In line with Miny’s web site, the corporate was based by Thomas Norberg in November 2019.

Thomas Norberg, who was born in Russia and accomplished his Grasp in Worldwide Enterprise and Administration in Sweden.

Norberg’s imaginative and prescient was to create a platform that permits anybody from any nook of the world to earn by mining.

Norberg doesn’t seem to exist outdoors of Miny’s advertising and marketing materials (no video), casting doubt on whether or not he’s an precise particular person.

Replace twenty third November 2020 – Eight days after we printed this text, Miny uploaded a advertising and marketing video that includes this man taking part in Thomas Norberg:

The actor taking part in Norberg has a definite European accent, marking him as a primary Boris CEO candidate.

To today Norberg doesn’t exist outdoors of Miny’s advertising and marketing materials, all however confirming he doesn’t exist. /finish replace

Miny’s web site area (“miny.cc”) was privately registered in September 2018.

On the time of publication Alexa ranks Venezuela (15%), Russia (10%) and Brazil (8%) as prime sources of site visitors to Miny’s web site.

As at all times, if an MLM firm isn’t overtly upfront about who’s operating or owns it, assume lengthy and onerous about becoming a member of and/or handing over any cash.

Miny’s Merchandise

Miny has no retailable services or products, with associates solely in a position to market Miny affiliate membership itself.

Miny’s Compensation Plan

Miny associates make investments USD and cryptocurrency on the promise of 10% to 19% month-to-month returns.

USD

- make investments $50 to $750 and obtain a ten% month-to-month ROI

- make investments $750 to $15,000 and obtain a 15% month-to-month ROI

- make investments $15,000 or extra and obtain a 19% month-to-month ROI

BTC

- make investments 0.005 to 0.08 BTC and obtain a ten% month-to-month ROI

- make investments 0.08 to 1.65 BTC and obtain a 15% month-to-month ROI

- make investments 1.65 BTC or extra and obtain a 19% month-to-month ROI

ETH

- make investments 0.25 to 4 ETH and obtain a ten% month-to-month ROI

- make investments 4 to 80 ETH and obtain a 15% month-to-month ROI

- make investments 80 ETH or extra and obtain a 19% month-to-month ROI

LTC

- make investments 0.75 to 11 LTC and obtain a ten% month-to-month ROI

- make investments 11 to 225 LTC and obtain a 15% month-to-month ROI

- make investments 225 LTC or extra and obtain a 19% month-to-month ROI

Returns are paid in MINY tokens, which associates can withdraw by Miny’s inside alternate.

Miny’s web site states that 1 MINY = $1 USD as a beginning worth. Whether or not this worth has since modified of their inside alternate is unclear.

Referral Commissions

Miny pays referral commissions on MINY token funding by way of a unilevel compensation construction.

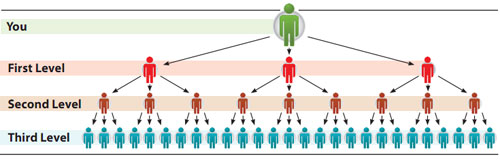

A unilevel compensation construction locations an affiliate on the prime of a unilevel staff, with each personally recruited affiliate positioned straight underneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel staff.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

Miny caps payable unilevel staff ranges at twenty.

Referral commissions are paid out as a proportion of funds invested throughout these twenty ranges as follows:

- stage 1 – 100% (personally recruited associates)

- stage 2 – 10%

- stage 3 – 5%

- ranges 4 to twenty – 1%

Word that referral commissions are paid in MINY tokens.

Becoming a member of Miny

Miny affiliate membership is free.

Full participation within the connected earnings alternative requires a minimal $50, 0.005 BTC, 0.25 ETH or 0.75 LTC funding.

Conclusion

Miny is your typical inside token cell app Ponzi scheme.

In its advertising and marketing materials, Miny claims to generate exterior income by way of cryptocurrency mining.

MINY presents you with an very simple, simple, and accessible methodology of incomes passive earnings.

Collaborating within the mining swimming pools of this cryptocurrency mining platform will provide returns on the stability retained in your mining pool.

No proof of mining income being generated and used to pay associates is supplied.

Nor has Miny registered its passive funding alternative with securities regulators in any jurisdiction it solicits funding in.

Thus even when “proof” of mining happening was supplied (sometimes on social media), it’d be meaningless.

Because it stands the one verifiable income getting into Miny is new funding.

New funding is saved by Miny and used to honor inside alternate withdrawal requests.

Utilizing new funding to pay present associates makes Miny a Ponzi scheme.

The explanation Miny makes use of MINY tokens to pay returns and commissions is as a result of they price the corporate little to nothing to generate on demand.

In impact MINY tokens are Ponzi factors, the worth of which is arbitrarily set by Miny’s homeowners.

MLM Ponzi factors schemes run into hassle when recruitment inevitably slows down. This starves Miny of funds to pay withdrawal requests with.

What occurs subsequent will both be a public-exchange exit-scam, or Miny’s nameless homeowners will merely disappear.

In both state of affairs, the vast majority of Miny associates will probably be left bagholding nugatory Miny tokens.

Replace sixth January 2020 – As of late December 2020 Miny has collapsed.

The corporate’s web site is now not on-line and Miny’s web site area itself has been deserted.