Outdoors of two Gmail addresses, no company particulars are offered on the InterCoin Capital web site.

The corporate does have an official LinkedIn profile (“INTERCOINCAPITAL”), which cites California as its base of operations.

From what I’ve seen InterCoin Capital is being primarily marketed throughout south-east Asia. There isn’t a proof to counsel InterCoin Capital has any bodily enterprise operations within the US.

Heading up InterCoin Capital is CEO Roman Arayan (proper)

Outdoors of InterCoin Capital itself although, Arayan doesn’t have an unbiased on-line footprint that may be verified.

Together with InterCoin Capital (and Arayan) purportedly being based mostly out California, I’m flagging this as extremely suspicious.

Learn on for a full evaluate of the InterCoin Capital MLM alternative.

InterCoin Capital Merchandise

InterCoin Capital has no retailable services or products, with associates solely in a position to market InterCoin Capital affiliate membership itself.

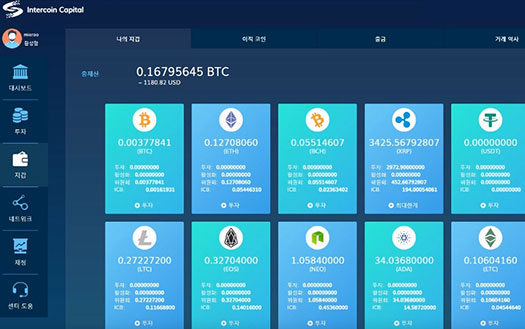

As soon as signed up, InterCoin Capital associates put money into ICC factors by means of the corporate’s “ICB Pockets” web site.

ICB purportedly stands for “Worldwide Coin Financial institution”.

The ICC Pockets web site serves as InterCoin Capital’s backoffice. Via it associates can commerce ICC amongst themselves, make investments and put in bitcoin withdrawal requests.

The InterCoin Capital Compensation Plan

InterCoin Capital associates make investments bitcoin for ICC factors, on the promise of a every day 0.4% ROI.

InterCoin Capital splits ROI withdrawal requests 70% in bitcoin and 30% in ICC factors.

A 100% match is paid on ROI funds to personally recruited associates.

Residual Commissions

InterCoin Capital pay residual commissions through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel workforce, with each personally recruited affiliate positioned immediately underneath them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel workforce.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

InterCoin Capital caps payable unilevel workforce ranges at ten.

An 8% residual fee is paid out as a share of funds invested throughout these ten unilevel workforce ranges.

Whether or not InterCoin Capital cut up residual fee funds 70%/30% as with ROI withdrawals is unclear.

Becoming a member of InterCoin Capital

InterCoin Capital affiliate membership is free.

To take part within the hooked up revenue alternative nevertheless an affiliate should make investments cryptocurrency.

No minimal funding quantities are specified on the InterCoin Capital web site.

Conclusion

InterCoin Capital are fairly cagey concerning specifics of their MLM alternative. Off the bat it must be apparent that this isn’t how a reliable firm operates.

When you dig round although you possibly can unravel what InterCoin Capital are literally advertising; a 0.4% every day ROI supposedly generated through AI bot buying and selling and arbitrage.

Naturally no proof of any of those actions is offered, nor does InterCoin Capital present any various verifiable income coming into the corporate.

Because it stands the one verifiable income coming into InterCoin Capital is new affiliate funding. And from there it’s the identical previous MLM cryptocurrency Ponzi scheme mannequin.

New InterCoin Capital associates join and make investments cryptocurrency on the promise of a every day 0.4% ROI.

That ROI is paid out of subsequently invested funds, with 30% paid in ICC factors to delay the rip-off simply that little bit longer.

ICC factors are fully nugatory and serve no function outdoors of instilling a false sense of wealth amongst gullible InterCoin associates.

So far as I can inform ICC factors are at present not tradeable and don’t exist outdoors of InterCoin Capital’s ICB Pockets web site.

Anticipate ICC to seem on just a few dodgy lesser-known cryptocurrency exchanges when the time comes for Roman Arayan and pals to inevitably exit-scam.

That’ll occur when InterCoin Capital affiliate recruitment slumps, concurrently ravenous the corporate of ROI income.

I’d nearly be prepared to guess “Roman Arayan” isn’t the precise title of InterCoin Capital’s CEO. However in any occasion, in the event that they’re going to fake to be based mostly out of California, InterCoin Capital fails the regulators check with neither the corporate, ICB Pockets or Arayan registered with the SEC.

As per US securities legislation, it is a requirement for any US firm providing securities, which InterCoin Capital’s cryptocurrency funding scheme most undoubtedly is.

The mathematics behind a Ponzi scheme ensures that after they collapse, nearly all of buyers lose cash.

InterCoin Capital will play out no totally different, with investor losses maximized by means of use of cryptocurrency.