In SwissGold Market’s Phrases and Circumstances, the corporate represents it’s integrated as a shell firm in Belize.

For the aim of due-diligence and regulation, that is meaningless.

SwissGold Market’s web site area (“sg.market”) was first registered in June 2018.

The registration info isn’t accessible as a result of EU legislation, nonetheless we do get a metropolis and nation of registration – the Republic Adygea, a federal topic of Russia.

This ties in with SwissGold Advertising and marketing movies narrated in Russian.

As at all times, if an MLM firm will not be brazenly upfront about who’s operating or owns it, suppose lengthy and exhausting about becoming a member of and/or handing over any cash.

SwissGold Market’s Merchandise

SwissGold Market has no retailable services or products, with associates solely in a position to market SwissGold Market affiliate membership itself.

Be aware that whereas SwissGold Market does characteristic gold on the market on its web site, this has nothing to do with the MLM alternative.

SwissGold Market’s Compensation Plan

SwissGold Market associates make investments funds in a four-tier 2×2 matrix cycler.

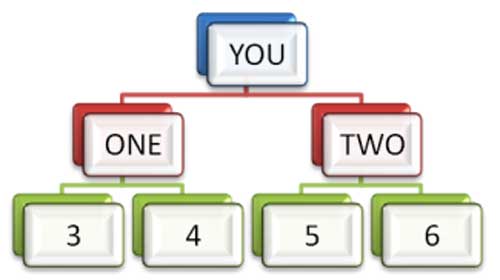

A 2×2 matrix locations a SwissGold Market affiliate on the prime of a matrix, with two positions immediately beneath them:

These two positions kind the primary degree of the matrix. The second degree of the matrix is generated by splitting these first two positions into one other two positions every (4 positions).

Returns are generated as positions within the matrix are crammed.

Matrix positions are crammed through positions invested in by immediately and not directly recruited SwissGold Market associates.

Listed here are the returns paid throughout SwissGold Market’s 4 cycler tiers:

- Begin – make investments €280 EUR and obtain €540 EUR (capped at €1800 per place)

- Major – make investments €740 EUR and obtain €1890 EUR (capped at €7000 per place)

- Normal – make investments €2800 EUR and obtain €7425 EUR (capped at €27,500 per place)

- VIP Plus – make investments €9850 EUR and obtain €29,000 EUR (capped at €98,000 per place)

As soon as a matrix is crammed, the place on the prime of the matrix “cycles” out into a brand new matrix on the identical tier.

This happens over and over till the capped whole ROI quantity is paid out.

Be aware that whereas the above quantities are in euro, as of Might 2020 SwissGold Market is accepting bitcoin too.

I additionally need to add that SwissGold Market seem to have modified their funding tiers a number of occasions since their 2018 launch.

SwissGold Market don’t disclose funding tiers on their web site however I imagine the above quantities are present.

Referral Fee

SwissGold Market pays a referral fee on funds invested by personally recruited associates:

- funding within the Begin cycler generates a €20 EUR referral fee

- funding within the Major cycler generates a €40 EUR referral fee

- funding within the Normal cycler generates a €60 EUR referral fee

- funding within the VIP Plus cycler generates a €80 EUR referral fee

Becoming a member of SwissGold Market

SwissGold Market affiliate membership is tied to a €280 to €9850 EUR funding.

- Begin – €280 EUR

- Major – €740 EUR

- Normal – €2800 EUR

- VIP Plus – €9850 EUR

Upon reaching maturity, reinvestment is required with a purpose to proceed incomes.

Be aware that undisclosed admin charges apply for every funding made.

Conclusion

SwissGold Market is your traditional gold ruse cycler Ponzi scheme.

The corporate presents itself as a gold retailer, nonetheless in actuality gold has nothing to do with SwissMarket Gold’s earnings alternative.

SwissGold Market associates make investments, wait till their matrix is crammed through subsequent funding, after which money out.

It’s that straightforward.

Gold could be ignored, with associates given the choice to money out as an alternative of losing cash receiving €1000s of euros in gold.

That choice solely exists for pseudo-compliance. It’s sometimes used solely to order minute quantities of gold, that are utilized in advertising and marketing movies.

Aware of their fraudulent enterprise mannequin, SwissGold Market insists it isn’t an funding alternative.

That’s after all baloney, however it does present us with this hilarious video of some schmuck dying on stage.

Being a cycler Ponzi, SwissGold Market primarily advantages its nameless proprietor(s).

That is by means of a number of preloaded admin accounts, by means of which the lion’s share of invested funds are stolen by means of.

When recruitment tanks and SwissGold Market inevitably collapses, funds hooked up to stalled matrices will stay trapped within the system.

It is a superficial loss nonetheless, as that cash is stolen by one other SwissGold Market investor the second it’s deposited.

The mathematics behind MLM Ponzi schemes ensures that after they collapse, the vast majority of individuals lose cash.