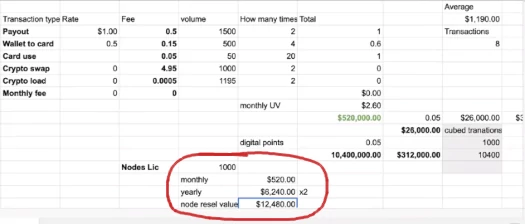

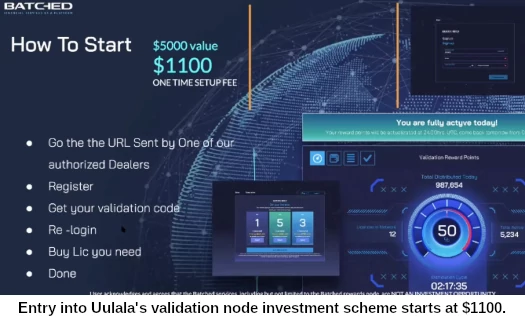

Uulala affiliates sign up and invest $1100 into a validation node position.

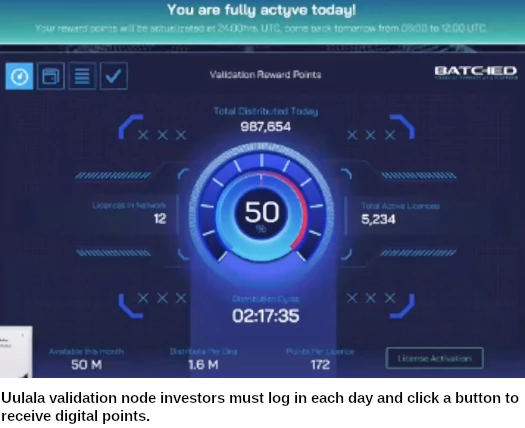

Having a validation node position allows a Uulala affiliate to log in and click a button.

This generates an unspecified amount of “digital points”.

Once acquired, digital points are parked with Uulala on the promise of a return.

- park up to 15,000 digital points and receive 5 cents per point redeemed

- park 15,001 to 99,999 digital points and receive 7 cents per point redeemed

- park 100,000+ points and receive 10 cents per point redeemed

Digital point redemption occurs in an arbitrary manner controlled by Uulala.

The company claims digital points are redemption is tied to transactions within the Batched platform.

Referral commissions are available on validation node investment, paid down two levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 30%

- level 2 – 10%

Joining Uulala

Uulala affiliate membership is tied to investment in a $1100 validation node position.

Note that Uulala marketing material states the required investment amount will increase with every 500 positions invested in.

Conclusion

Lucrazon Global’s marketing schtick was a finance alternative platform.

Affiliates invested $1000 to $15,000 and collected a passive return, purportedly generated via use of its platform.

In reality Lucrazon Global was a Ponzi scheme, primarily recycling invested funds to pay returns to affiliate investors.

Uulala is essentially that same model but with cryptocurrency and “digital points”.

The original plan was probably to use UULA and EUULA tokens, but the SEC put a stop to that.

Still, regardless of whether UULA, EUULA or digital points are used, Uulala’s validation node investment scheme is still a securities offering.

Oscar Garcia himself represents that validation node positions are worth $5000.

Garcia goes on to state validation node positions are “worth quite a bit of money”.

He represents Uulala affiliate investors will be able to sell the positions at a profit in the future.

Uulala having affiliates sign in and click a button to receive digital points, is akin to Zeek Rewards having its affiliates log in each day to enter in advertising URLs.

We can earn these daily points by logging in, hitting the start button and helping validate these transactions.

They validate the transactions and get a percentage of everything being done.

By earning those points, you can then put it into our transaction gateway.

It’s busy-body work that has nothing to do with generation of returns.

And even if it did, clicking a button is entirely passive – the “work”, whether anything actually happens or not, still takes place passively via Uulala’s systems.

Thus the criteria of an investment contract is satisfied.

Uulala affiliates invest $1100 (or more) on the expectation of a passive return derived via the efforts of others (Uulala).

Parking digital points with Uulala and waiting for them to get “used” is simply a mechanism to control the rate of withdrawal.

Should new investment dry up, Uulala can reduce or altogether stop usage of digital points. All they have to tell their affiliates is there’s not enough transactions taking place.

No doubt Uulala will point to their Batched platform and claim actual transactions are taking place and this is all above board.

The problem is that is Uulala’s validation node scheme is still an investment contract. This makes Uulala’s MLM opportunity a securities offering.

Companies that offer securities in the US are required to register with the SEC and periodically file audited financial reports.

Those reports are the only way consumers can verify Uulala is generating external revenue to pay digital point returns with.

There are no financial reports, and thus the only verifiable source of revenue entering Uulala is new $1100 investments.

Any MLM company marketing a securities offering should absolutely not be taken at face value regarding any revenue claims made.

With Uulala this is even more important.

This is from the SEC’s filed August 2021 complaint;

This case involves the fraudulent and unregistered offer and sale of digital asset securities known as UULA tokens by Defendant Uulala, Inc. (“Uulala”), and its subsequent fraudulent and unregistered offer and sale of promissory notes that could be converted to equity (the “Convertible Notes”).

Uulala purports to be a “financial solutions platform that provides the world’s underbanked populations access to the financial inclusion tools they need to change their future.”

Uulala represented to investors that it had developed a functional mobile phone application (“app”) that allows users to store, transfer, and borrow money, pay bills, make purchases, earn rewards for this activity, and establish a credit history to qualify for microcredit loans.

The UULA White Paper contained false claims about Uulala’s technology, including that it incorporated “Proprietary Patent Pending Decentralized Database Technology.”

This technology was actually owned and patented by a different company, Uulala had no rights to the technology, and Uulala had not in fact incorporated that technology at the time of the UULA offering.

Starting in 2019, Uulala and Garcia raised an additional $500,000 from four U.S. investors through its Convertible Notes offering.

Garcia created a presentation slide deck to promote the offering, which they showed to potential investors.

This offering document contained false financial information about Uulala, including claiming that it had over $250,000 in revenue in 2019, which Garcia admitted was false.

Uulala’s co-founder and chief executive officer, Defendant Oscar Garcia (“Garcia”), was the primary architect of both fraudulent offerings.

We know Uulala has no problem with using 40% of validation node investments to pay referral commissions (a pyramid scheme in and of itself).

Even using a tiny percentage of what’s left to fund digital point withdrawals would make Uulala a Ponzi scheme.

The more pressing matter however is securities fraud.

Oscar Garcia got away with security fraud with Lucrazon Global.

With Uulala Garcia doubled down on securities fraud with his own platform and got busted.

Now he’s tripled down with the Batched validation node investment scheme.

This likely isn’t going to end well.

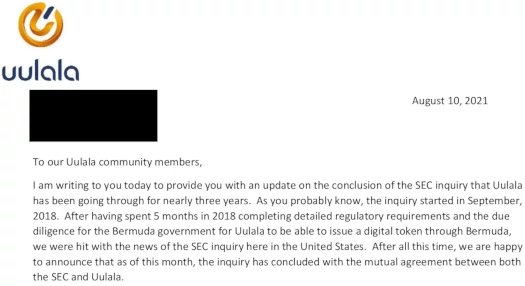

By their own admission, in an August 10th email sent out to Uulala investors, the company acknowledged;

The inquiry has concluded with a settlement between Uulala and the SEC whereby Uulala has agreed to abide by the Securities Act of 1933, like all other companies, and unless and until a registration

statement is in effect as to securities Uulala cannot sell any unregistered Securities.

Given Garcia’s history of fraud, I’m confident all we’re looking at here is a variation of the “staking” MLM crypto Ponzi model.

That is participants invest in tokens/coins (digital points), park those tokens/coins with the company (staking) and collect a passive ROI.

Returns are either wholly or primarily paid out of subsequently invested funds, making the model that of a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Uulala of ROI revenue (either in part or full), eventually resulting in a collapse.

The math behind Ponzi schemes guarantees the majority of participants lose money.

Update 22nd January 2023 – In late 2021 Uulala was abandoned and rolled into Batched.

Batched prevented affiliate investors from logging into their accounts in early January 2023 – thus preventing them from intiating withdrawals.

In researching Uulala and the Batched reboot collapse, I was able to confirm an active SEC investigation into Batched and Oscar Garcia.