Quility gives a short historical past on its origin;

Whereas the Quility identify is new, we’ve been within the insurance coverage enterprise for some time.

Earlier than becoming a member of forces, our brokers represented two companion firms, Symmetry Monetary Group and Asurea.

In 2020, we mixed our nationwide household of brokers to grow to be Quility.

Watkins, Ellison and Pope are behind Symmetry Monetary Group, based in 2009.

I’ve additionally seen Pope credited as a co-founder of Asurea. On Asurea’s web site (which remains to be up for some cause), Pope is credited as Chairman of the Board.

This prompted me to go search for Symmetry Monetary Group, whose web site can be nonetheless up for some cause.

For a merger that occurred virtually a 12 months and a half in the past, Quility model messaging seems to be in every single place.

From what I can collect each Symmetry Monetary Group and Asurea operated as MLM firms.

In a Might 2020 interview, Casey Watkins acknowledged

Symmetry Monetary Group and Asurea have labored in alignment with one another since our firm’s inception.

Seeing as Brian Pope was co-founder of each firms, I’m not likely positive what the necessity for 2 firms within the first place was.

Since their respective launches, neither Symmetry Monetary Group or Asurea seem to have run into regulatory bother.

I can’t communicate to the person MLM alternatives as BehindMLM didn’t evaluation both.

In the present day although we check out the present Quility MLM alternative.

Quility’s Merchandise

Quility markets insurance coverage fulfilled by third-party suppliers. Quility claims to work with “80+ insurance coverage firms”.

We store greater than 80 main insurance coverage firms that will help you discover the most effective coverage at the most effective worth.

Insurance coverage firms featured on Quility’s web site embrace American-Amicable, Mutual of Omaha, Foresters Monetary, Americo, John Hancock and Assurity.

Insurance coverage merchandise supplied by Quility embrace:

- mortgage safety

- time period life

- everlasting life

- last expense

- debt free life

- incapacity and significant sickness; and

- retirement resolution

Quility doesn’t present any pricing examples.

To be truthful although, as a result of personalised nature of insurance coverage, they aren’t that useful anyway.

Quility’s Compensation Plan

The compensation plan I’m working off for this evaluation is a “Symmetry Agent Handbook”, dated October 2021.

The highest of the handbook does state Symmetry is “powered by Quility”. The doc nevertheless continuously hyperlinks to Symmetry Monetary Group’s web site.

Why Quility nonetheless doesn’t have its personal compensation documentation a 12 months and a half after launching I don’t know.

Quility Affiliate Ranks

There are fifteen affiliate ranks inside Quility’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- New Agent – join as a Quility affiliate

- Seasoned New Agent – submit six coverage purposes inside your first six weeks

- Prime Producer – generate at the very least $20,000 in coverage quantity for 2 consecutive months

- Elite Producer – generate at the very least $30,000 in coverage quantity for 2 consecutive months

- Workforce Chief – generate at the very least $10,000 in private coverage quantity and $15,000 in group coverage quantity for 2 consecutive months, and recruit and preserve three New Brokers or greater

- Key Chief – generate at the very least $20,000 in private coverage quantity and $30,000 in group coverage quantity for 2 consecutive months, and generate a downline of 4 New Brokers or greater (three should be personally recruited)

- Company Proprietor – generate at the very least $30,000 in private coverage quantity and $50,000 in group coverage quantity for 3 consecutive months, be on the 95% fee rank and generate and generate a downline of six New Brokers or greater (4 should be personally recruited)

- Company Director – recruit and preserve one Company Proprietor or greater

- Regional Company Director – recruit and preserve two Company Proprietor or greater

- Managing Vice President – recruit and preserve one Company Director and two Company Homeowners or greater

- Senior Vice President – recruit and preserve two Company Administrators and one Company Proprietor or greater

- Govt Vice President – recruit and preserve three Company Administrators or greater

- Affiliate Companion – recruit and preserve one Managing Vice President on a 120% fee charge, two Company Administrators and one Company Proprietor or greater

- Senior Companion – recruit and preserve two Managing Vice Presidents on a 120% fee charge and one Company Director or greater

- Managing Companion – recruit and preserve three Managing Vice Presidents on a 120% fee charge and one Company Director or greater

Notice that specified required ranks and fee charges of recruited associates are minimal quantities.

For fee rank qualification standards see beneath.

Fee Ranks

Quility’s fee ranks are along with affiliate ranks.

Fee ranks decide base commissions paid on approve insurance policies.

- 70% – join as a Quility affiliate

- 75% – generate $2500 in PV or GV

- 80% – generate $5000 in PV or GV

- 85% – generate $10,000 in PV or GV

- 90% – generate $15,000 in PV or GV

- 95% – generate $20,000 PV or $30,000 GV (throughout six recruited associates)

- 100% – generate $25,000 PV or $45,000 GV (throughout 9 recruited associates)

- 105% – generate $27,500 PV or $65,000 GV (throughout 13 recruited associates)

- 110% – generate $30,000 PV or $95,000 GV (throughout nineteen recruited associates)

- 115% – generate $35,000 PV or $145,000 GV (throughout twenty-nine recruited associates)

- 120% – generate $40,00 PV or $225,000 GV (throughout forty-five recruited associates)

PV stands for “Private Quantity” and is coverage quantity generated by an affiliate.

GV stands for “Group Quantity” and is PV generated by an affiliate and their downline.

Notice that required PV and GV should be maintained for 2 consecutive months.

Additionally be aware that not more than 50% of required GV can come from anybody unilevel leg.

Though not explicitly clarified, I imagine as soon as certified for ranks are everlasting.

Coverage Quantity Commissions (first 12 months)

Quility’s coverage quantity commissions are tied to fee ranks above.

Notice {that a} 120% fee is paid on all written insurance policies. This permits greater ranked Quility associates to earn commissions on downline quantity.

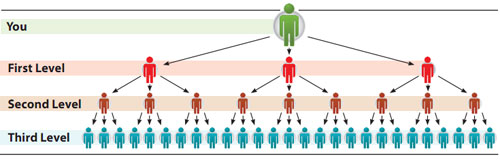

These are known as “override” commissions, and are tracked by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel workforce, with each personally recruited affiliate positioned straight below them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel workforce.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

The way in which an override works is a lesser ranked affiliate sells a coverage and is paid their corresponding fee rank charge.

If their upline is greater ranked, they earn the distinction between their fee rank charge and that of the downline affiliate.

On this method upline associates are in a position to acquire override 5% to 50% variations, relying on their fee rank and that of downline associates.

Renewal Commissions

Quility don’t present coverage renewal fee specifics.

The corporate’s compensation plan states solely that “such a fee will not be out there from all carriers.”

Downline Quantity Bonus

Quility associates can qualify to earn a bonus on downline quantity (GV).

Bonus qualification is decided by whether or not an affiliate is fee rank qualifying on their very own quantity (Producer) or that of their downline (Builder).

- Producers should generate $5000 PV a month

- Builders should be on the 95% fee rank and producing $25,000 GV a month

- Builders on the 105% fee rank and better should be producing $35,000 GV a month

The next lead-based extra qualification additionally applies:

- $200 to $249 in PPL over a 90-day rolling interval = 50% bonus charge paid out

- $250 or extra PPL over a 90-day rolling interval = full bonus charge paid paid out

- $7500 in “max case credit score” is required

PPL stands for “paid premium per lead” and is the typical PV generated throughout bought leads in a month.

“Max case credit score” isn’t outlined anyplace within the compensation doc. I do not know what that is.

If the above qualification standards is met, bonus charges are then calculated based mostly on month-to-month generated PV:

- generate $12,500 to $14,999 a month in PV and earn a 2% bonus charge

- generate $15,000 to $19,999 a month in PV and earn a 2.25% bonus charge

- generate $20,000 to $24,999 a month in PV and earn a 2.5% bonus charge

- generate $25,000 to $29,999 a month in PV and earn a 3% bonus charge

- generate $30,000 to $39,999 a month in PV and earn a 4% bonus charge

- generate $40,000+ a month in PV and earn a 5% bonus charge

Different Bonuses

Quility’s compensation documentation references a Capital Bonus, “120+ Fairness Bonuses” and “extra incentives”.

No data on the Capital Bonus is supplied.

The 120+ Fairness Bonus seems to be an alternate that kicks in when a downline affiliate reaches the 120% fee rank.

“Fairness” suggests shares could also be supplied however once more no specifics are supplied.

Further incentives are described as follows:

SFG Vacation spot is the featured journey for every year and brokers are given a yearlong qualification interval during which to earn an invite on the journey.

Different contests comparable to Symmetry Open, November to Keep in mind, Bonus Lead Bandito, and many others. have a shorter period and are rolled out periodically all year long.

The paragraph above that references “journeys and contests” supplied by Quility’s partnered insurance coverage carriers.

Becoming a member of Quility

Quility associates are required to use for licenses, errors and omissions insurance coverage (non-compulsory) and move an in home examination.

Prices for any of this aren’t supplied by Quility.

Conclusion

My main concern with Quility is the dearth of transparency.

There’s rather a lot to digest with regards to insurance coverage MLMs. Quility do a great job of explaining what they do clarify (which is admittedly rather a lot), however essential due-diligence factors are withheld.

For starters, the price of becoming a member of the corporate. I take it licenses are required and that’s on prime of no matter Quility themselves are charging.

Not disclosing these prices is a right away purple flag and potential violation of the FTC Act (disclosures).

Then there’s Quility’s fairness program, which I flagged as a fear in going over compensation.

Whereas specifics aren’t supplied, Quility do present this rationalization of their compensation glossary:

Fairness Appreciation Rights (EARs)

EARs permit the recipient to take part in a share of the worth creation of Quility above a flooring worth established in an award.

These are granted by the corporate in its sole discretion as a “present” to the recipient and are topic to the particular phrases of the grant (together with situations on forfeiture).

Recipients should stay in good standing on the time of a “set off occasion” to be entitled to obtain fee on the

EARs she or he holds.

Appears like somebody is attempting very onerous to not use the time period “shares” to explain a digital share scheme.

That is important as a result of neither Quility, Symmetry Monetary Group or Asurea are registered with the SEC.

It’s definitely odd that Quility don’t present specifics relating to their fairness program. The corporate’s “Agent Handbook” is offered as a abstract of the “Company Proprietor Handbook”.

This summarized model clocks in at thirty-six pages, so it’s not like Quility draw back from explanations.

As an alternative particulars of the fairness program seems to be intentional, which is one other purple flag to me.

Aside from that Quility’s compensation seems fairly straight ahead. You qualify for a fee charge, earn on lesser ranked downline associates and extra bonuses can be found.

One sticking level for bonuses is the requirement Quility associates buy leads and preserve a $200 PPL.

Conversion of company-supplied leads is a serious variable and tying it to bonus qualification appears unfair.

Not solely that, Quility will even reduce you off should you don’t convert their leads:

Brokers ought to preserve a $250 month-to-month minimal Paid Premium Per Lead (PPL), a 65% or greater problem charge, and an in depth ratio

of 30% or greater to make sure profitability and continued participation within the Mortgage Lead Program.SFG reserves the best to cancel a standing A lead order if an agent’s

numbers fall beneath these minimums for 2 consecutive months.

“A Leads” are Quility’s premium leads. The corporate gives

- A Leads – “the freshest kind of leads” which are lower than 21 days previous

- Overstock A Leads – unsold A Leads which are over 21 days previous ($9 to $13)

- Bonus Leads – leads already offered to present brokers, $7.99 to 50 cents

- DX Leads – no rationalization supplied

With respect to A Lead pricing, Quility states:

The associated fee per lead depends on the agent’s contract stage (see the SFG Promotion Pointers for A lead value).

The linked “SFT Promotion Pointers” doc accommodates no details about A Lead value.

From the costs which are disclosed nevertheless, we are able to surmise A Leads value over $13 every.

That may add up rapidly. Oh and presumably should you don’t convert bought A Leads, Quility will nonetheless promote you cheaper leads.

Theoretically these leads could be tougher to transform, so I’m undecided what the logic is there aside from cha-ching.

With respect to supplied insurance coverage, Quility declare to supply “the most effective coverage at the most effective worth”.

We do the procuring so that you can make sure you get the most effective protection at the most effective worth. It’s our promise to you.

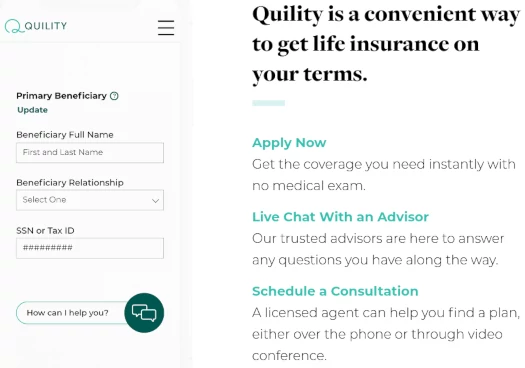

For those who’ve obtained insurance coverage, comparability appears painless sufficient by means of a Quility internet app.

Get a free quote in seconds based mostly in your insurance coverage wants, then proceed to our on-line utility and safe the protection you want in 10 minutes. It’s that easy.

The app does harvest your contact particulars however that appears unavoidable.

What I’m not clear on is whether or not utilizing the app makes you a sellable lead or not. I can see that being annoying if that’s the case.

The excellent news is leads can provide you some concept of how your potential upline’s Quility enterprise goes.

You possibly can both ask them for the whole variety of leads bought over the previous few months and what number of transformed.

Or simply ask for his or her PPL (PV divided by what number of A Leads they bought that month).

Personally I’m not a fan of obligatory lead purchases (it’s a must to purchase results in totally take part in Quility’s MLM opp), but when it’s there finest to utilize it as a device earlier than signing up.

The opposite factor to be careful for is clawbacks. 120% commissions don’t materialize out of thin-air. You’re being paid on future coverage funds on the idea these insurance policies aren’t cancelled.

If they’re, you’re on the hook.

Fee Chargeback

If an agent has acquired superior fee and the shopper fails to pay premium or cancels the coverage, the provider will problem a chargeback on the fee acquired by the agent for any unpaid premium.

Chargebacks may also be issued on override commissions acquired for a downline agent’s enterprise.

I couldn’t discover this addressed anyplace. And it’s definitely complicated.

Take for instance the “Code of Conduct” on the best, taken from a Symmetry Monetary Group branded handbook supplied on Quility’s web site.

As you may see the corporate makes use of each names interchangeably.

Was there even a merger, or was Quility created as a brand new identify to market Symmetry and Asurea by means of?

Absolutely if there was a real try at merging the businesses every part could be below the Quility model by now?

Strategy with warning.