Intelligence Prime Capital provides no information on its website about who owns or runs the company.

Intelligence Prime Capital also goes by the company names IPC Trade and IPCapital.

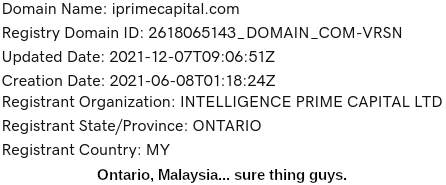

Intelligence Prime Capital’s website domain (“iprimecapital.com”), was registered with bogus details on June 8th, 2021.

Shortly after launch, a video titled “Meet the CMO of IPCapital” was uploaded to Intelligence Prime Capital’s official YouTube channel.

The video features a “Dr. Val Ng Sh”, who claims to be Intelligence Prime Capital’s Chief Marketing Officer:

Outside of Intelligence Prime Capital’s marketing videos, Val Ng exists only in a LinkedIn profile for Val Ng See Huat.

Purportedly Ng is based out of Singapore, but the LinkedIn profile could have been created as Intelligence Prime Capital marketing.

Ng’s Intelligence Prime Capital videos are your typical Boris CEO setting. Rented office space, desk props and company mugs and flags.

Oh and for some reason Ng is dressed in a bow tie dinner suit. Hardly convincing.

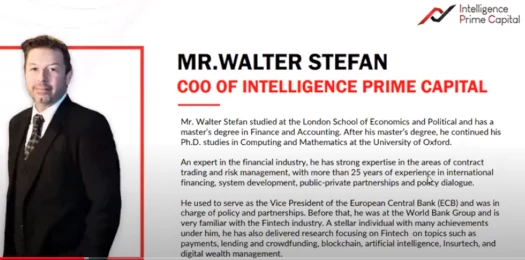

Intelligence Prime Capital’s other named executive is featured in the company’s official marketing presentation:

Despite a claimed “more than 25 years of experience in international financing, system development, public-private partnerships and policy dialogue”, Stefan doesn’t exist outside of IPCapital marketing.

The reason for this is because, like Val Ng, Walter Stefan is played by an actor.

If I can direct your attention to this paragraph in Stefan’s made-up Intelligence Prime Capital corporate bio:

He used to serve as the Vice President of the European Central Bank (ECB) and was in charge of policy and partnerships.

There is a Stefan Walter who works/worked at the ECB. Here’s what he looks like:

Like I said, Intelligence Prime Capital’s Walter Stefan is an actor.

I believe the name order bungle can be attributed to the common practice in Asia of reversing a name when westernized.

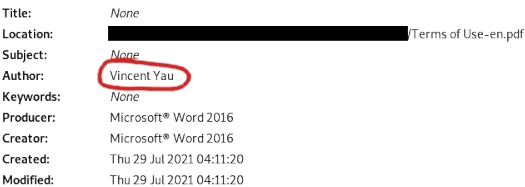

Of further note is Intelligence Prime Capital’s official PDF files were created back at launch by “Vincent Yau”.

I wasn’t able to find any additional information on this individual in connection to Intelligence Prime Capital.

Despite not existing until a few months ago, on its website Intelligence Prime Capital claims its been “leading the way in online trading for 15 years”.

At time of publication, Alexa ranks top sources of traffic to Intelligence Prime Capital’s website as Nigeria (21%), the US (21%) and Mexico (17%).

Update 27th December 2021 – The Central Bank of Russia has issued an Intelligence Prime Capital securities fraud warning. /end update

Update 31st January 2022 – Intelligence Prime Capital represents it has registered with financial regulators in multiple jurisdictions.

BehindMLM has analyzed these claims and debunked them as bogus. /end update

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

IPCapital’s Products

IPCapital has no retailable products or services.

Affiliates are only able to market IPCapital affiliate membership itself.

IPCapital’s Compensation Plan

Intelligence Prime Capital affiliates invest $100 or more into an “AIA Bot”.

Access to the bot is provided via a monthly subscription:

- Smart Bot – pay $19.90 a month and earn up to 15% a month

- Brilliant Bot – pay $39.90 a month and earn up to 30% a month

- Genius Bot – pay $99.90 a month and earn up to 45% a month

Note that while the above amounts are USD, Intelligence Prime Capital only accepts bitcoin or tether.

Intelligence Prime Capital charges a 20% fee on any generated returns.

Note that Intelligence Prime Capital only permits affiliates to withdraw on weekends.

The MLM side of Intelligence Prime Capital pays on recruitment of affiliate investors.

IPCapital Affiliate Ranks

There are seven affiliate ranks within Intelligence Prime Capital’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Leader – invest $100 and generate $500 in personally recruited investment volume

- Supervisor – invest $500, generate $1000 in personally recruited investment volume and $3000 in total downline volume

- Senior Manager – invest $1000, generate $3000 in personally recruited investment volume and $10,000 in total downline volume

- Department Manager – invest $3000, generate $5000 in personally recruited investment volume and $30,000 in total downline volume

- Regional Manager – invest $5000, generate $10,000 in personally recruited investment volume and $100,000 in total downline volume

- Managing Director – invest $10,000, generate $30,000 in personally recruited investment volume and $300,000 in total downline volume

- Shareholder Director – invest $20,000, generate $100,000 in personally recruited investment volume and $1,000,000 in total downline volume

Personally recruited investment volume are funds invested by personally recruited affiliates.

Total downline volume are funds invested by your entire downline (directly and indirectly recruited affiliates).

Recruitment Commissions

Intelligence Prime Capital affiliates earn 10% of subscription fees paid and funds invested by personally recruited affiliates.

Residual Commissions

Intelligence Prime Capital pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Intelligence Prime Capital caps payable unilevel team levels at twenty.

Residual commissions are paid as a percentage of daily returns paid based on rank:

- Leaders earn 30% on level 1 (personally recruited affiliates)

- Supervisors earn 30% on level 1 and 20% on level 2

- Senior Managers earn 30% on level 1, 20% on level 2 and 10% on level 3

- Department Managers earn 30% on level 1, 20% on level 2, 10% on level 3 and 5% on levels 4 to 6

- Regional Managers earn 30% on level 1, 20% on level 2, 10% on level 3, 5% on levels 4 to 6 and 3% on levels 7 to 9

- Managing Directors earn 30% on level 1, 20% on level 2, 10% on level 3, 5% on levels 4 to 6, 3% on levels 7 to 9 and 2% on levels 10 to 14

- Shareholder Directors earn 30% on level 1, 20% on level 2, 10% on level 3, 5% on levels 4 to 6, 3% on levels 7 to 9, 2% on levels 10 to 14 and 1% on levels 15 to 20

Joining IPCapital

IPCapital affiliate membership is tied to a monthly subscription:

- Smart Bot – $19.90

- Brilliant Bot – $39.90

- Genius Bot – $99.90

The more an affiliate pays in monthly fees the higher their income potential.

IPCapital Conclusion

Intelligence Prime Capital represents it generates external revenue via forex trading.

Following years of dedicated research, the IPCapital team has developed our proprietary AI analysis system with the best available technology in the market.

Our IPC AIA BOT system have a average winning rate of 97%, allows customization of trading systems to make it suitable for any type of traders, and will completely change the way you trade.

Remembering Intelligence Prime Capital only came into existence a few months ago, the math behind these claims also doesn’t add up.

Intelligence Prime Capital offers returns of up to 45% a month. If that was remotely possible, surely after “years of dedicated research” they wouldn’t be selling access for just $99.90?

Why sell access at all? Run the bot quietly yourself and retire with Jeff Bezos money in a year.

As it stands there is no verifiable evidence Intelligence Prime Capital generates external revenue at all.

Affiliates are given the usual marketing “proof of trades” data in their backoffice. This is not a substitute for legally required audited financial reports.

This leads us to Intelligence Prime Capital committing securities fraud.

By offering a passive investment opportunity, Intelligence Prime Capital’s MLM opportunity constitutes a securities offering.

Neither Intelligence Prime Capital, it’s executives (actors or otherwise), or promoters are registered with financial regulators.

Securities fraud is illegal the world over.

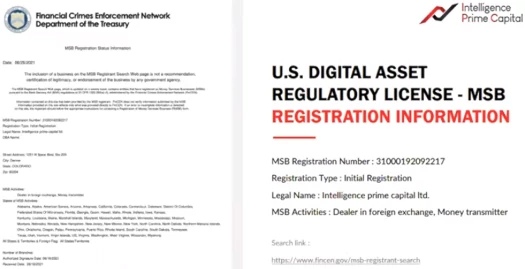

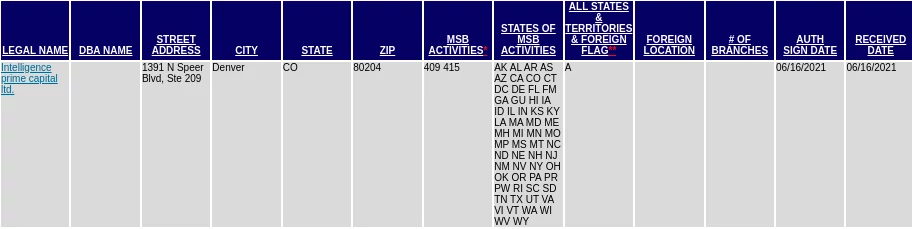

In an attempt to appear legitimate, Intelligence Prime Capital provides a FINCEN registration number in its marketing material.

This registration does correspond to Intelligence Prime Capital LTD, a Colorado shell company (click to enlarge):

For the purpose of due-diligence, this is not a substitute for registration with financial regulators and audited financial reports.

Like Intelligence Prime Capital’s bogus domain registration details…

…Intelligence Prime Capital LTD will have also been set up with bogus details. FINCEN registration is a much lower bar to clear than SEC registration and having to file financial reports.

More importantly, FINCEN registration is meaningless with respect to securities regulation compliance.

Why am I ramming home this point? Because an MLM company committing securities fraud is guaranteed to be a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Intelligence Prime Capital of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.