Ferez is represented by a closely photoshopped picture (touch-up) and, in keeping with Mia;

is a widely known macroeconomics analyst and a overseas alternate buying and selling skilled in Southeast Asia.

In 2007, he earned his first bucket of gold from the inventory market on the age of 25 and managed to multiply his private wealth by 57 instances primarily based on his enterprise acumen {and professional} dealing with of capital.

The issue is outdoors of Mia advertising materials (circa 2017-2018), Ferez has no skilled digital footprint.

This isn’t what you’d count on of somebody claiming to be “well-known” in macroeconomics and overseas alternate skilled circles.

Nonetheless Ferez does look like an actual particular person (right here’s what he was as much as in 2012-2014), nevertheless there’s a giant query mark on his claimed skilled background.

Equally Jensen Choong, cited as Mia’s CEO, additionally has no digital footprint outdoors of Mia.

On the time of publication Alexa cites Malaysia (41%) and Singapore (37%) as main sources of visitors to the Mia web site.

I’m going to exit on a limb and recommend Mia is being operated out of Malaysia and is probably going run by Malaysians. Antonio Ferez and Jason Choong are in all chance simply puppets.

Whether or not Mia has any operations in Singapore past recruitment of buyers is unclear.

Learn on for a full evaluation of the Mia MLM enterprise alternative.

Mia Merchandise

Mia has no retailable services or products, with associates solely in a position to market Mia affiliate membership itself.

The Mia Compensation Plan

Mia associates make investments funds on the promise of passive returns, supposedly derived by means of spot gold buying and selling.

Particular ROI averages cited by Mia, primarily based on previous efficiency, vary from 12% to 16% a month.

One other advertising slide means that complete ROI payouts are capped at 24.5% per funding. After which new funding have to be made.

Mia Affiliate Ranks

There are 4 affiliate ranks inside Mia’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- common affiliate – enroll and put money into no less than one Mia Pax

- Supervisor – personally make investments no less than $3000, recruit no less than 4 investing associates and persuade others to take a position a complete of $150,000 or extra (break up $105,000 and $45,000 or extra through a binary workforce)

- Company Supervisor – personally make investments no less than $5000, recruit no less than 5 investing associates and have three Supervisor ranked associates in your downline (one in three separate unilevel workforce legs)

- Regional Supervisor – personally make investments no less than $10,000, recruit no less than six investing associates and have three Company Manger ranked associates in your downline (one in three separate unilevel workforce legs)

Observe how a lot a Pax funding prices just isn’t disclosed. Mia’s advertising materials nevertheless suggests is it $10,000 or much less.

Recruitment Commissions

Mia pays associates to recruit new associates through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel workforce, with each personally recruited affiliate positioned immediately beneath them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel workforce.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Recruitment commissions generated throughout the unilevel workforce are paid out of funds invested by immediately and not directly recruited associates.

Mia caps payable unilevel workforce ranges, primarily based on how a lot an affiliate has invested:

- put money into 1 Pax and obtain 5% on degree 1 (personally recruited associates) and 4% on degree 2

- put money into 2 Pax and obtain 5% on degree 1, 4% on degree 2, 3% on degree 3 and 1% on degree 4

- put money into 3 Pax and obtain 5% on degree 1, 4% on degree 2, 3% on degree 3 and 1% on ranges 4 to six

- Supervisor ranked associates obtain 5% on degree 1, 4% on degree 2, 3% on degree 3, 1% on ranges 4 to six and 0.5% on ranges 7 and eight

Infinity Revenue

Supervisor and better ranked associates obtain an extra 1.5% or greater bonus on downline funding.

- Managers obtain a 1.5% Infinity Revenue price

- Company Managers obtain a 3% Infinity Revenue price

- Regional Managers obtain a 4.5% Infinity Revenue price

Supervisor Management Bonus

The Supervisor Management Bonus is an extra proportion paid on ROI funds made to recruited associates.

Supervisor and better ranked Mia associates obtain a 0.5% Supervisor Management Bonus price.

Regional Managers obtain 1% on degree 1 and 0.5% on ranges 2 and three.

Becoming a member of Mia

Mia affiliate membership is tied to funding in a Pax.

Mia don’t disclose the minimal funding quantity on their web site or of their advertising materials.

Conclusion

It’s been some time since we’ve come throughout a Malaysian buying and selling rip-off.

Mia ticks all of the containers:

- shell firm in AU/NZ used to launder cash by means of

- involvement of no less than on Datuk

- the pretense that Mia buyers can’t lose cash and

- puppet administration who’re clearly in over their heads

Mia as a global monetary platform. A sustainable monetary channel was constructed so that you can create an limitless stream of passive earnings.

The above is quoted from Mia’s official advertising materials and highlights the central downside of trading-based MLM firms.

If scammers like Datuk Paduka Zamri Nazir had been in a position to legitimately generate a constant stream of “limitless passive earnings” – then what do they want your cash for?

So long as you make investments YOU’LL PROFIT THROUGH MIA!

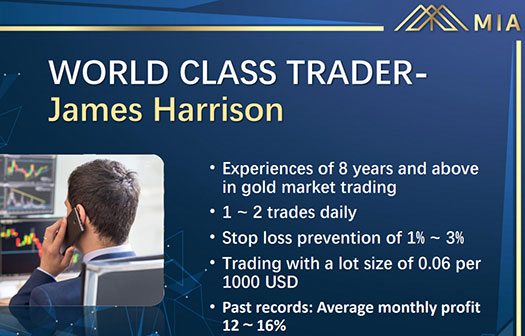

With respect to Mia’s purported buying and selling, your first crimson flag is Mia’s “world class dealer”, James Harrison;

Certain factor guys.

Apparently Mia contracts Mr. Harrison by means of FintechFX, a generically named firm registered in Australia.

Naturally FintechFX wasn’t included until October 2017, some six months after Mia surfaced.

Oh and one other crimson flag, FintechFX was included as “My Group Fintech Co Pty Ltd”.

The 2 addresses initially offered for FintechFX are residential and leased workplace area in Melbourne, Australia. They’ve since switched them out for an additional residential deal with in Sydney (nothing suss).

No affirmation that FintechFX has precise enterprise operations at any of those addresses.

Malaysian scams are infamous for incorporating in AU/NZ as a result of ASIC and NZCO have a tendency to not do something till the scams have collapsed.

The scams are cautious to not recruit buyers in AU/NZ, and so there’s truly not quite a bit the regulators can do besides delist the shell firms as soon as they’re conscious of them.

That is why, regardless of having ASIC/NZCO equivalents in Malaysia, it’s uncommon to see a Malaysian rip-off included in Malaysia itself.

Malaysian scams which are much like MIA we’ve coated prior to now embody FX United (whose three Datuk homeowners had been arrested again in Feb) and VenusFX (homeowners arrested March 2017).

There have been a lot extra we haven’t coated, largely as a result of they aim non-English talking buyers.

In case you undergo the feedback of our FX United and VenusFX critiques, you’ll discover the identical arguments you’re more likely to come up in opposition to when mentioning Mia’s fraudulent enterprise mannequin.

“Oh however you could have full management over your cash always!”

“The homeowners are respected businessmen, I do know this for a truth as a result of I noticed them in a YouTube video!”

“These guys have a verifiable buying and selling historical past, simply take a look at these MSPaint graphs somebody cobbled collectively!”

Ultimately these buying and selling schemes all collapse simply the identical, ensuing within the majority of buyers dropping cash.

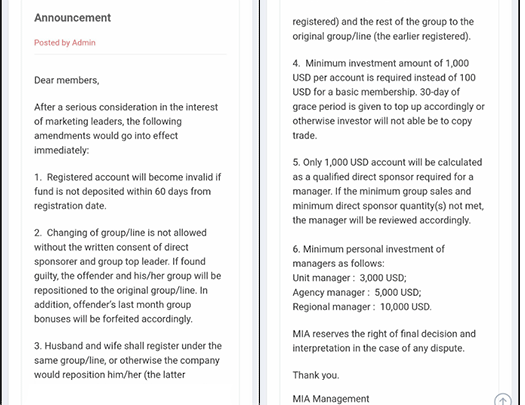

As for Mia, it appears it’s nicely on the best way to break down. Final month the corporate despatched out the next memo to its associates;

It appears as whereas beforehand a minimal $100 funding was required to qualify for ROI funds, that has now been raised to $1000.

When that fails and other people begin to bail… shouldn’t be lengthy earlier than Mia’s withdrawals cease working altogether.