RECB’s web site area (“recbank.io”) was privately registered on April third, 2020.

It’s value noting the RECB’s official Vimeo presentation is in Spanish. On the very least this means whoever is operating RECB is concentrating on a Spanish viewers.

In an try to look authentic, RECB gives a company tackle in London, UK on its web site.

Analysis reveals the road tackle offered is that of the fictional detective Sherlock Holmes.

As at all times, if an MLM firm just isn’t brazenly upfront about who’s operating or owns it, suppose lengthy and laborious about becoming a member of and/or handing over any cash.

RECB’s Merchandise

RECB has no retailable services or products, with associates solely capable of market RECB affiliate membership itself.

RECB’s Compensation Plan

RECB associates make investments $50 to $1500 on the promise of a 1000% ROI paid over 12 months.

Referral commissions are paid down “7 ranges of earnings”, nonetheless particular particulars aren’t offered.

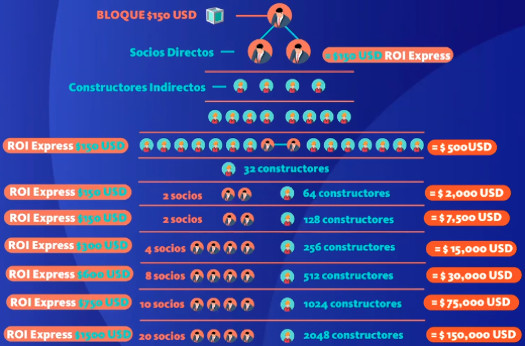

There’s additionally some $150 “bloque” funding scheme, which seems to pay commissions primarily based on recruitment of associates who additionally spend money on $150 “bloques”.

Becoming a member of RECB

RECB affiliate membership is free.

Full participation within the connected revenue alternative nonetheless requires an preliminary $50 to $1500 funding.

Conclusion

No proof of RECB participating in any real-estate exercise is offered. Neither is there proof of RECB producing exterior income from any extra sources.

Because it stands the one verifiable income getting into RECB is new funding.

Utilizing new funding to pay associates a 1000% ROI over 12 months makes RECB a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dies down so too will new funding.

It will starve RECB of ROI income, ultimately prompting a collapse.

The mathematics behind Ponzi schemes ensures that after they collapse, nearly all of contributors lose cash.

There’s additionally the problem of RECB referring to itself as a financial institution. This attracts extra regulatory consideration in most jurisdictions – specifically as a result of RECB isn’t a financial institution or offering authentic banking operations.