The UniHelps web site area (“unihelps.com”) was registered on April 1st, 2019.

No particulars aside from the situation Paris, France are supplied within the registration.

On UniHelps’ official Fb web page, the corporate location supplied is Delhi, India.

This corresponds with Hindi language advertising movies and descriptions on UniHelps official YouTube channel:

It’s extremely seemingly that whoever is working UniHelps is predicated out of India itself.

As all the time, if an MLM firm just isn’t overtly upfront about who’s working or owns it, suppose lengthy and laborious about becoming a member of and/or handing over any cash.

UniHelps Merchandise

UniHelps has no retailable services or products, with associates solely in a position to market UniHelps affiliate membership itself.

The UniHelps Compensation Plan

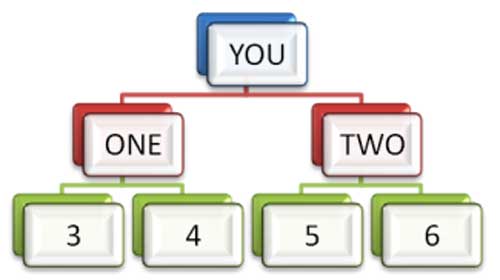

UniHelps associates make investments $100 right into a seven-tier 2×2 matrix cycler.

A 2×2 matrix locations a UniHelps affiliate on the prime of a matrix, with two positions instantly below them:

These two positions kind the primary degree of the matrix.

The second degree of the matrix is generated by splitting these first two positions into one other two positions every (4 positions).

Positions within the matrix are crammed by way of place purchases by new and current UniHelps associates.

As soon as all six positions are crammed, a “cycle” is generated and a fee paid out.

Fee funds throughout all seven UniHelps matrix cycler tiers are as follows:

- Tier 1 (positions price $100) – $300 cycle fee and cycles into Tier 2

- Tier 2 – $600 cycle fee and cycles into Tier 3

- Tier 3 – $1200 cycle fee and cycles into Tier 4

- Tier 4 – $2400 cycle fee and cycles into Tier 5

- Tier 5 – $4800 cycle fee and cycles into Tier 6

- Tier 6 – $9600 cycle fee and cycles into Tier 7

- Tier 7 – $19,200 cycle fee (should reinvest $100 to start out once more)

Becoming a member of UniHelps

UniHelps affiliate membership is tied to a minimal $100 cycler funding.

Conclusion

UniHelps claims to be the “world’s largest peer to see crowdfunding system”.

Any time you see “peer to see” or “crowdfunding” used to explain an MLM alternative, meaning associates are sending cash to one another.

That by itself is money gifting. When coupled with a matrix cycler nevertheless, it turns into a Ponzi scheme.

UniHelps themselves even drop the facade in certainly one of their advertising movies:

The Ponzi facet of UniHelps exists by means of associates investing $100 after which being paid out of subsequent $100 investments.

Irrespective of the cycler tier, returns are pushed alongside by new $100 investments throughout Tier 1.

The general math behind UniHelps is $100 in and $38,100 out.

Only one full return payout requires 300 and eighty one $100 investments. These preliminary 381 investments in flip require 145,161 new investments to cycle via all seven tiers.

And from there issues shortly spiral uncontrolled.

One different factor I observed is that this verbiage from UniHelps’ web site;

It’s primarily based on the world well-known Mobius Loop and the system G Expertise, which is probably the most profitable Peer-To-Peer Workforce Crowdfunding Program in historical past!

I’ve solely ever seen the phrases “mobius loop” and “system G know-how” used to market one different scheme, David Rosen’s 50/50 Crowdfunding.

The phrases are meaningless rip-off jargon themselves, however recommend whoever is working UniHelps was concerned in 50/50 Crowdfunding.

50/50 Crowdfunding makes use of the identical 2×2 matrix Ponzi cycler mannequin as UniHelps. Not surprisingly, Alexa at present pegs India as the highest supply of visitors to the 50/50 Crowdfunding web site (76%).

As with all cycler Ponzi schemes, as soon as new $100 funding dry off UniHelp’s matrices will start to stall.

As soon as sufficient matrices stall, an irreversible collapse is triggered.

The mathematics behind Ponzi schemes like UniHelp ensures that once they collapse, nearly all of individuals lose cash.