RSF Holdings fails to offer firm possession or government data on its web site.

RSF Holdings’ web site area (“rsfholdings.com”), was first registered in 2008. The registration was final up to date in September 2021.

That is across the time RSF Holdings’ proprietor(s) took possession of the area. RSF Holdings’ present web site went stay on or round December 2021.

Previous to September 2021, RSF Holdings’ area was owned by an schooling software program firm.

From this we conclude that RSF Holdings didn’t exist previous to late 2021.

Regardless of this reality, RSF Holdings falsely makes use of the unique area registration 12 months as its launch date.

RSF Holdings is without doubt one of the world’s premier Diversified earnings funding managers. With our launch in 2008 in Wilmington, Delaware.

Wilmington, Delaware corresponds to a company deal with offered on RSF Holdings’ web site. This deal with corresponds to a digital workplace service offered by Regus.

As at all times, if an MLM firm shouldn’t be brazenly upfront about who’s operating or owns it, suppose lengthy and exhausting about becoming a member of and/or handing over any cash.

RSF Holdings’ Merchandise

RSF Holdings has no retailable services or products.

Associates are solely in a position to market RSF Holdings affiliate membership itself.

RSF Holdings’ Compensation Plan

RSF Holdings associates make investments funds on the promise of marketed returns:

- Progress Fund – make investments $100 or extra and obtain 1.4%

- Mutual Fairness – make investments $5000 or extra and obtain 1.86%

- Annuity Portfolio – make investments $50,000 or extra and obtain 2.32%

- Dividend Belief – make investments $100,000 or extra and obtain 2.8%

- Vanguard Capital – make investments $250,000 or extra and obtain 3.26%

- Provident Endowment – make investments $500,000 or extra and obtain 3.72%

- Reserve Endowment – make investments $1,000,000 or extra and obtain 4.6%

- Capital Hedge – make investments $5,000,000 and obtain 9.32%

Returns are paid out 3 times every week for 9 months. After 9 months reinvestment is required to proceed incomes.

The MLM facet of RSF Holdings pays on recruitment of affiliate buyers.

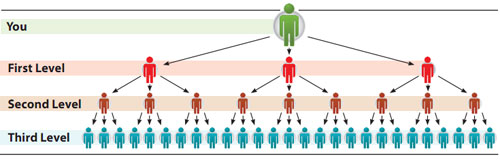

RSF Holdings pays referral commissions down three ranges of recruitment (unilevel):

- stage 1 (personally recruited associates) – 10%

- stage 2 – 5%

- stage 3 – 2.5%

Becoming a member of RSF Holdings

RSF Holdings affiliate membership seems to be free.

Full participation within the hooked up earnings alternative requires a minimal $100 funding.

RSF Holdings Conclusion

RSF Holdings represents it generates exterior income through RSF Asset Administration.

RSF Asset Administration is a number one international different asset supervisor with over $27 billion of property beneath administration throughout actual property, infrastructure, renewable energy, non-public fairness and credit score.

This declare fails the Ponzi logic take a look at. If RSF Holdings already has $27 billion in property, what do they want your cash for?

Even a small share of $27 billion in property liquidated, and invested and compounded at 9.32% paid 3 times every week, explodes over a brief time period.

Moreover, if we take RSF Holdings’ representations that it’s primarily based within the US at face worth, the funding alternative clearly constitutes a securities providing.

Promoting and selling securities within the US requires registration with the SEC. A search of the SEC’s Edgar database reveals neither RSF Holdings or RSF Asset Administration aren’t registered.

The explanation RSF Holdings’ enterprise mannequin is not sensible is as a result of it’s a Ponzi scheme. RSF Holdings takes new funding and makes use of it to repay present buyers.

As with all MLM Ponzi schemes, as soon as affiliate income dries up so too will new funding.

This can starve RSF Holdings of ROI income, finally prompting a collapse.

The mathematics behind Ponzi schemes ensures that after they collapse, nearly all of individuals lose cash.