The company is incorporated and based out of South Africa. Heading up Mirror Trading International is CEO and founder Johann Steynberg.

Based on his Twitter account activity, at some point Steynberg took an interest in cryptocurrency.

Earlier this year Steynberg was advertising a “turn $25 into $75 over and over again” opportunity on Twitter:

Guess that didn’t work out.

Read on for a full review of Mirror Trading International’s MLM opportunity.

Mirror Trading International’s Products

Mirror Trading International has no retailable products or services, with affiliates only able to market Mirror Trading International affiliate membership itself.

Mirror Trading International’s Compensation Plan

Mirror Trading International affiliates invest $100 or more on the representation of perpetual trading returns.

How long is the investment period?

The investment period is continuous and you will continue to earn profits as long as you keep the minimum balance of 0.01 BTC in your trading account.

Recruitment Commissions

Mirror Trading International affiliates earn a 10% commission on funds invested by personally recruited affiliates.

Residual Commissions

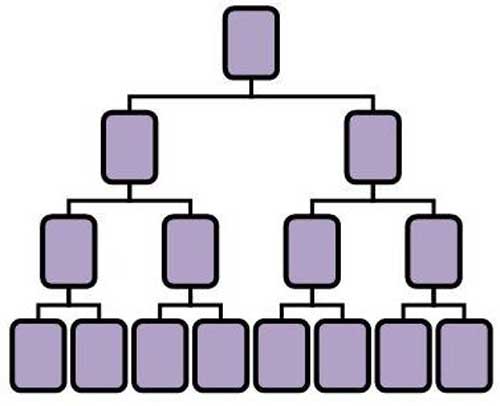

Mirror Trading International pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

How many binary team levels a Mirror Trading International affiliate earns residual commissions on is determined by how much they’ve personally invested:

- invest $200 to $999 and earn residual commissions down ten binary team levels

- invest $1000 to $4999 and earn residual commissions down twenty binary team levels

- invest $5000 to $9999 and earn residual commissions down thirty binary team levels

- invest $10,000 or more and earn on your full binary team (unlimited depth)

Residual commissions are calculated weekly, based on 20% of company-wide generated returns.

Mirror Trading International states that of the 20% set aside, affiliates earn their share based on “the total business your team structure contributes”.

Although not explicitly clarified, residual commission payouts are clearly based on binary team investment volume.

Joining Mirror Trading International

Mirror Trading International affiliate membership is tied to a minimum $100 investment.

Full participation in the attached MLM opportunity requires a minimum $200 investment.

Note that all fund transfers within Mirror Trading International (both paid and received), are made in bitcoin.

Conclusion

Mirror Trading International combines pyramid recruitment with a passive investment opportunity.

The system is fully automated and you can sit back and relax.

Johann Steynberg doesn’t appear to have a forex trading background, so it is unclear where and how Mirror Trading International is trading.

This is important because Mirror Trading International’s passive investment opportunity constitutes a securities offering.

Securities in South Africa are regulated by the Financial Sector Conduct Authority.

Although Mirror Trading International might be incorporated in South Africa, neither the company or Johann Steynberg appear to be registered with the FSCA.

This means that Mirror Trading International is operating illegally in South Africa.

Indeed if Mirror Trading International is not registered with securities regulators in every jurisdiction is solicits investment in, the company is operating illegally worldwide.

The only reason Mirror Trading International would opt to commit securities fraud is if they aren’t doing what they say they are. Namely paying returns from trading revenue.

Part of securities regulator registration is providing audited accounting demonstrating trading revenue being actually used to pay returns. Mirror Trading International would also have to make disclosures regarding what happens to investor funds to their investors and the public.

Again, this is not optional. By failing to register and providing disclosures, Mirror Trading International is committing securities fraud.

As it stands the only verifiable source of revenue entering Mirror Trading International is new investment.

Using new investment to pay existing affiliates a daily return would make Mirror Trading International a Ponzi scheme.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.